Food and Beverage, Government:

On this page

Prepared by the New Zealand Embassy in Jakarta

Summary

- Indonesia is in a good shape for economic recovery, provided the COVID-19 pandemic continues to be managed properly, with GDP growth forecasted to rebound up to 3.7% in 2021 and 5% in 2022.

- The Indonesian government is introducing various fiscal policies to return to a state budget deficit below 3% of GDP starting in 2023, to increase investors and global market confidence in Indonesia.

- In the June 2021 quarter, New Zealand’s total goods and services exports to Indonesia had risen by 37.1% compared to the previous year, supported by the increase in agricultural goods exports, despite the pandemic triggering a 23.7% fall in services exports.

- There is concern that newly introduced import regulations could potentially disrupt the horticultural and beef import processes for New Zealand businesses.

- While some New Zealand business sectors such as Food & Beverage have fared well during the pandemic, others such as the aviation sector have suffered significantly.

Report

On track for economic recovery

Indonesia's gross domestic product (GDP) growth of 7.1% in the second quarter of 2021, compared to a contraction of 5.3% for the same period last year, has brought the Indonesian economy beyond pre-pandemic levels as the COVID-19 pandemic situation continues to improve and movement restriction eases. An increase in consumption activity, including sales of commercial vehicles and imports of capital goods, indicates the continuation of private sector investment. Export-import performance is strong with double digit growth and an increasing trade balance surplus. Production performance remains resilient, mainly driven by exports which rose significantly in August. According to the World Bank and the Asian Development Bank (ADB) forecasts, Indonesia’s annual GDP growth is expected to rebound to between 3.5% and 3.7% in 2021 and strengthen further to between 4.8% and 5% in 2022, although many jobs in low-value-added services may be slow to return. ADB forecasted the annual inflation rate to be at 1.7% in 2021 and 2.7% in 2022. The strength of the economic recovery, however, will depend on the ability of major regional economies to fulfill their vaccine commitments, continuation of government stimulus, and growth of economic activities.

The current pandemic situation has led to a high demand internationally for energy and commodities, and has led to a boom in Indonesia’s coal and petroleum gas exports. This “energy boom”, while positive in the short-run, may hinder Indonesia’s green energy transition goals. Yose Rizal Damuri, Head of Economic Department at the Center for Strategic and International Studies, commented that as only 11% of Indonesia’s energy is from renewable energy sources, the gap between the current state and Indonesia’s target of 23% by 2025 is significant. He added that 80% of Indonesia’s energy is from fossil fuels and in the past 5 years, new coal-fired power plants with a life cycle of 30-40 years were still being built. Indonesia also faces a number of challenges in achieving a green economic recovery target, which included: inadequate financial and technical resources; lack of a fixed carbon market mechanism and definitive programmes for the private sector to encourage their participation; and lack of clarity on policy direction due to diverse and scattered Ministries working on green economy transition.

Proposed policies to support economic recovery

Indonesia released its 2022 state budget focusing on supporting economic recovery and structural reform. The government said its spending plan for 2022 will be “more balanced” with greater allocation for infrastructure and human development programmes, and some social assistance for the vulnerable (e.g. urban informal sector) retained. The breakdown of spending for key sectors included: health $17.7 Billion (9.4%); social protection budget $29.7 Billion (15.8%); education $37.6 Billion (20%) and infrastructure development $26.7 Billion (14.2%).

The macroeconomic assumptions used in the budget included economic growth at 5.2%, inflation rate at 3%, unemployment rate at 5.5%–6.3% and poverty rate at 8.5%–9%. After nearly two years of heavy spending on COVID-19 relief efforts, the planned 2022 budget deficit was set at 4.85% of GDP (from 6.1% in 2020 due to the pandemic), with the aim to return to a deficit of less than 3% starting in 2023. (Comment: We understand that the budget deficit level was around 2% pre-pandemic.) The Head of the Fiscal Policy Agency of the Ministry of Finance, Febrio Kacaribu, said that this commitment is intended to signal to investors and the global market that the government is credible in managing state finances and that it will continue to make the Indonesian market more attractive compared to other countries. Damuri commented that it would be possible for Indonesia to meet the 3% state budget deficit target if the economic recovery process gains momentum in the last quarter of 2021 and the first quarter of 2022, provided that the health aspect is well-managed.

As a result of heavy spending on COVID-19 relief efforts, Indonesia's debt position jumped to 40.8% of the GDP in August 2021. (Comment: We understand that this figure was around 30% pre-pandemic and that the debt ratio may increase to 45% of the GDP by the end of this year.) Teuku Riefky, macroeconomic and financial market economist from University of Indonesia’s Institute for Economic and Social Research, said that the increase is still relatively safe and measurable as Indonesia is still in the midst of Covid-19 pandemic. However, he warned that the U.S. Federal Reserve has signalled that it may scale back its asset purchases, which is a precursor to higher interest rates. If this happens, it may weaken the condition of the Rupiah and increase Indonesia’s foreign-denominated debt. This would lead to Indonesia having to increase its spending on debt interest payments. According to Damuri, Indonesia would start to lose its financial credibility if its debt ratio rises to 60% of the GDP.

