Sustainability:

On this page

Prepared by the New Zealand Embassy in Tokyo

Overview

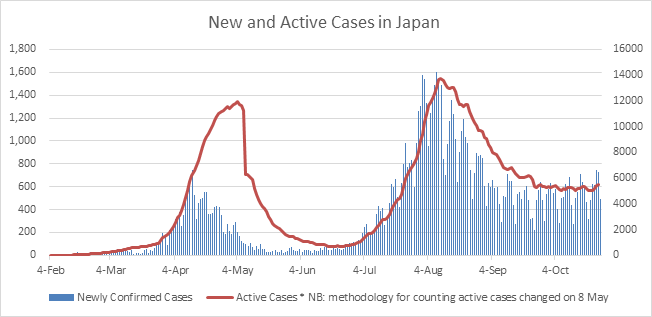

Japan’s ‘second wave’ of COVID-19 infections has declined and reached a steady plateau of around 500-600 new confirmed cases each day indicating ongoing community transmission (see chart below)

Despite the ongoing low level of community transmission, Japan has not resorted to lockdowns and has instead relied mainly on voluntary adherence to mask wearing and social distancing measures. The death rate from COVID-19 remains low at 13 per million population compared to 600-700 per million in some parts of Europe and North America

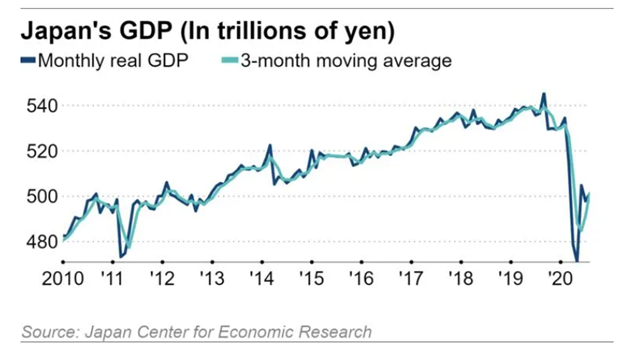

Following three consecutive quarters of negative economic growth, the Japanese economy started to pick up in the July-Sept quarter (Q3). Full GDP figures for the quarter are not yet available but in August the economy grew by 0.6% in real terms due to external demand lifting exports by 5.4%

New Zealand’s goods exports to Japan in Q3 (July-Sept) were nearly 11 percent down on the same period last year, although year to date (YTD) Jan-Sept 2020 goods exports are still up 3.5% on the same period last year due to high volumes of horticulture exports in Q2 (see charts below)

New Prime Minister Suga announced on 26 October that Japan is committing to cut greenhouse gas emissions to net zero by 2050 which promises to stimulate more investment in ‘green’ technology and may create opportunities for New Zealand leveraging our clean green image and renewable energy capability.

This monthly report also includes an introduction to potential opportunities for New Zealand companies in the agri-tech sector in Japan.

Economic Overview

The Japanese Government’s latest assessment is that “The Japanese economy is still in a severe situation due to the Novel Coronavirus, but it is showing movements of picking up recently” supported by the effects of Government stimulus policies and improvement in overseas economies

The Bank of Japan expects the Japanese economy to shrink 5.5 percent in this fiscal year (ending March 2021) and for the consumer price index to fall 0.6 percent

Japan experienced three consecutive quarters of negative economic growth beginning in the final quarter of 2019 (-1.8%) when the Government increased the consumption tax rate from 8 – 10%

GDP growth in the first quarter of 2020 was also slightly negative (-0.6%) as the impacts of the coronavirus travel restrictions were starting to be felt; and in the second quarter a sharp contraction of -7.9% (-28.1% annualised) occurred during the state of emergency declared to combat Japan’s first wave of COVID-19 infections

The economy returned to positive real growth of 0.6% in August due to strong growth in exports of automobiles to Europe but domestic demand was still in negative territory.

