Supply Chains:

On this page

Prepared by the New Zealand High Commission in Singapore

Summary

- Singapore’s economy remains on-track for 7% growth in 2021, with expansion in manufacturing output offsetting ongoing weakness in key service sectors, particularly those connected to tourism. Despite the disruption of COVID-19 and other structural challenges, the long-term economic prospects for Singapore remain strong.

Report

Singapore economy: crunching the numbers

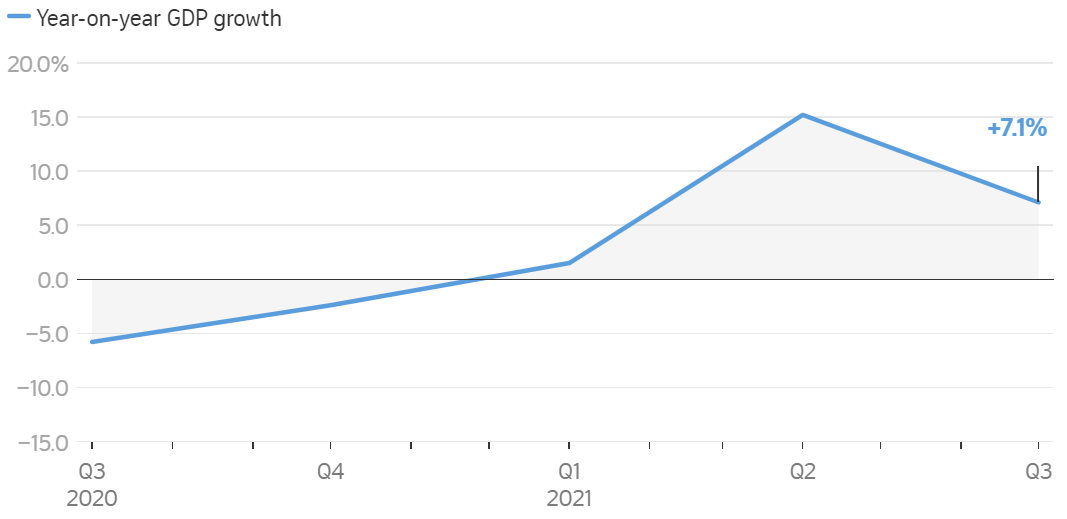

Singapore’s economic growth for 2021 is projected to come in at around 7% (off a low base in 2020), and thereafter dropping to between 3% - 5% in 2022. The lower 2022 calendar year growth projection reflects uncertainty over regional and global growth, including due to the impact of Omicron and any other new COVID-19 variants.

Singapore's GDP

The manufacturing sector remains key to Singapore’s economic growth – with output increasing 16.9% year-on-year in October 2021. Although coming off a low base, biomedical manufacturing output recorded a standout 56.1% increase over the same time period. Manufacturing momentum however is waning and could weaken during the first half of 2022.

The food and beverage sector shrank 4.2% from Q3 2020 to Q3 2021 due to Singapore’s imposition of dine-in and event restrictions to curb the spread of COVID-19. The tourism sector was also adversely impacted by ongoing border restrictions. It is expected that these service sectors will not recover to pre-COVID-19 levels until the end of 2022 at earliest.

Like much of the region, inflation in Singapore remains high. Consumer prices rose 3.2% in October (year-on-year), the most since March 2013. Meanwhile, core inflation, which excludes rents and private road transport costs, climbed to 1.5 per cent - the highest level in nearly three years. An Economist Intelligence Unit (EIU) report released on 1 December placed Singapore as the most expensive Asian city to live in, overtaking Hong Kong.

The employment rate for residents aged 15 and over increased from 64.5% to 67.2% between June 2020 and June 2021. The nominal median income of full-time employed residents also grew over the same period by 3.2%. As outlined by Singapore’s Ministry of Trade and Industry, the resident work-force has been buffered by a decline in employment amongst non-residents (-187,000 over the period 4Q19 and 2Q21).

Supply Chains: Air and Sea

Pre-COVID, the aviation and airline industry contributed about $48.7 billion or around 12 percent of Singapore’s GDP. When jobs in ancillary support industries are factored in, Singapore’s air transport sector supported about 375,000 jobs pre-COVID-19. In October 2021, there were 120,000 arrivals at Changi Airport (in comparison there were 42,000 arrivals in October 2020). Singapore’s establishment of vaccinated travel lanes (27 to date) has supported the gradual increase in passenger movements through Changi Airport, with air traffic and capacity growing five-fold against 2020’s low base.

