Supply Chains, Primary Products:

On this page

Summary

- Endowed with plentiful sun and wind, with geographic advantages for export to Europe and the United States, as well as considerable domestic demand, Brazil has the opportunity to become one of the world leaders in the production of green hydrogen (GH2). The production of GH2, financed by both Brazilian and international investors, and supported by international cooperation from Germany, the Netherlands, World Bank and the EU, is taking place throughout the country, with more than 40 projects underway. Brazil’s largely renewable, and integrated, electricity grid - powered by hydro, wind and solar - is fuelling green hydrogen production. Further, the generation of green hydrogen with sugar-cane ethanol provides another big opportunity.

- The strong potential for offshore wind generation in Brazil has also captured attention and investment opportunities. At least 88 licence applications are pending for projects across the length of Brazil’s coastline, and partnerships with the Netherlands, Denmark, Norway and the United Kingdom are in train. Offshore wind is expected to be a strong contributor to green hydrogen production. Many GH2 operations have already been established in close proximity to future offshore wind farms, particularly in the north-east of Brazil.

- The lack of a legal framework and regulations for both green hydrogen and offshore wind power generation is preventing faster progress. However, bills covering both sectors are currently being considered by Congress and are expected to be passed in 2024. High production costs (despite relatively cheap electricity in Brazil), infrastructure for transportation and storage, and certification of “green” credentials are potential barriers to the success of the green hydrogen sector. However, these are not insurmountable.

- Opportunities for cooperation between Brazil and New Zealand in this area include sharing knowledge and experiences about the reuse of gas infrastructure, transportation, and storage for green hydrogen, as well as new techniques regarding its use and production. Companies with expertise in the fossil-fuel industry, transferable to this sector, such as pipeline-coating solutions and valves, seals, and pump developers, are in a good position to break into the market, as are infrastructure companies and shipyards.

Report

Brazil is a clean energy powerhouse with an abundance of renewable sources, including hydro, biomass, wind and solar. As such, the country – the third biggest producer of renewable electricity in the world – is well positioned to play a leading role in the global energy transition and to meet increasing demand for green hydrogen (GH2). The vast majority of Brazil’s electricity is generated from renewable sources (a record of 93% in 2023) and 45% of the country’s overall energy is from renewables, making it one of the cleanest grids in the world. While hydro-electric generation is the primary renewable source, wind and solar capacity has been increasing in recent years; of 7GW installed capacity expansion between January and August 2023, 6.2 came from wind and solar. As an international leader in ethanol production with the potential to become a “green Saudi Arabia” , Brazil is also exploring opportunities for generation of green hydrogen from this energy source.

Green hydrogen launches with a strong start

The first molecular hydrogen production facility in Brazil was launched in the north-eastern state of Ceará in January 2023, drawing on electricity from Brazil’s integrated grid. An investment of USD $8.4 million, the project is the initiative of EDP, one of the country’s largest power companies, with support from both the federal and state governments. This pilot project is not unique, with a number of green hydrogen projects being developed in Brazil that could account for investment of more than USD 30 billion according to the Brazilian Institute of Clean Energy. A mapping exercise conducted by H2 Brasil, a project funded by Germany that aims to establish a H2 economy in Brazil, in 2022 identified 42 green hydrogen production projects(external link) of different sizes and stages of development. Most initiatives are in early phases, such as the signing of memoranda of understanding (Ceará alone has signed more than 30 MOUs) and feasibility assessments, however, some are in the implementation stage with pilot and commercial plants under operation.

One of Brazil’s most advanced green hydrogen endeavours is located in Bahia, also in the north-east of the country. The commercial plant, a venture between Unigel (a Brazilian petrochemical company) and Petrobras (Brazil’s state-owned oil and gas enterprise), will enter in operation this year (also using electricity from the grid, which is 80-90% renewable in the state of Bahia) and will have the capacity to produce 10 thousand tonnes of green hydrogen per year initially, with plans to eventually quadruple production. The hydrogen will be stored as green ammonia, with 10 tonnes of green hydrogen converting to 60 thousand tonnes of green ammonia - currently considered the most cost-effective way to store and transport green hydrogen. Another Brazilian company, White Martins, one of the largest producers of “grey hydrogen” (generated from fossil fuels – in this case, natural gas) in the country, is also investing in the green version. The company started small-scale production – using solar energy – in Pernambuco in December. It expects to produce 156 tonnes per year. Other green hydrogen initiatives are in train, including one to supply green hydrogen as fuel for electric vehicles.

