Supply Chains, Sustainability:

On this page

Summary

- Viet Nam is strongly committed to the development of its renewable energy sector. Achievement of the government’s ambitious targets will require significant foreign investment. Reliable sources of renewable energy will attract investment in the manufacturing sector.

- New Zealand’s renewable energy credentials, including expertise in wind and solar power generation, position New Zealand well to cooperate and invest in joint projects with Viet Nam.

- Opportunities in Viet Nam’s renewable energy sector for New Zealand include provision of equipment and technology, consultancy services, installation services, development of new sources of renewable energy, environmental credits and carbon-offsetting, and green technology innovation.

Report

Viet Nam’s commitment to renewable energy

In 2023, Prime Minister Pham Minh Chinh approved the National Power Development Plan For 2021 – 2030, with a Vision To 2050 to achieve net-zero emissions by 2050. Viet Nam has also joined the Just Energy Transition Partnership (JETP) which aims to develop renewable energy sources for electricity production, up to 30.9-39.2% by 2030 and 67.5- 71.5% by 2050.

In addition to Viet Nam’s international climate commitments, energy reform aims to secure the country’s future as a manufacturing hub in Southeast Asia. The sole producer and distributor of energy in Viet Nam is the state-owned Vietnam Electricity Group (EVN). For Viet Nam’s manufacturing industry to grow and to move into high tech manufacturing sectors such as the semi-conductor industry (a key government priority), reform is needed to a) create reliable and uninterrupted energy supply and b) provide manufacturers with renewable energy alternatives as they seek to boost their consumer-driven green credentials. The reforms making their way through the Vietnamese system now will enable private energy production for the first time, including the ability to store and/or sell excess power production to the national grid, and also to ensure reliable power supply for their investments.

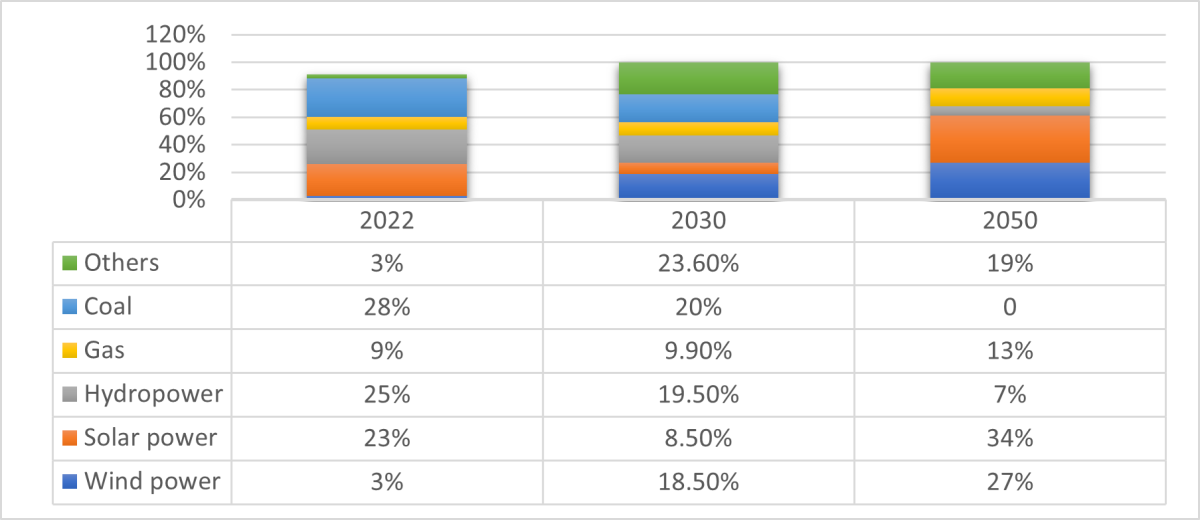

Vietnam energy projections: 2020 to 2050

Source: Viet Nam’s PDP VIII

In order to reach its renewable energy targets by 2050, it is estimated that Viet Nam will need total investment capital of around US$135 billion, of which investment in power source development is estimated at US$120 billion (average US$12 billion per year), and transmission grid about US$15 billion (average US$1.5 billion per year). The high demand for investment in the renewable energy sector will need to come from a range of public, private, domestic and foreign sources.

On 3 July 2024, the Vietnamese government issued Decree 80/2024/ND-CP on Direct Power Purchase Agreements (DPPA). This decree facilitates the direct sale of rooftop solar and other renewable energy sources via two main models of DPPA. The first is a ‘wire DPPA’ for the sale and purchase of electricity via private distribution systems. The second is a ‘virtual DPPA’ where the sale and purchase of electricity is via the national grid (details of these two models can be found here(external link)).