In an effort to reduce debt and boost state revenue, the Indonesian government passed the Law on Harmonizing Tax Regulation on 7 October 2021. Key aspects of the new law include a carbon tax policy from 1 April 2022 (Rp30 or NZD$0.0029 per kilogram of carbon dioxide equivalent on emissions surpassing a designated cap); an increase in the value-added tax rate for sales of nearly all goods and services from 10% to 11% from April 2022 and to 12% by 2025; expansion of income tax brackets; and another round of the tax amnesty programme. Damuri commented that as 85% of Indonesia’s debt comes from the market, fiscal policies alone will not be sufficient to reduce debt in order to reach the 3% state budget deficit target, hence the government will need also to depend on its economic policies to ensure that the economy do well first.

The Indonesian government has introduced the Omnibus Law on job creation to accelerate Indonesia's national economic growth and encourage reform of the country's regulatory system. One of the initiatives under the Omnibus law, designed to attract foreign investment, is the positive investment list regulation. The list, which came into force on 4 March 2021, opens up opportunities for foreign investment in sectors in which foreign ownership was previously restricted including: construction services, distribution, energy, telecommunications and transportation. Another initiative is the new online integrated business licensing scheme known as the Online Single Submission (OSS) system, launched on 9 August 2021. The OSS is meant to improve the ease of doing business as the one-stop platform for all businesses (except those in the financial services industry) to obtain business and operational licenses. To date, we have yet to receive any indication as to when (or if) existing businesses will be transferred into the OSS system. We will continue to monitor developments on this closely.

Bilateral trade statistics

Despite the impact of COVID-19, we have seen a relatively strong growth in New Zealand’s bilateral trade with Indonesia. In the June 2021 quarter, New Zealand exported $373.22 million (up 37.1% from the same period last year) of total goods and services to Indonesia. This increase was supported by the growth of agricultural goods exports and a positive trend in food services. New Zealand also imported $317.16 million (up 41.9%) total goods and services from Indonesia. This has led to a New Zealand trade surplus of $56.06 million (up 39.2%). The total two-way trade value increased by 15.3% to $690.38 million. Indonesia is now New Zealand’s 7th largest goods export destination (improving from 12th before the pandemic).

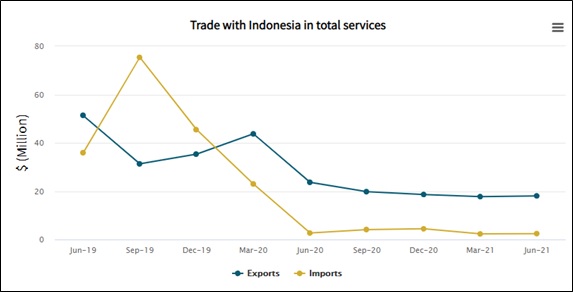

While the trend has been positive for our goods exports to Indonesia (up 42.9% compared to the same quarter last year), trade in services (including tourism, travel and education) has suffered significantly due to border closures. In the June 2021 quarter New Zealand exported $18.06 million of total services to Indonesia (down 23.7%) and imported $2.42 million (down 9.7%), representing a total trade value of $20.48 million (down 22.3%).

Navigating the complex regulatory environment

Despite the increase in agricultural goods exports, the regulatory environment in Indonesia remains complex. Adding to regulatory uncertainly is the new import regulations on horticultural and beef products, which were recently issued by the Indonesian Ministry of Trade, effective from 15 November 2021 but back-dated to 1 April 2021. As these regulations relate to our WTO case with Indonesia, we are thoroughly assessing the content of more than 1,000-pages of regulations and continue to monitor developments closely to ensure that import licenses will be issued in a timely manner, in line with Indonesia’s WTO commitments.

How are New Zealand businesses in Indonesia faring?

Our recent engagement with New Zealand businesses in Indonesia, including via NZTE, has shown that the pandemic has led to a mix of positive and negative business outcomes depending on the sector. On the one hand, the food and beverage (F&B) businesses (especially food service) have seen a positive trend following the reduction in COVID-19 cases and easing of movement restrictions by the government. This positive trend is expected to continue in Indonesia’s big cities, including Bali after government approval of entry to Bali by foreign tourists starting on 14 October 2021. The New Zealand F&B industry also appear to have benefitted from the disruption in the global supply chains, where global shipping and supply chain congestion issues had caused delays for products shipped from the United States to Indonesia. This has led to Indonesian businesses sourcing from Oceania countries like New Zealand and Australia, with NZTE fielding an increased number of enquiries from Indonesian F&B businesses wanting to source ingredients and food service products from New Zealand.

New Zealand businesses in the aviation sector are suffering as it has been heavily impacted by the COVID-19 situation. As a result, this sector is focusing on survival and recovery preparations. Despite being unable to travel to Indonesia, New Zealand businesses in the geothermal, construction, and manufacturing sectors are still participating in the Indonesian market tender submission processes, with some achieving satisfying results. NZTE has also received several enquiries from New Zealand businesses in the healthcare and specialised manufacturing sectors wanting to enter the market. Prospects are also looking positive for existing, in-market, New Zealand energy and specialised manufacturing businesses. NZTE has been supporting these businesses in their strategy for a more aggressive business expansion through tapping new sectors and unlocking new partnerships with more diversified local partners.

Comment

Indonesia was showing similar signs of economic recovery in March 2021 until the second wave of COVID-19 crippled its recovery. In order to sustain the current momentum of the economic recovery, the Indonesian government will have to balance its economic recovery priorities with its health considerations. This will be a challenging task for Indonesia, as Indonesia would also need to consider how it could implement its climate change ambitions and green energy transition to support a sustainable and green economy.

More reports

View full list of market reports.

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link).

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.