While traveller numbers remain well below the pre-COVID-19 average, the Singapore Airlines Group has reported a 18.3% overall increase in revenue to S$1.53 billion. This is predominantly attributed to a strong showing from its cargo business, with revenue from cargo flown increasing 51% year-on-year to a record S$1.88 billion.

Civil Aircraft Arrivals and Departures, Passengers and Mail - Changi Airport

Like others, Singapore business and consumers are facing supply chain delays due to backlogs in ports in China and the United States, erratic ship movements, and global bottlenecks due to the rebound of consumer demand in the second half of 2021, Shipping costs from the US to Singapore have reportedly doubled, while shipping costs from Perth to Singapore are reportedly now 6 times higher than pre-COVID.

In response to ongoing global supply chain disruptions, the Port of Singapore (PSA) has positioned itself as a “catch-up port” and is working to help vessels make up for delays along other parts of the supply chain, including by using its international port connections to suggest alternative routes or options. The not-yet operational Tuas Port under construction has been designated a free trade zone, and opened its yards to add 2,000 TEUs (20-foot equivalent units) of capacity to further facilitate the movement and storage of goods. Beyond ramping up port operations, Singapore is expediting the movement of more critical materials, including semiconductors, while working with SMEs to make sure cargo flows from China to Singapore stay punctual enough to meet project deadlines.

Asia continues to lead globally in terms of economic growth, the rise of the middle class, wealth creation and urbanisation. Most Asian economies are working hard to bounce back from the pandemic. Singapore, like many other regional countries, is learning to live with Covid-19, and progressively re-opening our economy.

Finance Minister Lawrence Wong

Senior Minister of State for Transport Chee Hong Tat has commented that these decisions were undertaken consciously, “based on longer-term strategic considerations and the recognition of Singapore’s role as a key transhipment hub port”. These investments are already paying off – in the first 10 months of 2021 over 30.87 million twenty-foot equivalent units (TEUs) were handled, a 2.2 per cent increase over the same period last year. In Singapore, the average wait for off/onloading is between 2-3 days, compared to an average delay of 7-9 days seen at other major ports, further bolstering Singapore’s position as a reliable transhipment hub.

Singapore’s long-term economic prospects

As noted by Finance Minister Lawrence Wong in a speech in November 2021, Asia’s fundamentals remain strong despite the short-term economic disruption caused by COVID-19. Wong noted that ‘Asia continues to lead globally in terms of economic growth, the rise of the middle class, wealth creation and urbanisation. Most Asian economies are working hard to bounce back from the pandemic. Singapore, like many other regional countries, is learning to live with Covid-19, and progressively re-opening our economy.’

On the back of strong performance in the pharmaceuticals and medical technology segments Singapore’s biomedical manufacturing cluster was a linchpin of Singapore's manufacturing growth in 2021. Consequently, Singapore continues to seek to attract foreign medical/biotechnology companies with the dual aim of securing its own access to key supplies, while simultaneously positioning itself as a hub for production and distribution into the region. Earlier this year BioNTech announced that it will set up an mRNA manufacturing facility and its regional headquarters in Singapore, while other major pharmaceutical companies such as Sanofi and GlaxoSmithKline are similarly growing their presence in Singapore.

In the medium-term, Singapore is looking to ‘emerge stronger from COVID-19’ by protecting and building on its status as an aviation and maritime hub. Singapore is also looking to expand the size of its manufacturing sector by 50% by 2030, with a focus on building (in particular) its bio-medical and precision engineering sub-sectors. In line with this objective, during 2021 Singapore has seen significant investments made by GlobalFoundaries ($US4 billion) and Silitronic (S$3 billion) in semi-conductor manufacturing in the city-state.

Momentum in the deep tech space is also set to grow. Singapore's investment company, Temasek, will invest $1 billion annually into the development of deep-tech innovation across a variety of domains, including digital solutions, advanced manufacturing, life sciences, sustainability and agritech. These investments will be put towards generating returns from the following regional trends:

The size of the digital economy in South East Asia is expected to reach US$1 trillion by 2030(external link).

The carbon market in South East Asia will present $10 billion of economic opportunity annually by 2030(external link).

By 2030, around 55 percent of incremental food spend, or US$2.4 trillion,(external link) will be actively driven by consumer-conscious behaviour in Asia.

In evolving Singapore’s economy, the government is committed to tackling challenges such as social inequality, an ageing population, and climate change.

Comment

For New Zealand businesses looking to expand and diversify offshore as the world starts to recover from COVID-19, Singapore (and South East Asia) continues to be worth looking at very closely across a range of sectors – from value-added food products through to technology, and digital services. The long-term economic and social trends, including a growing regional middle class and ongoing digital transformation, are compelling in terms of opportunities for New Zealand firms.

More reports

View full list of market reports.

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link).

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.