Primary Products, Manufacturing (excludes F&B), Services:

On this page

Summary

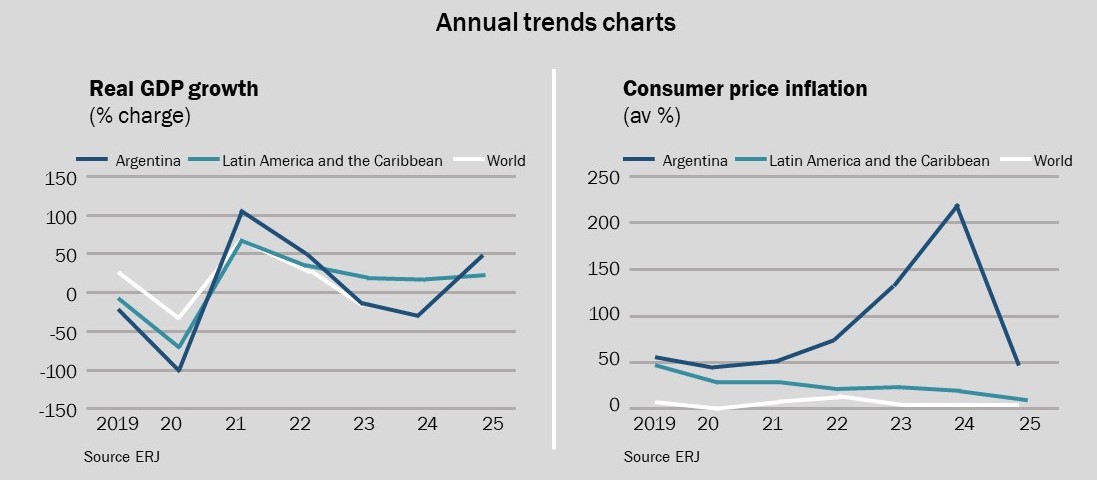

- Following skyrocketing inflation and decades of economic crisis, Javier Milei won the Argentine Presidency in December 2023 based on promises of economic shock therapy and radical change.

- The past year has seen government spending slashed, the peso devalued by over 100%, and significant deregulation including simplification of foreign exchange and export systems.

- The measures have delivered impressive macro-economic results with inflation reduced dramatically (from a monthly rate of 25.5% in December 2023 to 2.7% in December 2024) and a fiscal surplus achieved. The Argentine market is now gradually opening up.

- While forcing the country into recession has been brutal for Argentines, (with around 50% of the population now in poverty and GDP falling by an estimated -2% in 2024), economic recovery has now begun and the IMF predicts 5% GDP for 2025.

- The more stable macro-economic context and opening of the market provide opportunities for Kiwi exporters, particularly in agriculture, health, technology and mining - sectors which are leading the recovery.

Report

The Argentine economy – A snapshot

Argentina is the 8th largest country geographically, the 3rd largest economy in South America, and the world’s 3rd largest agrifood exporter. It has immense renewable energy capability and a wealth of natural resources including the 3rd largest lithium deposit and 2nd largest oil and share gas formation in the world.

The country’s natural resources and large manufacturing sector are dispersed throughout its 24 provinces, although the largest economic and social epicentre is the AMBA region (Buenos Aires City and Greater Buenos Aires).

Home to 16.4 million residents, AMBA represents over a third of Argentina’s total population of 47 million people. Other important provinces include Santa Fe, Cordoba and Mendoza, which together with Buenos Aires, represent 70% of Argentina’s total exports during the first half of 2024.

As a Member of Mercosur, Argentina’s import tariffs are governed by the blocs’ rules and regulations. The Mercosur trade bloc also includes Brazil, Paraguay, and Uruguay, and creates an opportunity for nearshoring and selling products with reduced tariffs between member countries.

Argentina’s political and economic landscape set the scene for radical change

Figure 1: Quarterly exports to the US and Australia

While Argentina is a participating G20 economy, it nevertheless has proven to be a complex market. Following decades of macroeconomic missteps and a stagnated economy for the last ten years, in 2023 it secured the unfortunate title of having the world’s highest inflation rate, peaking at 211%.

