Food and Beverage, Primary Products:

On this page

Prepared by the New Zealand Embassy in Tokyo

Overview

- “The Japanese economy is still in a severe situation due to the Novel Coronavirus but it is showing signs of picking up recently.” Japan Cabinet Office 6 August 2020

- The Japan Research Institute predicts that “the Japanese economy will likely return to positive growth of approximately 10% on an annualized basis in the July-September period” following a record contraction in GDP of 28% on an annualised basis in the April-June quarter.

- New Zealand exports to Japan in July were 8.3% lower than the same time last year but fared better than the overall 22% drop in Japan’s imports from all countries. Looking back at the first half of 2020 (Jan-June) New Zealand goods exports to Japan increased by 10.3% to $2,063 million, the highest total export value for this period since the previous record in 2001.

- On Friday 28 August, Japan’s Prime Minister Shinzo Abe announced his intention to step down in September due to health reasons. The Tokyo stock market dropped in response to the news due to concerns of political instability.

- This report includes some information on recent changes in consumer behaviour in Japan and a snapshot on the health and beauty market.

Japan’s Covid-19 Situation

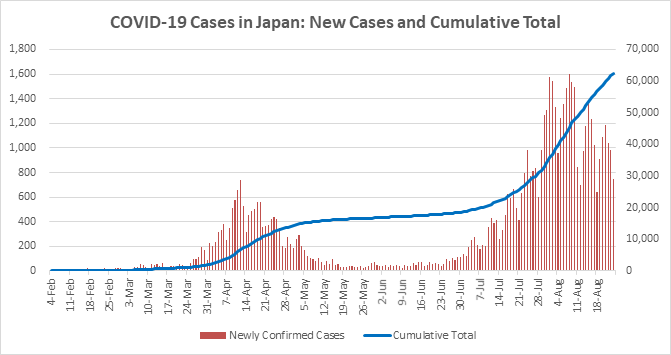

- Japan has been experiencing a ‘second wave’ of COVID-19 cases in July-August following a smaller ‘first wave’ which occurred over April/May

- However the economic impact of the second wave has not been as severe as the ‘first wave’ when the Government declared a State of Emergency in April/May; pushed strongly for people to work from home; and requested the closure of some entertainment-related businesses

- During this ‘second wave’ the Government has resisted calls to declare a State of Emergency and has stuck to its approach of keeping the economy open while asking citizens and businesses to observe COVID-19 precautions such as mask wearing and social distancing

- Experts believe Japan's second wave may have already peaked (in late July).

Japan’s Economic Situation

- The worst economic impacts from COVID-19 on the Japanese economy were felt in the April-June quarter when GDP contracted by a postwar-record 27.8% in annual terms.

- The national State of Emergency was lifted in late May and since then there has been something of a recovery although the rebound has not been uniform and overall economic activity is down on previous years (further details below).

- A resurgence of virus infections in major cities across the country has weighed on the recovery of consumption, and downward pressure on prices is expected to grow in the coming months due to weak demand and falls in household income (Norinchukin Research Institute).

- Two ratings agencies have cut their outlook for Japan's credit rating from "stable" to "negative” (Fitch) and "positive" to "stable" (Standard and Poors) due to increased issuance of debt by the Japanese Government to pay for fiscal stimulus measures.

- Japan’s exports in July 2020 dropped 19.2 percent from a year ago, marking a double-digit fall for the fifth straight month.

- The pace of decline in exports in July 2020 was slower than the 28.3 percent year-on-year drop in May, and 26.2 percent fall in June.

- On Friday 28 August, Japan’s longest serving Prime Minister, Shinzo Abe, announced his intention to step down in September for health reasons.

- The Tokyo stock market initially dropped 2% at the news, due to concerns of political instability. The next leader will be chosen from within the ruling party by mid-September and no major changes to economic policy settings are expected.

Households

- Household spending is a key indicator of private consumption, which accounts for more than half of Japan's gross domestic product.

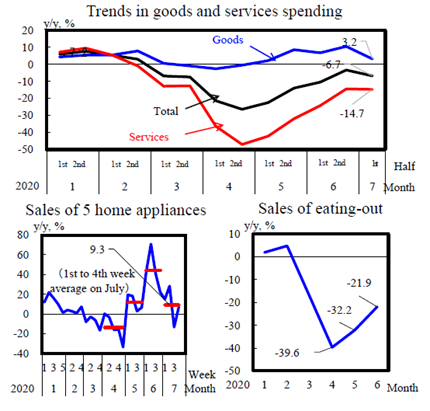

- Japan's household spending fell 1.2 percent in June from a year earlier, down for the ninth straight month, but data from Japan’s Cabinet Office indicates signs of recovery after record falls in May (-16%) and April (-11%):

- A universal Government grant of NZD1,400 per person helped boost spending on furniture and small appliances as people spent more time at home.

- The Japan Research Institute, an organisation linked to Sumitomo/Mitsui Bank, predicts that a rebound in personal consumption in the July-September quarter will recover about 60% of the decline from the April-June quarter.

- However, personal consumption is expected to remain below pre-coronavirus levels in coming months as a result of measures to prevent the spread of coronavirus such as restrictions on the number of customers and seating capacity in restaurants and entertainment venues, on top of requests by local authorities to avoid unnecessary outings. This lower level of demand will be reinforced by a rise in unemployment and a worsening income situation, including a decline in overtime payment and bonuses.

|

Doing well |

Doing poorly |

|---|---|

|

|

Changes in consumer behaviour

- Retail consumption has shifted from convenience stores to supermarkets, possibly as a result of increased teleworking. It appears that people who previously used restaurants and convenience stores near their workplaces are increasingly shopping at supermarkets close to their homes.