Consumer spending down except for food, appliances and luxury goods

Mobility data for October continues to show a lower than usual level of activity (-7%) at restaurants, cafes, movie theatres; less use of public transport (-16%) and some people still working from home (physical presence at work -10%)

Nominal wages fell 1.3% in August as many domestic companies have said they will cut bonus payments this winter due to a decline in revenues amid the pandemic

Overall Japanese household spending in August dropped 6.9% from a year earlier in due to the continued impact of the coronavirus

Sales of clothing sank 23.5% as people continued to avoid outings and worked from home

Food sales, however, rose 1% in September from a year earlier, as demand grew for cut vegetables and fresh fish

There are some signs emerging of an increase in consumption of luxury goods in Japan possibly due to fact that wealthy households cannot travel overseas and are eating out less frequently

There are over 53 million households in Japan and one estimate by Nomura Research is that around 20% of these households could be described as “well-off”

One luxury car dealership in Tokyo is reporting sales up in 2020 by 30% compared to last year, bucking the overall trend of a 22% fall in sales of automobiles in the April-Sept period compared to last year

Daiwa Department store in Kanazawa reported an upsurge of 20-30% in summer sales of pricey imports such as Louis Vuitton, Tiffany and other luxury brand goods over the previous year

Demand for musical instruments is also up due to people spending more time at home, for example electric piano sales are up 40% over last year

Sales of large home appliances (such as air purifiers and electric grills) in the six months from April to September are at the second highest level for a decade, supported by the Government’s cash handout of $1400 per citizen

Business sentiment improving but still in negative territory

The Bank of Japan’s latest survey of business sentiment improved in the July-Sept quarter from the 11 year low in the previous quarter, but businesses with a pessimistic outlook still outnumbered those feeling optimistic

In one positive sign, big firms plan to raise capital expenditure by 1.4% in the current business year to March 2021 but total spending plans by companies of all sizes and industries are 2.7% lower for this business year

Tokyo Shoko Research says more than 35,000 firms suspended operations or closed down from January to August, up 24% from the same period last year

Japan's exports in the period April-Sept fell 19.2% from a year earlier, posting the largest year-on-year drop in more than 10 years, due to sharp falls in overseas demand for cars and other goods

New Suga administration aim to create a “green society,”

New Prime Minister Yoshihide Suga declared that “Japan will strive to become a carbon neutral society, with zero net emissions, by 2050" in his first policy speech to the Diet on 26 October

This is a significant announcement from the world’s fifth largest emitter of CO2 which is expected to drive a faster shift toward renewable energy and low emissions vehicles

Japan closed most of its nuclear power plants following the Fukushima disaster in 2011, and the proportion of Japan’s energy mix derived from nuclear power contracted sharply

Japan is currently reliant on fossil fuels for 87% of its primary energy needs and over 90% of Japan’s energy supply is imported from overseas

According to the US Energy Information Administration, Japan was the world’s third largest importer of coal in 2019. (Coal accounts for around one third of Japan’s electricity generation.) In July this year, Japan announced it would deactivate more than 100 domestic low-efficiency coal-fired power plants by 2030, and only support the export of coal-fired power plants under certain conditions

At the same time as announcing the overall goal of reaching zero net emissions by 2050, the Government also announced new subsidies for developing the next generation of batteries for electric vehicles

New Zealand already has a strong brand in Japan for sustainability and renewable energy which has been a factor in attracting investment in New Zealand by some Japanese companies, for example in hydrogen production

New Zealand companies specialising in geothermal energy are active in providing consulting services in Japan

New Zealand goods exports to Japan down nearly 11% in Sept quarter

New Zealand’s goods exports to Japan in Q3 (July-Sept) were nearly 11 percent down on the same period last year, although year to date (YTD) Jan-Sept 2020 goods exports are still up 3.5% on the same period last year

Demand has been high in Japan for healthy foods in 2020 partly due to COVID-19. This demand has driven positive results for exports of New Zealand fruits, vegetables, and food and beverage products

As can be seen from the graph below, horticulture exports (particularly kiwifruit and apples) had a bumper year with most product shipped in Q2. Exports are lower in Q3 as the season ends for our major fruit exports

New Zealand meat and fisheries exports have been affected by the Japanese public eating out less during the pandemic. Frozen beef products have fared better than chilled/fresh products

Forestry products were severely affected in Q2 due to the lock down in New Zealand limiting production and demand in Japan has been hit by the slow-down in housebuilding

New Zealand metal exports to Japan are mostly aluminium which is used in production of computer equipment and autos. Japan’s exports of autos have been hit by slow-downs in the US and Europe

As we have reported in previous months, about 20 percent of New Zealand’s exports to Japan are tourism and education services which have been severely impacted by the border closures in New Zealand.

