Government:

On this page

Prepared by the New Zealand Embassy in Ha Noi

This report summarises key changes to import tariffs in the recently-ratified European Union Viet Nam Free Trade Agreement (EVFTA) and provides side-by-side comparative analysis of the EVFTA, the ASEAN Australia New Zealand FTA (AANZFTA), and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) for certain product groups.

Summary

- The European Union Viet Nam Free Trade Agreement (EVFTA) came into force on 1 August 2020. The EVFTA includes deep commitments on tariff elimination and bilateral trade facilitation.

- The Government of Viet Nam has also recently adjusted its Most Favoured Nation (MFN) tariff rate for a wide range of products imported into Viet Nam.

- The Vietnamese economy remains comparatively buoyant in spite of COVID-19, however the EVFTA and adjusted MFN rates will increase competition in the market, including for agricultural products and other sectors traditionally of interest to New Zealand exporters.

Impact for New Zealand Exporters

The majority of products currently traded between New Zealand and Viet Nam enjoy zero tariffs under the AANZFTA, which has been in force since 2010. CPTPP provided some additional tariff preference wins for a few products as well as additional commitments on services, investment and government procurement. CPTPP entered into force between New Zealand and Viet Nam in January 2019.

The introduction of the EVFTA immediately eliminated some tariffs for European exporters to Viet Nam, with others reducing over the coming ten years. This, coupled with recent unilateral reductions to Viet Nam’s MFN tariff rates, means that New Zealand exporters’ comparative tariff advantage, secured under AANZFTA and CPTPP, is decreasing.

Recent developments

After seven years of negotiation the European Union Viet Nam Free Trade Agreement (EVFTA) was signed on 30 June 2019 in Ha Noi, and following ratification by EU and Viet Nam parliaments it came into force on 1 August 2020. The EU has cited the EVFTA as the most comprehensive trade agreement that the EU has signed with a developing country. The EVFTA contains broad and deep commitments on tariff elimination and bilateral trade facilitation, and is seen as a comprehensive and ambitious agreement that will see Viet Nam further integrate into the global economy and international community, and assist with its economic recovery from the COVID-19 pandemic.

The EVFTA is the second agreement between the EU bloc and a Southeast Asian nation, after Singapore, and could potentially serve as a model for a future ASEAN-EU multilateral FTA.

Reduction in MFN tariffs

In May 2020 the Government of Viet Nam issued Decree 57 / 2020 / ND-CP(external link) click on ‘Tiếng Anh’ for English) regarding its Most Favoured Nation (MFN) tariffs. The Decree, effective from 10 July 2020, decreases the MFN tariff rates for a number of products including milk and dairy products, fresh apples, some meats, as well as the automotive industry and supporting industries.

These reduced MFN tariff rates will now apply to all of Viet Nam’s trading partners where there are no preferential trade agreements in place, such as the United States.

Tariff elimination in the EVFTA

The EVFTA’s tariff cuts are expected to help Viet Nam boost its agriculture, forestry, and fisheries exports into the European market. According to the Viet Nam Minister of Industry and Trade Tran Tuan Anh, Viet Nam currently accounts for only 2% of the EU’s total imports, but it is hoped the EVFTA will help Viet Nam “step onto a larger playground”. The Agreement reduces or eliminates EU tariffs on Vietnamese rice and seafood exports, and Viet Nam’s burgeoning apparel exports industry (currently fourth largest in the world) is also likely to see a benefit.

Viet Nam’s Prime Minister Nguyen Xuan Phuc has described the deal as “two wide, modern highways connecting the EU and Viet Nam” opening up opportunities for Viet Nam to penetrate the EU market of more than 500 million people and a gross domestic product (GDP) of US$18 trillion.

At the same time Viet Nam will further open its door to imports from the EU. The EU is currently the seventh largest supplier of agricultural and related products to Viet Nam (the United States is the second largest supplier, after China at number one), and is also a major exporter to Viet Nam of aircraft, automobiles, and associated industries and services.

At EVFTA’s Entry into Force (EIF) Viet Nam eliminated nearly half (48.5%) of Vietnamese duties on imports from the EU, equivalent to 64.5% of EU exports to Viet Nam. For example, tariffs on imports of EU machinery and appliances into Viet Nam have reduced from 35% to 0%, tariffs on automobiles dropped from 78% to 0%, and tariffs on pharmaceuticals fell from 8% to 0%. Tariffs on other products will be gradually eliminated gradually over a ten year period.

Once the Agreement is fully in force 99% of all tariffs on both sides will be eliminated.

Side-by-side comparison of EVFTA, AANZFTA, and CPTPP tariffs on imports into Viet Nam

The reduction and elimination of import tariffs on products from the EU, along with the recently adjusted MFN rates, highlights the increasing competitiveness of the Vietnamese marketplace for many New Zealand exporters.