International companies are also establishing large-scale green hydrogen investments in Brazil. The Australian mining company Fortescue has pledged to invest USD 5 billion in a major green hydrogen production facility in the Port of Pecém in Ceará, and recently received approval for its environmental impact assessment (the first of its kind). Production is due to commence in 2027 and the plant will produce 300,000 tonnes per year to be converted to green ammonia for export to international markets.

Stakeholders in Brazil are also assessing the feasibility - including costs and carbon footprint - of producing green hydrogen from ethanol. This clean fuel, produced from sugarcane biomass, has been used widely across Brazil for more than 40 years and has a high hydrogen content (six atoms compared to two in water), thus making it a strong candidate for GH2 production. Shell plans to invest USD 10 million in GH2 production from ethanol in the next two years, with a pilot fuelling station for electric vehicles at the University of Sao Paulo planned to enter in operation in 2024.

In addition to Bahia, Ceará and Pernambuco in the north-east, the states of Rio de Janeiro and Rio Grande do Sul further south are ramping up their GH2 production capacity. All five states have industrial ports, which offer competitive advantages such as proximity to export infrastructure and potential customers in industrial zones.

Brazil has a strong comparative advantage and strong international support

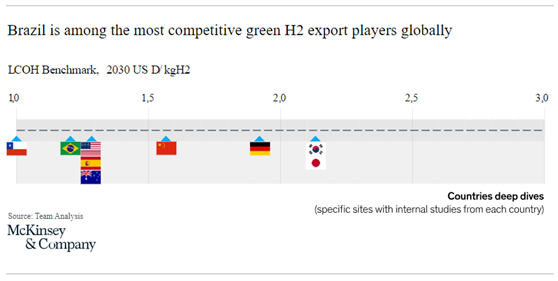

A study conducted by McKinsey placed Brazil as the second most competitive place in the world to produce green hydrogen (after Chile and ahead of the US and Australia). Brazil’s high capacity for renewable energy generation at a comparatively low cost (Brazil has a low levelized cost of energy [LCOE][1] for solar and wind) is a big factor in Brazil’s favour, given 70% of hydrogen production costs are energy inputs. Brazil’s interconnected electricity system provides an additional advantage as hydrogen plants can make use of the existing grid, reducing the need for capital investment. According to H2 Brasil’s mapping project, Brazil’s green hydrogen value chain is also well developed, comprising more than 800 companies and institutions in diverse sectors across the country.

In addition to strong supply, Brazil is in a good position in terms of demand, which could generate USD 15-20 billion in revenue by 2040 according to McKinsey and $30 billion USD by 2050 according to Roland Berger. There is high interest in the production of green hydrogen in Brazil for export, particularly from the EU, which aims to import 10 million tonnes of GH2 by 2030. However, McKinsey estimates that about two thirds of GH2 revenues will come from the domestic market given potential high demand from energy-intensive industries such as steel, pulp and paper and chemicals as well as the agricultural and transport sectors. In addition, Brazil is highly import-dependent for fertiliser supply (80% is imported), so green ammonia could provide a potential way out of this dependency.

As well as strong interest from the international private sector, Brazil has support from international partners to develop its green hydrogen sector. Germany and Brazil have had an Energy Partnership since 2008, with an active working group on GH2. Brasilia and Berlin also work together on the German-funded project H2Brasil, a EUR 34 million investment that aims to support the legal, institutional, and technological development of the green hydrogen sector, and the GH2 taskforce, which links companies and institutions to share knowledge and experience. Both collaborations have supported a number of initiatives including fact-finding missions and a mapping of the Brazilian green hydrogen sector.

