Food and Beverage, Primary Products, Manufacturing (excludes F&B):

On this page

Trade and economic overview of Central America

All figures listed are in New Zealand dollars (NZD)

Central America—comprising Belize, Guatemala, Honduras, El Salvador, Nicaragua, Costa Rica and Panama—is a diverse region with a combined population of more than 55 million. As of 2023, the region had a combined GDP of NZ $628.7 billion, slightly smaller than that of the Philippines. Guatemala is the largest economy in Central America ($181.6b), followed by Costa Rica ($149.9b), Panama ($142.2b), El Salvador ($60.6), Honduras ($58.5b), Nicaragua ($30.4b), and Belize ($5.5b).

Central America’s recent annual GDP growth rate of 3.1% (2023) has far exceeded that of the 1.2% average of its Latin American counterparts. There is ample intra-regional trade, and the United States is the region’s largest external trading partner. Central America growth rates are predicted to remain strong, thanks in part to the nearshoring policy approach in the United States. For example, both Costa Rica and Panama are eligible for US tax incentives via the CHIPS Act - Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, August 2022 - and have benefited from increased foreign direct investment, including significant investment in their semi-conductor industries. Despite a wide variety in development (Panama’s GDP per capita is $31,074 vs. Nicaragua’s $2,503), all Central America economies are now larger than the pre-pandemic peak. Demographics also point to the potential for further economic growth with a youthful and growing population (the region’s median age is just 28.6 years).

Politically, there are some positive signs for businesses with Governments in the region actively seeking trade and investment partnerships. In Guatemala, the region’s largest economy and most populous country, the new Arévalo administration has prioritised fighting corruption and made a concerted pitch to attract investment and trade. Significant tax incentives are available for investors including in clothing manufacturing and call centres in Guatemala, El Salvador and in Panama. Re-elected El Salvadorian President Nayib Bukele is expected to continue an outward-facing trade policy, while the new President José Raúl Mulino of Panama has expressed interest in developing new trade connections. Costa Rica’s active trade agenda, including application to CPTPP and DEPA, also provide future potential for New Zealand businesses.

Report

New Zealand trade in the region

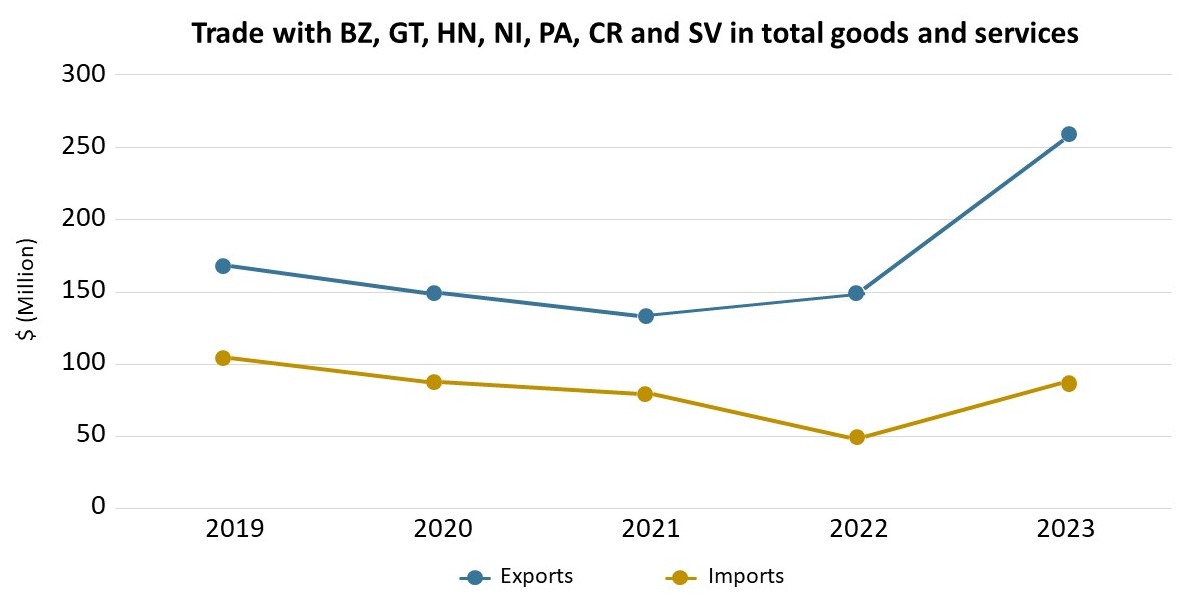

Historically, New Zealand’s trading relationship with Central America has been thin. In recent years, however, it has increased considerably, culminating in two-way trade reaching $344.2 million (YE June 2023).

Our total export value to the region was $247.3 million in 2023[4], similar to New Zealand’s exports to Chile and a considerable increase (66%) from $149.4 million recorded in 2022. An increase in trade between New Zealand and Guatemala, our largest trading partner in Central America, was a substantial contributor. New Zealand’s exports to Guatemala were valued at NZ$111.9 million in 2023, a 113% increase compared to $52.6 million the year before. Our next largest regional trading partner in 2023, El Salvador, imported $59.7 million of New Zealand exports, followed by Panama ($49.7m), Costa Rica ($10.4m), Honduras ($9.6m), Nicaragua ($5.3m), and Belize ($0.7m). Guatemala, El Salvador, and Honduras all saw considerable increases in New Zealand exports in 2023, while exports to Nicaragua have experienced a decrease.

