Primary Products, Creative and ICT:

On this page

Summary

- Poland's economy is the largest in Central Europe and one of the fastest growing in the European Union (EU), averaging GDP growth of 4.1% over the last 20 years. Macroeconomic stability and competitive labour costs have made it a popular destination for foreign investors and entrepreneurs.

- Poland has a large population of 37.6 million and market access to 446 million EU Single Market consumers. Situated at the crossroads of Europe, Poland also serves as an important logistics hub.

- New Zealand exports to Poland have increased by over 900% in the 20 years since Poland joined the EU.

- Entry into force of the NZ-EU Free Trade Agreement provides opportunities for New Zealand businesses wishing to expand into the European market, as well opportunities to explore Poland's dynamic market.

- While there are currently only a narrow range of New Zealand consumer products readily available in Poland, New Zealand enjoys a positive image among Poles and trust in high-quality Kiwi products, meaning most can be sold at a premium price.

- The increasing purchasing power of Polish consumers makes Poland a good market to consider for fast-moving consumer goods (FMCG), including through online sales.

Report

Basic facts

The Polish economy has undergone remarkable transformation since the fall of communism in 1989. Over the past three decades, it has transitioned from a centrally planned system to a market-oriented economy, experiencing robust economic growth of almost 800%, and an average increase of 4.1% per annum since joining the European Union in 2004. The Polish economy is expected to grow by a further 2.7% in 2024 and 3.2% in 2025.

The leading Polish sectors are wholesale and retail trade, transport, accommodation and food industry, which account for a quarter of gross value added. Other significant sectors are industry (24.7%); public administration, defence, education, health care and social activities (14.6%); professional, scientific, and technical activities (8.6%); construction (7.2%); and real estate (5.5%).

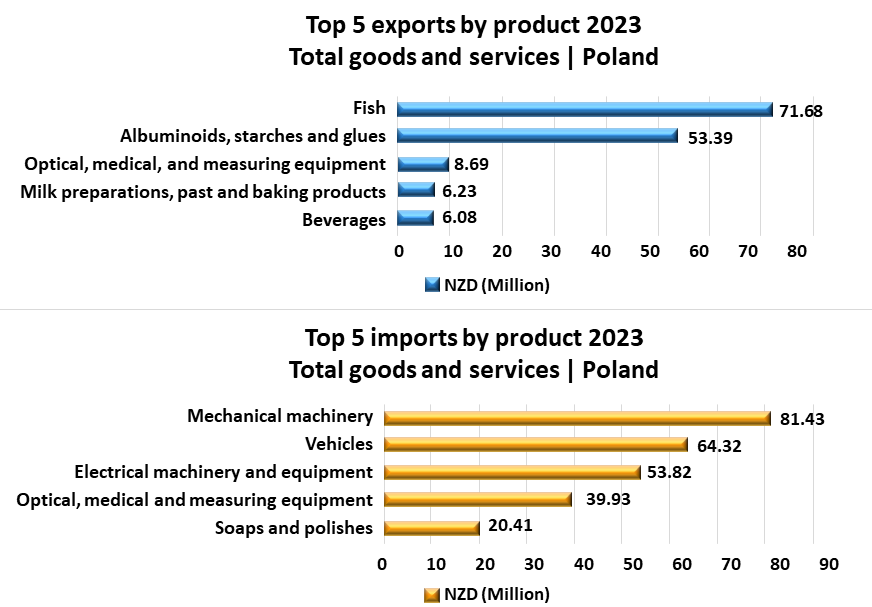

New Zealand’s trade with Poland has grown significantly over its EU membership, with exports up by over 900%. With some products entering the EU through other countries such as Germany or the Netherlands, this growth is likely even greater. In 2023, New Zealand exported NZD180.45 million of goods and services to Poland and imported NZD406.09 million. Key products traded include:

The New Zealand – European Union Free Trade Agreement that entered into force on 1 May 2024 creates opportunities for improving bilateral trade. Poland’s population is 37.6 million, and it hosts almost 1 million Ukrainian war refugees. Being a member state of the EU and integrated into its single market, Poland provides access to 446 million European consumers.

Five reasons to consider Poland

Economic stability and growth over the long term

Since Poland joined the EU in 2004, the country has maintained GDP growth averaging 4.1% annually (KPMG report June 2023). GDP in 2022 grew 5.3% to over EUR 700 billion, making it the largest economy in Central Europe and the sixth largest in the EU by GDP. While growth was down to 0.2% in 2023, it is forecast to bounce back to 2.7% in 2024 and 3.2% in 2025, thanks to private consumption, additional government social support, receding inflationary pressures, and an uptick in investment fuelled by EU funds.

Poland's economy is stable and predictable. Its debt-to-GDP ratio indicates a more favourable state of public finances compared to the EU average. Three major rating agencies - Moody’s, S&P and Fitch - predict that the Polish economy will remain resilient to shocks. They rate Poland at A2, A- and A- respectively with a stable outlook.

