Primary Products:

On this page

Summary

- Recent positive economic developments in Samoa, including a strong economic rebound from increased tourism revenue and remittance inflows, slowing inflation, and active management of debt, have put the Government of Samoa in a stable position to tackle the year ahead.

- Samoa’s Budget 2024/25 reflects a continuation of its priorities since the FAST administration took office in 2021, as well as significant costs related to hosting the Commonwealth Heads of Government Meeting (CHOGM) in October 2024 and the establishment of new public services.

- The Government remains confident of the economic opportunity from hosting CHOGM, which it expects will attract international visitors and investment.

Report

By all accounts, Samoa is in a positive macroeconomic situation

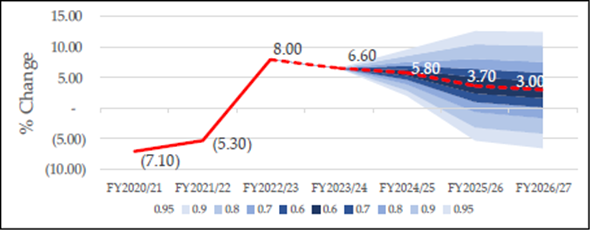

Samoa’s economic outlook is expected to remain largely positive as it exits this financial year, recording another year of positive growth owing to continued significant contributions from tourism revenue (20% of GDP) and remittances (33% of GDP). Samoa is expected to exceed the IMF’s projections for global economic growth of 3.2% for the 2023/24 financial year, with the Asian Development Bank projecting Samoa’s growth at 4.2%. Samoa’s Ministry of Finance is projecting an even more optimistic figure of 6.6%. This is expected to level out in 2025 and slow back down beyond 2026, as the surges from post-COVID and the hosting of the Commonwealth Heads of Government Meeting (CHOGM) activities taper off. (see Figure 1)

Figure 1: GDP growth projection (2020/21 – 2026/27)

Inflationary pressures in Samoa are also easing. As a net importer (with a negative trade balance of NZD640 million as of 2023) and a tourism and remittance-led country, Samoa experienced substantial pressures on imported goods and oil as a result of global impacts and the reopening of its borders in August 2022, reaching 12.0% in June 2023. Inflation dropped to 5.1% in April 2024, relieving Samoan families with moderate drops in prices for both imported and local goods, including foods such as taro, fresh fish, and green banana. (see Figure 2)

Figure 2: Key economic indicators

| 2021/22 | 2022/23 | 2023/24 (forecast) | 2024/25 (forecast) | |

| GDP growth | -5.3% | 8.0% | 4.2% | 4.0% |

| CPI inflation | 8.8% | 12.0% | 4.5% | 4.3% |

| External debt-to-GDP ratio | 43.6% | 39.1% | 29.8% | 25.0% |

|

Source: Asian Development Bank, April 2024; Samoa Ministry of Finance, May 2024 |

||||

The Central Bank of Samoa in April 2024 announced only a gradual tightening of its monetary policy (currently the Official Interest Rate is 0.46%) towards reducing consumer spending. Like the New Zealand Reserve Bank, the Central Bank has a mandate to manage price stability towards its medium-term target of 3.0%.

Budget 2024/25

In this context, the Government’s books appear to be reasonably healthy, ending the 2023 calendar year with a projected surplus of NZD63.9 million (roughly 4.7% of GDP), attributable to high tax collections, increases last year in project-tagged grants from Samoa’s bilateral and multilateral partners (including New Zealand), ongoing general budget support from donors, and continuous external debt servicing. In addition, gross foreign reserves as of March 2024 are recorded at NZD768 million, prospectively sufficient for 13 months’ worth of goods import cover.

The Minister of Finance Hon Lautimuia Uelese Afoa Va’ai tabled Budget 2024/25 to Parliament on 28 May, and echoing the theme of CHOGM 2024 he stated the budget’s focus is on “sustaining growth pathways for the social, economic, and climate resilience of our common wealth”. To achieve this, core spending areas for Budget 2024/25 are:

- Hosting of CHOGM in October 2024;

- People-centred priorities such as: the District Development Programme, Education, Health, Private sector (including a notable NZD1.8 million to the Samoa Business Hub), and civil society;

- Public sector development, including: another round of cost-of-living adjustments for public servants and a salary band restructure;

- Disaggregating government functions with funding for new ministries: Ministry of Lands and Survey (NZD5 million), Ministry of Sports and Recreation (NZD4.8 million), and the Samoa Export Authority (NZD710,000); and

- Other infrastructure development projects, such as: the Savai’i Courthouse, the Alaoa Multipurpose Dam, and other climate resilience-targeted investments.