The table below shows a side-by-side comparison of tariff rates for a selection of product groups commonly exported by New Zealand companies to Viet Nam in the following concluded FTAs: the EVFTA, the ASEAN Australia New Zealand FTA (AANZFTA), and the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). The recently-reduced MFN rates are also shown.

EVFTA Entry into Force (EIF) was 1 August 2020.

| Product / HS Codes / Staging category | Applied MFN (as of 10 July 2020) | AANZFTA rate | CPTPP rate | EVFTA base rate and timeframe for elimination* |

|---|---|---|---|---|

| Liquid milk / 0401 / B3 | 15% | 0% | 0% | 11.25% at EIF, dropping to 0% by 2023 |

| Skim & whole milk powder / 0402.10 -0402.21 B3 | 2% | 0% | 0% | 2.25% at EIF, dropping to 0% by 2023 |

| Cheese (fresh, processed, and grated or powdered)/ 0406.10 to 0406.40)/ B5 | 5% | 0% | 0% | 8.3% at EIF, dropping to 0% by 2025 |

| Cheese (other including Colby and Cheddar)/ 0406.90.00/ B3 | 5% | 0% | 0% | 7.5% at EIF, dropping to 0% by 2023 |

| Honey/ 0409.00.00/ A | 10% | 0% | 0% | 0% at EIF (2020) |

| Wine (sparkling) / 2204.10.00 / B7 | 50% | 80% (2020) reduce to 20% in 2022 | 36% (2020), 23% (2023), reduce to 0% by 2028 | 43.75% at EIF, dropping to 0% by 2027 |

| Wine (other) / 2204.21.11/ B7 | 50% | 80% (2020) reduce to 20% in 2022 | 36% (2020), 23% (2023), reduce to 0% by 2028 | 48% at EIF, dropping to 0% by 2027 |

| Apples /0808.10.00 / B3 | 8% | 0% | 0% | 7.5% at EIF, dropping to 0% in 2023 |

| Medium density fibreboard/ 4411.12.00/ B5 | 5% | 0% | 0% | 4.16% at EIF, dropping to 0% by 2025 |

*EVFTA tariff reduction calculations are based on the ‘staging category’ for the goods in the EVFTA Tariff Schedule of Viet Nam. According to Annex 2-A General Provisions, tariffs on goods in category ‘A’ shall be removed immediately, tariffs on goods in category ‘B3’ shall be removed in four equal annual stages, tariffs on goods in category ‘B5’ shall be removed in six equal annual stages, tariffs on goods in ‘B7’ shall be removed in eight equal annual stages, and goods in category ‘B10’ shall be removed in 11 equal annual stages. The sequence of reductions commences at date of EIF, and at the end of the sequence of reductions goods shall be free of any customs duty.

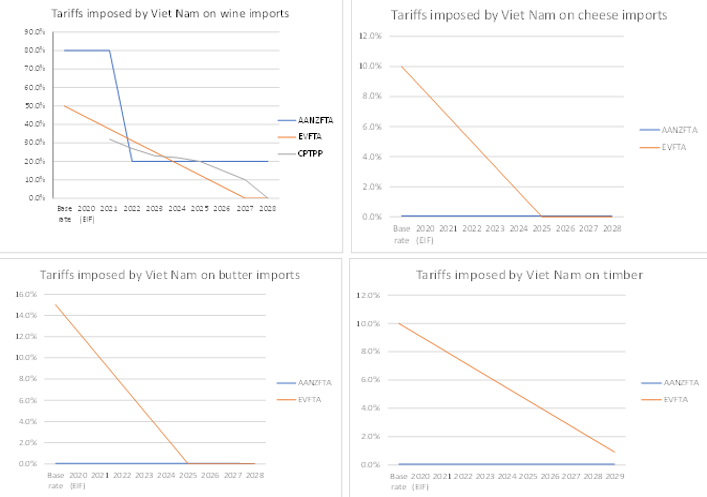

Tariff comparison graphs

The graphs below show the reduction in tariffs for a number of product groups commonly exported to Viet Nam. In almost every case New Zealand exports already have zero tariffs through AANZFTA.

The exception to this iwine, where the most significant tariff cut under AANZFTA, from 80% to 20%, is scheduled to occur in 2022. The CPTPP also introduces cuts to wine tariffs, although it is not until 2026 that the CPTPP rate drops below the AANZFTA rate. For New Zealand exporters, it will make sense to export wine to Viet Nam under CPTPP from 2026.

As shown in the graph below, the EVFTA will eliminate wine tariffs for European exporters to Viet Nam, achieving a zero tariff in 2027 - one year earlier than the CPTPP.

To contact our Export Helpdesk

- Email: exports@mfat.net

- Phone: 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.