Strategic location in the heart of Europe

Poland’s location positions it as a key player in regional supply chains. According to a joint Reuters Events and Maersk white paper “A generational shift in sourcing strategy”, in 2022 Poland was ranked fourth globally and first for EU companies for sourcing, nearshoring, and reshoring. It benefits from its proximity to major European markets, facilitating trade flows and enhancing its role as a logistics hub.

Poland boasts a highly developed transport and logistics infrastructure and stands at the forefront in Europe for availability of high-class warehouses and road transportation. Freight forwarding, and logistics (including passenger transport) are vital parts of the Polish economy. In 2021, the industry generated 5.7% of Poland's GDP and employed approximately 6% of the Polish workforce. Polish drivers transported 19% of goods in the intra-EU market, ranking first ahead of Germany and Spain.

Following Russia's full-scale invasion of Ukraine in February 2022, Poland has become the key supply hub for freight going into Ukraine, and the defence sector is growing, both in terms of supporting Ukraine, but also to meet Poland’s procurement needs as it aims to invest over 3% of GDP on defence. Poland's location could prove advantageous for Ukraine's post-war reconstruction.

A prime destination for foreign direct investment

In 2022 Poland received EUR 32 billion of foreign direct investment. The largest sources were the Netherlands, Luxembourg, Germany and South Korea. High levels of Korean investment in the western city of Wrocław have seen daily direct flights to Seoul introduced from the city (as well as from Warsaw). Full year figures for 2023 are not yet available, but it is estimated that Poland attracted some EUR 30 billion of foreign direct investment. 93% of investors are willing to reinvest in Poland and this willingness is growing every year.

Recent investments have been wide-ranging, including in manufacturing as well as services. Examples include:

- Aircraft engines (all of the five largest firms are present - Lufthansa, GE Aviation, Sikorsky, UTC Aerospace Systems and Augusta Westland);

- Electric vehicles batteries, where Poland is now the second largest producer the world (LG Energy Solutions, Umicore, SK Innovation, and Mercedes-Benz);

- Intel and Volkswagen announced major investments in 2023,

- Amazon and Uber opened research and development centres,

- Microsoft and Google opened data centres providing cloud services to business and government making Warsaw the “cloud capital” of Europe.

EU funding and government incentives add liquidity to the economy

Poland provides extensive business support through a comprehensive network of EU and domestic funding channels. The European Commission recently announced €137 billion of grant and loan funding for Poland under the Cohesion Policy, the Fair Transformation Fund, and COVID Recovery Fund. The priorities for assistance under the Cohesion Fund include: energy transition away from coal, digital transformation, smart green mobility and road investments. Cooperation with local government partners will be critical for delivery.

In addition, the Polish government incentivises foreign investment through grants, tax breaks, and investment support programmes. The Polish Investment Zone scheme, introduced in 2018, offers tax exemptions and reduced corporate income tax rates for eligible investors operating in designated zones, stimulating investment in key regions across the country.

A highly skilled and educated labour force

One of Poland’s biggest strengths is its people, well-educated and highly skilled, known for their strong work ethic, ambition, and loyalty. 92% of Poles of working age have completed secondary education, and more than 29% have a tertiary degree. Statistics show that 67% of Poles know at least one foreign language, and 22% say they can communicate in two or more languages. Due to its strong engineering and mathematics education, the country has a large pool of highly skilled technical talent. Start-ups and companies have access to a workforce of skilled developers, engineers, and scientists. The Polish research and development sector is also developing dynamically particularly in biotechnology, electro-mobility, advanced manufacturing, robotics, control systems and machinery used in agriculture, aviation, and space technologies. In 2022, the Polish government allocated over EUR 9.5 billion or 1.46% of its GDP to research and development – up 15.6% from 2021, and 737% higher than the year it joined the EU.

Opportunities for New Zealand companies

Poland's diverse economy offers ample opportunities for New Zealand companies. We are seeing a particular focus on investments that support sustainability (in both industry and agriculture), with some state funding available. While traditional industries continue to play a significant role, emerging sectors present compelling growth prospects and investment potential in the years ahead. Heavy industry (e.g. cement production) is also seeking technological solutions to reduce energy consumption and emissions. Poland provides opportunities for New Zealand firms looking for an EU manufacturing base, thanks to its strong manufacturing capability and competitive labour costs.

Green-tech

Poland is undergoing a significant transition towards renewable energy. The country's abundant natural resources (including wind, solar, and biomass), present vast opportunities for investment in renewable energy infrastructure and projects. Poland’s goal is to increase renewable energy to at least 32% of total energy consumption from 18% in 2023, which will drive further investment in the sector.

The Polish Ministry of Climate and Environment runs an innovative program GreenEvo – the Green Technology Accelerator – aimed at supporting the development of environmental technologies in Poland and abroad. Eight companies benefiting from government support under the programme, were in New Zealand in September 2023 to explore new technologies and identify potential partners. Poland's strengths can be complemented by New Zealand's expertise in sustainable practices. Collaboration between Polish and New Zealand companies can foster synergies, innovation, and knowledge exchange.