The Netherlands is also active in the sector. In May 2023, during the visit to Brazil of Prime Minister Mark Rutte, the Netherlands signed an agreement with the state of Ceará to create a Green Hydrogen Corridor between the ports of Pecém and Rotterdam as well as a Green Ports Partnership. Further, a Dutch-Brazilian consortium led by the Trans Hydrogen Alliance plans to invest USD 2 billion in a hydrogen production project in Pecém. In June 2023, during her visit to Brazil, President of the European Commission Ursula von der Leyen announced that the EU would invest EUR 2 billion in green hydrogen in Brazil, with a focus on energy efficiency in the industry.

But challenges remain

The development of green hydrogen in Brazil has the potential to generate jobs, introduce leading-edge technologies, and attract substantial investment, as well as integrate Brazil into global value chains. Brazilian Finance Minister Fernando Haddad has noted that the low-carbon agenda has the capacity to boost Brazil’s economy through “reindustrialisation”– the central economic goal of the current administration.

However, there are various barriers to green hydrogen succeeding in Brazil. The key challenge is the production cost. Despite Brazil’s cost-effective LCOE for solar and wind, currently grey hydrogen is cheaper to produce than green hydrogen. For GH2 to be competitive, the price of electricity generated from renewable sources needs to be cheaper than that of electricity produced from fossil fuels. Green hydrogen’s low volumetric energy density compared to other energy carriers also poses a challenge for the transportation of the material. Due to its volume, storing and transporting GH2 requires large, specialised tanks to hold the gas under pressure. This will require substantial investment. The Brazilian Solar Energy Association estimates that investment in the development of green hydrogen in Brazil could reach USD 200 billion over the next 15 years - most of it directed towards infrastructure.

The certification of hydrogen as “green” may also create future challenges for Brazil. There is currently no specific international criteria for H2 to be considered green; however, potential criteria include production from renewable energy sources, guarantees of origin and actual reduction in emissions levels. Depending on the criteria agreed upon, Brazil may not be able to use its integrated grid (which includes a small percentage of fossil-fuel generated electricity) to produce green hydrogen, losing one of its competitive advantages. Hydrogen produced from ethanol may also not be considered green, given the environmental impacts of the production of this biofuel.

In addition, Brazil still lacks a comprehensive government strategy and legal framework for green hydrogen, in contrast to Chile, Germany and the United States. In 2022, the government published the “Brazilian Programme on Hydrogen” with six key objectives, including the establishment of a legal framework and guidelines for the sector. A Three-Year Action Plan followed, which was updated by the Lula administration in August last year, including the introduction of regulations to govern the sector set as top priority. The Lower House of Congress has approved a bill creating regulations for the production of low carbon hydrogen, which is now awaiting Senate approval. Attempts were made to include tax incentives for the sector in the bill but were ultimately removed by the Senate at the request of the executive, who cited a lack of funds to implement such tax breaks.

Offshore wind: the next frontier

Despite its more than 900 onshore wind farms with an installed capacity of 26 GW, Brazil still has vast spaces available for the development of additional wind farms with an estimated inland potential of 500 GW. In addition to onshore wind potential, since 2021, the number of prospective offshore wind projects has been increasing by the day. As of September 2023, 88 requests for offshore wind licences had been submitted (including 10 by Petrobras) with a total generation capacity of more than 212 GW. Many of these projects relate to the generation of green hydrogen (including for export), as the total power generated would exceed Brazil’s energy demand.

In 2020, Brazil’s Energy Research Office published an “Offshore Wind Roadmap” which identified opportunities and the possible challenges to the development of this energy source in Brazil. The roadmap estimated the Brazilian offshore wind potential at 700 GW, a huge contrast to the 2019 estimates from the World Bank that put Brazil’s technical potential at 1.228 GW. Brazil’s shallow continental shelf (between 6 and 20 metres), calm sea and constant wind create a favourable environment for offshore wind generation. The capacity factor of land-based wind in Brazil is above 40%, significantly higher than the global average of 25%; equivalent statistics for offshore wind are not yet available but initial indications show strong potential for Brazil’s offshore wind conditions as well.