- With the rising number of people working from home, there has been a growing demand for frozen food and packaged noodles, which are easy to prepare, as well as flour for making pancakes.

- Demand for fresh food items and alcoholic beverages is relatively firm as customers eat and drink at home more.

- Restaurants have mostly suffered but some have managed to adapt by moving to takeaways and home delivery. For example, drive-through sales at MacDonald’s restaurants accounted for about half of total sales in April-May, while its dine-in service was suspended.

- A ‘second wave’ of virus infections across the country continues to weigh on department store sales as people refrain from going out in response to requests by local Governors to avoid unnecessary outings.

- Sales of clothing fell 27% in July as people worked from home and went out less.

- Demand for home furnishings and small appliances is up due to the impact of Japan’s universal grant of NZD1400 and increased teleworking.

- Weaker consumer sentiment has led to a drop in purchases of larger items such as new vehicles - Japan's sales of new cars slid 13.7 percent in July from a year earlier.

Businesses

- The coronavirus-related State of Emergency affected a wide range of industries in April-June, amid widespread calls for people to avoid going out and the imposition of international travel restrictions

- 70% of companies listed on the First Section of the Tokyo Stock Exchange posted net losses of declines in profit in the fiscal 2020 April-June quarter

- Listed companies’ full-year earnings outlook for the fiscal year ending in March 2021 forecasts a 30.4% year-on-year decline in total net profit, with business performance expected to remain sluggish going forward

- Japanese bank lending hit a record high in July as regional lenders continued to boost loans to small firms hit by the coronavirus pandemic.

- According to the Japan Research Institute, fixed investment by businesses in property, plants and equipment has been decreasing while investment in software and other IT is increasing in order to control the risk of coronavirus infection through remote working and factory automation.

New Zealand Goods Exports to Japan – slowing down following record highs

- New Zealand’s goods exports to Japan decreased by 8.3% in July 2020 (compared to July 2019), following a similar drop in June (see table below).

- However, due to record highs in March/April/May, total goods exports from NZ to Japan for the first half of 2020 increased by 10.3% to $2,063 million, the highest total export value for this period since the previous record in 2001.

New Zealand Goods Exports to Japan by Industry Summary July 2020

| Sector | July 2020 | ||

| Exports to Japan $ Millions | % Change July 2020 vs July 2019 | % Share of NZ Goods Exports to Japan | |

| Dairy | 67.0 | -2.5 | 24.1 |

| Horticulture | 54.5 | -18.8 | 19.6 |

| Metal and Metal Products | 45.2 | -8.9 | 16.3 |

| Forestry and Wood Products | 34.4 | 0.4 | 12.4 |

| Meat and Meat products | 25.9 | -9.3 | 9.3 |

| Miscellaneous Food and Beverage Products | 19.9 | 8.1 | 7.2 |

- Although horticulture exports to Japan were down in July compared to 2019, this was largely a timing issue: product was shipped early this year, accounting for the record sales in March/April/May. In the first half of 2020, horticulture exports were up 27% compared to the first half of 2019.

- Miscellaneous Food and Beverages was the only sector to record an increase on last July. This sector includes exports of honey which tripled in the first half of 2020 compared to 2019.

- Metal product exports have been lower due to slower manufacturing activity in Japan.

- Fisheries products have been impacted by the decline in restaurant trade in Japan.

- Meat products were down in July after recording 20% growth in the first half of 2020 compared to 2019. There has been a build-up of inventories of beef, butter and skim milk powder in Japan due to domestic production being diverted to retail trade which will be weighing on sales in coming months.

Market insights: Health and Beauty in Japan (NZTE)

NZTE is engaging in further market research in this sector with a report due later this year on the growth opportunities and trends in the Health & Beauty sector in Japan. In the meantime, a snapshot of the market is included below:

Natural / Organic Cosmetics: A growing market

- Market Size – over NZD 2 billion with forecast growth of 3%-5% per year.

- Composition: skincare (41.3%), body care (25.7%), hair care (21.9%), make-up (6.3%).

Health and Beauty Market Trends

- Impact on traditional department stores from:

- Reduced foot traffic due to store closures earlier in the year;

- Lack of inbound Chinese tourism which was a strong customer segment for department stores;

- Not strong in e-commerce; and,

- Eliminating use of testers in stores due to COVID restrictions and many brands have products covered up with plastic, so can’t “try before you buy”.

- More consumers are shopping online so companies who have retail partners with strong e-commerce channels will have a strategic advantage.

- Beauty brands are investing in digital initiatives to reach their consumers.

- For example, there is an increasing use of Instagram live by retailers for showing consumers how to use products, and new product releases which will ultimately lead to e-commerce sales.

- Increased interest in skincare products with ‘sensitive-skin’ claims, due to skin irritation experienced from masks wearing in humid conditions.

- Areas of growth – natural and organic products, products that support a healthy / natural lifestyle, strong immunity eg. hand care (hand wash, hand cream, hand sanitiser), health supplements (supporting sleep, skin).

- Areas of decline – lipstick (due to mask wearing) and other make-up.

To contact our Export Helpdesk

- Email: exports@mfat.net

- Phone: 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.