Agri-tech

Polish agriculture employs 14.8% of workers and accounts for 2.1% of the value added to the country's GDP which is above the EU average. The country has 18 million hectares of arable land, with an average farm size of 12 hectares. A 2020 Agriculture Census reported 1.3 million farms. Over 90% are family farms, controlling over 90% of total agricultural land and 90% of livestock numbers. There is a gradual trend towards fewer, larger farms. In 2020, 1.4% of the total number of farms were certified for organic farming or were in the process of converting to organic farming methods. These are mainly larger farms with average farmland area exceeding 50 hectares.

Poland is a major European producer of agricultural and food products. Key agri subsectors include dairy (with 15 million tonnes of cow’s milk produced annually), beef (500,000 tonnes annually), horticulture (Poland is the biggest EU producer of cherries, raspberries, and currants), pork (fourth biggest producer in the EU), and poultry (the EU’s largest producer).

The food processing industry plays an important role in Polish agri-food production. Poland’s food industry is technologically advanced, although there is a need for a move towards more sustainable production systems. Poland has already embraced technological advancements in agriculture, with the adoption of precision farming, drone technology, and digital solutions for crop management and monitoring. Notable examples include:

- SatAgro - offering satellite imagery analysis and data-driven insights for optimizing agricultural practices,

- FarmCloud - offering cloud-based solutions for livestock monitoring, feeding optimization, and environmental control in animal farming,

- Farmony - specializing in vertical farming systems and hydroponic technology for indoor cultivation of crops in urban areas.

New Zealand firms specialising in agri-tech solutions for dairy farming and horticulture could explore avenues for expansion into the Polish market, leveraging Poland's vast agricultural resources and growing demand for advanced technologies. In some cases, there are existing Polish technologies being used, but these will not always be as comprehensive as New Zealand offers. There is still plenty of scope for further automation as labour costs increase, and most farms are still small compared to New Zealand. The dairy sector has widely adopted a cooperative model, although it is less common across the rest of the agriculture sector. The counter-seasonal nature of horticulture also provides opportunities to test new technologies in a continental environment.

Collaboration in research and development (e.g. under the Horizon Europe programme) could lead to the creation of novel solutions tailored to address specific challenges faced by both countries, such as climate change resilience and resource efficiency in agriculture.

Gaming

The Polish gaming industry has experienced significant growth in recent years, becoming one of the leading European hubs for game development. According to the Polish Video Games Industry Report 2023, the Polish gaming market generated EUR 1286 million in revenue in 2022. The industry employs thousands of professionals, including game developers, artists, programmers, and marketers.

There may be scope for collaboration. Both countries have expertise in different aspects of game development technology. New Zealand companies’ strengths in areas such as virtual reality (VR), augmented reality (AR) and procedural generation, could complement Polish strengths in game engines, graphics and animation.

Consumer products

Poland is a large consumer market, with a lot of competition and a large middle-class. Poles generally appreciate high-quality products and are willing to pay for goods that meet their expectations. With inflation down to 2% in the year to March 2024, economists are forecasting consumer spending to play a big part in Poland’s GDP growth this year, and those with disposable income seem happy to pay for quality.

Polish consumers appreciate New Zealand products for their quality, uniqueness, and association with New Zealand's pristine environment and reputation for excellence. New Zealand wine is available in nearly every wine retailer, although it is predominantly sauvignon blanc so there is room to grow the market for other varietals. Manuka honey is a valued health supplement (no one puts it on toast), and seasonal kiwi fruit, lamb, venison and hoki are the dominant food and beverage products, although it can be hard to find products such as lamb in a typical supermarket. There is a vibrant craft beer scene in Poland, with an increasing number of brewers adding ‘New Zealand IPA/APA’ brews using New Zealand hops.

Natural skincare products and cosmetics (especially those containing manuka honey) and wool-based products are also popular, with several Polish rug makers using New Zealand wool. Overall, New Zealand products that emphasize quality, purity, and natural ingredients are particularly appreciated by Polish consumers. Building on New Zealand's reputation for excellence and environmental stewardship, such products have the potential to capture the attention and loyalty of Polish consumers seeking high-quality goods from around the world.

Poles are modern consumers - often shopping online, open to technological innovations, and fond of modern banking solutions. E-commerce is an easy solution both for consumer goods providers and for customers. It is also one of the fastest growing industries in Poland. 77% of 30 million Polish active internet users regularly shop online (see Poland – e-commerce offers real opportunities for Kiwi companies - August 2023(external link)).

Conclusion

Poland presents a compelling and dynamic market for New Zealand exporters, driven by its strong economic fundamentals, strategic location, complementary industries, skilled workforce and supportive business environment. With many promising sectors such as renewable energy, technology, manufacturing, agriculture, and infrastructure, Poland offers ample and diverse opportunities for Kiwi businesses seeking long-term growth and returns. With the entry into force of the NZ-EU Free Trade Agreement, now is an opportune time to explore trade and investment prospects in this vibrant Central European nation.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.