Eight Brazilian coastal states across the length of Brazil have attracted multi-gigawatt projects, with two – Rio Grande do Sul and Ceará – standing out in particular. Ambitious projects in those two states foresee 482 and 400 turbines respectively with a projected generation capacity of 6.507 and 6.000 MW each. Initially, international energy companies were the dominant stakeholders in offshore wind projects, however, Brazil’s state oil giant Petrobras has become a bigger player in recent times and is now the company with the most applications pending.

|

Location |

Number of projects |

Total power (MW) |

Share total (%) |

|

Rio Grande do Sul |

25 |

61.719 |

33 |

|

Ceará |

26 |

58.105 |

31 |

|

Rio de Janeiro |

11 |

29.018,5 |

15 |

|

Rio Grande do Norte |

13 |

17.841,5 |

9 |

|

Piauí |

4 |

6.924 |

4 |

|

Espírito Santo |

4 |

6.400 |

3 |

|

Santa Catarina |

1 |

5.700 |

3 |

|

Maranhão |

3 |

3.360 |

2 |

Projects per state without Petrobras. Source: Ibama

|

Developer (company) |

Total power (MW) |

|

Petrobras (Brazil) |

~23.000 |

|

Shizen (China) |

17.475 |

|

Shell (United Kingdom) |

17.080 |

|

Ocean Winds (Engie + EDP Renewables) (France + Portugal) |

15.228 |

|

Bluefloat Energy (Spain + USA) |

14.960 |

|

Equinor (Norway) |

14.370 |

Top developers.

Notwithstanding the optimism regarding offshore wind potential in Brazil, the implementation of these projects is dependent on the establishment of a legal framework. Despite the many pending licence applications, none have yet received approval as the regulatory system is still being propped up. In January 2022, the Federal Government published the guidelines for the assignment of rights of use for offshore areas, including for energy generation, and in October 2023, the Ministries of Environment and Mines & Energy defined the rules for the creation and functioning of an “Offshore Areas Management Single Portal”. The Lower House of Congress approved a law establishing the rules for offshore wind projects in November 2023, which is awaiting Senate approval. Despite these developments, further regulations, including on bidding and leasing procedures for offshore areas, are necessary to provide greater certainty.

Brazil’s offshore wind potential has attracted significant international attention, with the Netherlands, Denmark, Norway and the United Kingdom active in this area. The Norwegian company Equinor (which has lodged six licence applications for offshore wind projects in Brazil) is a long-standing partner of Petrobras. In March the two countries updated their 2018 cooperation agreement to include potential offshore wind generation projects. In November 2023, Norway and Brazil announced a USD 4.2 million joint call for proposals for projects focusing on energy transition and decarbonisation of offshore operations (oil and gas, and offshore wind). The UK invested approximately GBP 20 million from their Prosperity Fund in the Brazil Energy Programme, a three-year project (which finished in March 2023) that, among other areas, supported Brazil to develop “frameworks for offshore wind producers to make confident investments”. In December 2021, Denmark and Brazil signed a Memorandum of Understanding on renewables and energy transition, with offshore wind one of the focus areas.

International financial institutions are also supporting the sector. Since 2019, the World Bank has assisted Brazil in evaluating its offshore wind power potential through events and studies. At COP28, the World Bank and the Brazilian Development Bank (BNDES) announced an investment partnership in green hydrogen, with the former establishing a credit line of up to USD 1 billion to support GH2 projects in Brazil.

Opportunities for New Zealand business?

New Zealand, similarly to Brazil, is exploring how best to realise the potential of the nascent green hydrogen sector and could share knowledge and experiences about the reuse of gas infrastructure, transportation, and storage as well as new techniques regarding the use of and production of green hydrogen. Companies with expertise in the fossil-fuel industry, transferable to this sector, such as pipeline-coating solutions and valves, seals, and pump developers, are in a good position to break into the market, as are infrastructure companies and shipyards.

[1] Value of the total cost of building and operating a power plant over an assumed lifetime (U.S. Department of Energy, 2018).

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.