The vast majority of New Zealand’s exports to Central America are agricultural products, which on average constitute nearly 80% of New Zealand’s exports across Central America. New Zealand dairy products have proved particularly popular among the growing middle class, including high quantities of concentrated milk, butter, cheese, whey, casein and other dairy products. Other substantial exports include sowing seeds and therapeutic appliances. High tariff rates on agriculture products, however, remain an impediment to further growth for many New Zealand exporters.

Despite this concentration in our current trade profile, a broad range of New Zealand companies are operating in and are interested in Central America. As well as Fonterra, these include Zespri, Gallagher Security, Loadscan, DataTorque, Navicom Dynamics, and Western Energy Services. Several exporters have identified Central America as an important market to offset slower economic growth in some of New Zealand’s traditional export markets.

Existing trade architecture

The Central American Integration System (SICA - Sistema de la Integración Centroamericana) provides regulatory consistency in a range of areas between the markets. There are also several existing free trade agreements (FTAs) in Central America. These include arrangements with fellow regional states, other parts of Latin America, and countries further abroad. The most notably agreements are the Central America- Dominican Republic-United States Free Trade Agreement (CAFTA-DR) whose members include Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and the Dominican Republic, which entered into force in 2006 and the European Union (EU-Central America Association Agreement/ EU-CAAA).

Costa Rica is likely to become New Zealand’s first FTA partner in the region. Costa Rica has applied to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Costa Rica has also expressed a desire to become a member of the Pacific Alliance – currently consisting of Colombia, Peru, Chile, and Mexico. New Zealand also launched FTA negotiations with the Pacific Alliance in 2017 with the goal of becoming an Associated State. Costa Rica has also applied to join the Digital Economy Partnership Agreement (DEPA), of which New Zealand was a founding member. Any of these agreements would enhance our existing trade cooperation with Costa Rica including within the World Trade Organisation (WTO) and the recently concluded Agreement on Climate Change, Trade and Sustainability (ACCTS). As one of the wealthiest countries in Latin America (per capita GDP of $27,626) any future agreement may offer further opportunities for exporters.

Opportunities and challenges in the region

There are a number of both challenges and opportunities that will be relevant to a company’s decision to operate in or engage with the region:

Opportunities

The unification of customs procedures under the Central American Uniform Customs Code (CAUCA) means the same documents are used in Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and Panama. This makes authorisation in one country effective in accessing the region’s wider markets.

Central America’s access to both the Pacific and Atlantic Oceans via the Panama Canal and a range of ports enables it to have strategic investment and trade value for major economies, better enabling access to North and South American markets, and facilitating trade between Europe and the Asia Pacific.

All countries in Central America are actively working to better enable prospects for nearshoring. In addition to unified customs procedures, each market offers different opportunities including Costa Rica’s large middle class, Guatemala’s growing manufacturing sector, and Panama’s unique location as a trade hub.

Panama and Costa Rica’s higher income status (first and fourth highest GDP per capita in Latin America) create a greater demand for high-value and internationally sourced products. New Zealand companies that offer premium or luxury goods may find success in these sectors. In El Salvador, prioritisation of digital transformation creates opportunities for businesses that offer e-government services and digital-based solutions across various sectors. In Guatemala, New Zealand companies have found opportunities in the country’s consumer goods sectors.

Central America offers a high degree of complementarity to our own exports. Most Central American countries are fellow members of the agriculture-exporter Cairns Group though unlike New Zealand, they are exporting large quantities of sugar and tropical fruits while importing large amounts of dairy and wine products.

Challenges

Tariffs on many of New Zealand's exports, particularly agricultural, remain high (averaging 32%). The United States’ Central America FTA - Dominican Republic (CAFTA-DR) tariff elimination schedule will see remaining tariffs for US dairy products removed in 2029, which could make the export of New Zealand’s dairy products to the region—subject to higher tariffs—less competitive. In addition, extensive intra-regional trade and the close integration of North American companies may increase market competitiveness in certain sectors.

At times, the business culture and operating environment may appear more bureaucratic than in New Zealand, with senior regulatory authorities often rotating between political administrations. While some business contacts will have a high level of English, many officials and other key stakeholders will only speak Spanish. Long term personal connections are highly valued in Latin American business contexts.

In terms of non-trade factors, New Zealand’s bilateral relationships with these countries are historically limited and often impacted by a high level of political volatility in some countries. The treatment of human rights and resulting sanctions from the US or others requires consideration, especially at present in Nicaragua. The region is also experiencing high levels of outwards migration and vulnerability to climate change.

In conclusion, while New Zealand’s trade with the region has historically been thin, it has grown significantly in recent years and presents opportunities for New Zealand exporters, including those seeking to diversify their markets. The New Zealand Embassy in Mexico City is accredited to many of the countries in the region. Information about factors to take into account when considering any travel, including for business purposes, can be found at www.safetravel.govt.nz(external link).

[1] Belize is both a member of Central American Integration System and the Caribbean Community (CARICOM). New Zealand’s diplomatic relations with Belize and other independent CARICOM nations are serviced through a non-resident High Commissioner in Wellington.

[2] International Monetary Fund(external link)

[3] World Population Review(external link)

[4] Stats NZ(external link)

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.