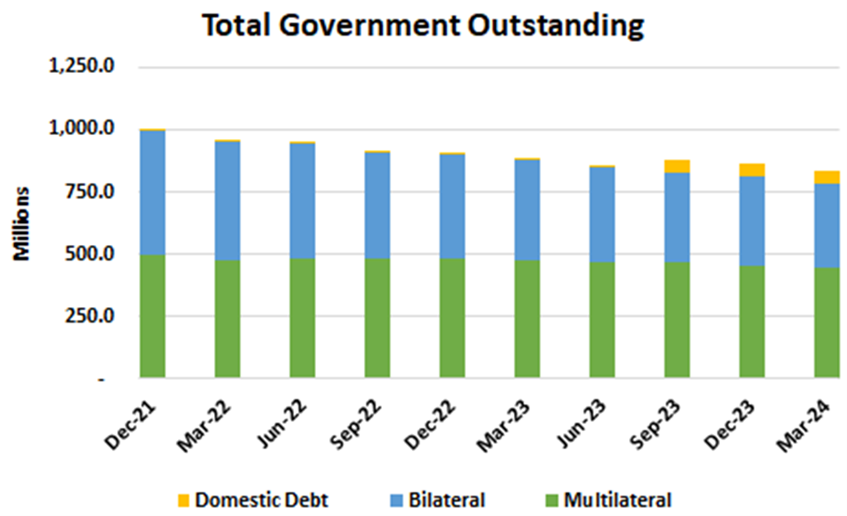

In his budget speech to Parliament, the Minister of Finance also announced that the Government would not introduce or raise any taxes. At the same time, with a stated goal of debt reduction, we can expect no increase to Samoa’s debt stock. As of March 2024, Samoa’s outstanding external debt sits at NZD462.1 million. Of this, China remains Samoa’s key bilateral creditor at NZD164.9 million (36% of Samoa’s total external debt), down by NZD70.4 million (roughly 30%) since March 2022. Samoa’s other major creditors are the World Bank (NZD155.1 million), the Asian Development Bank (NZD98.7 million), and Japan (NZD35.1 million). (see Figure 3)

Figure 3: Samoa’s debt composition (December 2021 – March 2024)

In totality, hosting CHOGM looks to cost the Government of Samoa around NZD23.7 million (WST40 million) based on current figures, accounting for roughly 1.9% of GDP.

The continuation of funding the Government’s District Development Programme (DDP) remains a significant feature of this year’s budget, with NZD30.2 million appropriated to fulfil its “WST5 million (NZD2.9 million) per district over 5 years” commitment.

As in previous years, the Government is also continuing to focus on its public servants by financing the cost-of-living adjustments for the public sector, with an additional increase of between 1.0% and 3.0% depending on salary band. At the same time, the Government has also allocated funding towards a comprehensive review and restructure of the public sector’s salary bands.

To meet total planned expenditure of NZD686 million (roughly WST1.16 billion), the Government ‘s projected revenue of NZD591.1 million for 2024/25 will come from tax receipts and donor grants, as well as the new administrative charges from the Australian and New Zealand labour mobility schemes planned for implementation from July 2024.

This leaves a current deficit of NZD90.8 million (roughly 2.1% of GDP) based on the forward estimates. While general budget support from donor partners (worth roughly WST68.1 million from New Zealand, Australia, and the European Union) will finance some of this fiscal gap, there remains a residual hole of NZD50.5 million which needs to be answered.

As such, Budget 2024/25 reflects significant cuts across several public services. Ministries that are set to be most impacted include the Ministry of Agriculture and Fisheries (reduction of 20.7%), Ministry of Natural Resources and Environment (reduction of 22.6%), the Ministry of Public Enterprises (reduction of 38.9%), and the Office of the Electoral Commission (reduction of 20.5%). Critical public services such as the Ministry of Health and the Ministry of Education and Culture – both still receiving the highest budget allocations – only saw marginal reductions, with the latter feeling a 10.4% reduction mostly to finance the new Ministry of Sports and Recreation (formerly amalgamated as the Ministry of Education, Sports, and Culture).

What to expect for the year ahead

Hosting CHOGM in October 2024 is already stimulating increased economic activity, with the Government of Samoa providing business opportunities for local accommodation providers, caterers, ICT, retail, and tourism. Historically Samoa has benefited from hosting large-scale events, including the Commonwealth Youth Games which saw 6.2% growth in 2015, and the Pacific Games in 2019 which saw a quarterly growth of 6.3% in Q3 (easing later on due to the 2019 measles outbreak).

Samoa’s comprehensive and government-wide (11 Ministries involved) economic and fiscal policy reform journey will be important going forward. Facilitated under the multi-donor Joint Policy Action Matrix (JPAM) mechanism, New Zealand, Australia, the European Union (EU), the World Bank, and the Asian Develop Bank continue to provide general budget support towards strengthening Samoa’s economic governance systems.

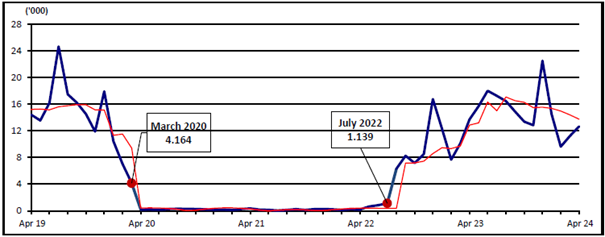

Looking ahead however, the contribution from tourism revenue is volatile. Based on the latest April 2024 arrival statistics, tourism numbers are in decline, down 4.5% compared with the previous year’s figures. This follows an expected levelling out from the initial surges felt through 2023 post-border reopening. (see Figure 4)

Figure 4: Monthly total visitors (April 2019 – April 2024)

The Ministry of Finance is projecting that growth will normalise in the 2025/26 financial year to around 3.7%. The current account deficit is also expected to narrow further as major costs wind down, such as hosting CHOGM, and the Government continues its programme of debt servicing while not taking on new loans. The 2026 General Election and its preparations is also likely to influence the economy’s performance.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.