Viet Nam has also introduced a number of favourable regulatory amendments for renewable energy investment projects, including a reduction or exemption of land rents, attractive tax incentives, and the removal of restrictions on the capital ownership ratio for foreign investors.

Potential opportunities for New Zealand products and services

Renewable energy power projects: New Zealand experience and expertise could support specific renewable energy power-generating projects [1], especially in wind (both onshore and offshore) and solar power generation.

Equipment supply: New Zealand’s experience in the manufacture and supply of renewable energy hardware, for both domestic use and export purposes, may have commercial potential in Viet Nam.

Technology: New Zealand companies may be a source of technology (e.g. software, automation, control systems, etc.) as energy sector reforms spur investment.

Consultancy services: New Zealand energy consultancy services could fill some of the anticipated demand for expert support on project scoping, operations, design, of renewable energy projects, both public and privately funded.

Installation and construction services: There may be scope for joint ventures between New Zealand and Vietnamese companies as installation and construction service providers.

Other renewable energy technologies: New Zealand experience in alternative renewable energy technologies, including in waste-to-energy development, may also have commercial application in Viet Nam.

Environmental credits and carbon offsetting: As renewable energy projects increase, so may the production of environmental credits and carbon offsets. Businesses that can trade these credits or offer consulting on carbon management may find potential revenue streams.

Green Tech innovation: Investment in innovative technologies that enhance the efficiency and integration of renewable energy, such as smart grids, Internet of Things (IoT)-based energy management systems, and AI-driven energy analytics, will be highly attractive in Viet Nam’s new energy sector.

Information for New Zealand investors and developers

Market entry model: There are three models from which foreign investors can choose to operate in Viet Nam: a 100% foreign-invested company, a joint venture, or a public-private partnership (PPP) in the form of a BOT (Build, Own, Transfer) contract. The advantage of the two latter investment models is that a Vietnamese partner will be able to guide a foreign investor through the intricacies of the local market, capital project, and regulatory environments. Furthermore, Vietnamese energy companies, such as subsidiaries of EVN, have critical in-country experience in the local energy market. Large real-estate developers with proficiency in land-use and capital projects in Viet Nam can also provide project expertise, especially in provincial areas outside the main centers. With low feed-in-tariffs and high production costs, a PPP is an effective means of entering the market in terms of minimising risk, provided a BOT contract is secured. A PPP term is often 20 years from the date of commercial operation.

Working with the Vietnamese government: Close collaboration with central and provincial agencies, such as the Ministry of Planning and Investment (MPI), Ministry of Industry and Trade (MoIT), and provincial investment promotion agencies is important for investors and developers to obtain accurate guidance and support for renewable energy developments and projects. It is worth noting that Viet Nam is still in the process of developing its strategy, policy and laws in the renewable energy sector. Government agencies can help investors and developers to avoid obstacles during project development as well as being able to resolve any specific issues more effectively. Good connections can be established through local partners who have already had experience working with relevant government agencies. There are two law firms in Viet Nam specialising in energy markets that have New Zealanders at the helm: Fraser Law and Allens Law. Both have been active in advising the Vietnamese Government on energy sector reform.

Recommended further reading

- BritCham Viet Nam (2022), Vietnam's Renewable Energy Overview(external link)

- Energy Tracker Asia (2022), Renewable Energy Investments in Vietnam in 2022 – Asia’s Next Clean Energy Powerhouse(external link)

- Euro Cham (2018), International Conference Vietnam Renewable Energy: Challenges and Practical Solutions(external link),

- Freshfields Bruckhaus Deringer (2030), Tony Foster and Bui Thanh Tien, Overview of Investment in Renewable Energy in Vietnam(external link)

- Friedrich Ebert Stifung, Koos Neefjes, Dang Thi Thu Hoai (2017), Towards a Socially Just Energy Transition in Viet Nam Challenges and Opportunities(external link)

- McKinsey and Company (2019), Marco Breu, Antonio Castellano, David Frankel, and Matt Rogers, Exploring an alternative pathway for Vietnam’s energy future(external link)

- PWC (2023), Vietnam’s Eighth National Power Development Plan (PDP VIII) Insights and key considerations for investors(external link)

- VietnamBriefing (2020), Renewables in Vietnam: Current Opportunities and Future Outlook(external link)

[1] Viet Nam has an abundance of hydroelectric potential, but its power sector development plans typically do not include an increased role for hydroelectric power generation by 2050.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.