Q1-Q3 2020 New Zealand Goods Export to Japan by Industry Comparison

| Industry Group | Q1 2020 | Percent Change, Q1 2020/ Q1 2019 | Q2 2020 | Percent Change, Q2 2020/ Q2 2019 | Q3 2020 | Percent Change, Q3 2020/ Q3 2019 |

| $Millions | %Change | $Millions | %Change | $Millions | %Change | |

| Miscellaneous Food and Beverage Products | 57.3 | 18.1 | 66.4 | 65.6 | 55.8 | 8.2 |

| Horticulture | 139.4 | 75.8 | 492.0 | 23.7 | 178.7 | -2.8 |

| Meat and meat products | 131.9 | 34.4 | 117.0 | 15.8 | 65.1 | -14.1 |

| Forestry and Wood Products | 94.0 | 2.2 | 71.8 | -38.0 | 87.9 | -18.8 |

| Dairy | 208.7 | 23.8 | 219.1 | -2.1 | 146.9 | -9.8 |

| Metal and Metal Products | 131.3 | -9.3 | 135.9 | -11.2 | 116.1 | -20.5 |

| Fisheries | 16.2 | -21.4 | 19.5 | -6.7 | 16.7 | -44.6 |

| Subtotal of leading industries | 778.8 | N/A | 1,121.7 | N/A | 667.3 | N/A |

| Other goods | 74.5 | N/A | 83.1 | N/A | 94.4 | N/A |

| Total | 853.3 | 16.3 | 1,204.8 | 6.1 | 761.7 | -10.8 |

Market Insights: Japan Agri-tech Market

NZTE is undertaking research on potential opportunities for New Zealand companies in the agri-tech sector in Japan

Initial estimates are that the agri-tech market size in Japan is around NZD2.6 billion within the wider domestic agricultural production market of over NZD130 billion

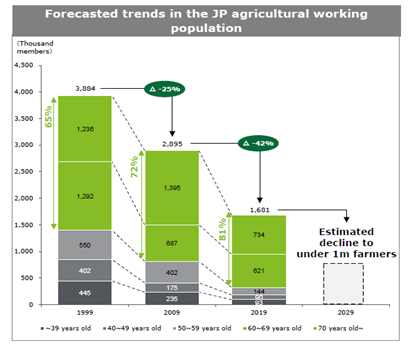

The agricultural workforce in Japan is aging rapidly and labour shortages in the agriculture industry as well as an aggregation of smaller farms into larger units are key drivers for the need to adopt more labour saving technology.

While efforts have been made to recruit younger Japanese farmers and foreign workers into the industry, the agriculture workforce in JP declined by around 42% from 2009 to 2019; emphasizing the need for automation and innovative technologies to improve yields and reduce labour requirements.

The Japanese Government has also adopted ambitious targets for increasing agricultural production that will require additional investment and innovation

New Zealand has some world class agricultural technology and a positive reputation in Japan for sustainable production of healthy products

NZTE has identified some constraints and opportunities to the adoption of New Zealand technology in the agriculture sector in Japan

- Aging farmers have a low level of digital literacy and ICT infrastructure is limited in some rural areas but younger farmers are gradually taking over as older farmers retire and these younger farmers are looking to expand their land size under management and maximise efficiencies

- The Japanese agri-tech market is a competitive landscape with strong local and overseas manufacturers already well established but there is an opportunity to provide more localised solutions with better after sales service in Japanese language

- Some of New Zealand’s agri-tech solutions are pasture based innovations that do not have wide applicability in Japan but there is growing interest in grass farming techniques and some small scale cooperative projects under way which are deploying New Zealand expertise in a Japanese context

There are a range of potential local partners in Japan that have either an established base of member farmers or access to sales and distribution channels

New Zealand companies interested in the opportunities in the agri-tech sector in Japan should contact your Customer Manager at NZTE or contact NZTE at https://my.nzte.govt.nz/home(external link) to find out more about potential partnership structures and other considerations.

To contact our Export Helpdesk

- Email: exports@mfat.net

- Phone: 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.