It was this context that laid the groundwork for libertarian Javier Milei to win the Presidential election in December 2023. His campaign promise of ‘economic shock therapy’ resonated with the Argentine public’s desire for change.

Despite controlling less than 15% of the seats in Congress, Milei and his team managed to broker a Cabinet with Ministers from a range of parties from the right, notably Luis Caputo as Minister of Economy.

The Milei administration has since implemented stringent austerity measures and a deregulation agenda to balance government budgets, tackle inflation and attempt to stabilize the economy.

So what has been done?

Upon taking office, the Milei administration immediately devalued the Argentine peso by over 100%, stopped printing money, slashed government spending, and significantly reduced energy and transport subsidies, and transfers to the provinces. Other measures include currency reform, debt negotiations, and social programme reductions.

Six months into his Presidency, Congress approved Milei’s Ley Bases. The mammoth law legislates across a broad spectrum of economic, regulatory and taxation measures, including labour reforms and the privatisation of some state-owned enterprises. Most notably for foreign businesses, the law introduced an investment incentive scheme (RIGI – using its Spanish acronym) for projects over USD 200 million. The regime provides generous tax, customs, and foreign exchange benefits for investors in forestry, tourism, infrastructure, mining, technology, steel, energy, oil and gas sectors.

The PAIS import tax (a 17.5% charge for accessing the foreign exchange market implemented in addition to import duties) was removed for importers in December 2024. The measure is intended to reduce inflationary and cost of living pressures, while also benefitting major industries reliant on imported materials.

Further measures to facilitate trade include the removal of import quotas on several products including household consumables, and of regulations that allowed the government to fix prices, intervene in markets and request information from beef and dairy producers.

To simplify the import process, the Administration removed the previous requirement for pre-authorisation from the Secretary of Commerce for imports and their payments. This complex process created delays and uncertainties for foreign exporters to both get products into the market and to get paid once their goods were sent. It has been replaced by the Import Statistical System (SEDI). While this still requires the importer to input some data, the approval system is considerably faster and payments are made in two separate tranches once the goods have been delivered.

Deregulation efforts have begun to simplify the business environment, with hundreds of regulations across a range of industries removed since January 2024. For the agribusiness sector, this has included the removal of the need to present bank details and statements and annual workplans to enable import and foreign exchange authorisation.

Most recently, anti-dumping regulations have been updated to foster competition and encourage free trade. This includes a reduction to the maximum duration of anti-dumping duties, reducing timelines for investigations, and streamlining the procedures required for submitting documentation in investigations.

What does this mean for New Zealand exporters?

While not every measure implemented will have a direct benefit for New Zealand exporters, they have largely stabilised the Argentine economy, lowered monthly inflation and opened the path for exporters to enter a still very complex, but simplified and more open business environment.

Low levels of foreign direct investment (-US$ 21 billion in 2023) and barriers to market entry have created significant gaps in the availability and uptake of technology and capital upgrades. Recent developments mean that demand is growing and there are opportunities in Argentina for New Zealand technologies across sectors like agriculture, mining, healthcare, and software services.

Agritech

- The agriculture sector is currently experiencing high levels of growth – with exports up 26% in 2024. Key products for the sector include soy, grains, beef and dairy and represent the majority of Argentina’s foreign trade.

- Opportunities for New Zealand agritech companies to benefit from and play a continued role in this growth are ample. Kiwi products have a strong reputation for being top-quality and are highly valued and desired by Argentine producers, even if this could mean higher in-market prices.

- New Zealand agritech, including smart livestock farming technologies, precision management tools and innovative farm equipment are well suited for the market.

Mining and Energy

- With its vast territory and mineral wealth, this sector offers opportunities for New Zealand businesses, particularly in mining-adjacent goods and services. The sector includes gold, silver, lithium, and copper while other natural resources include oil and gas.

- Argentina is positioning itself as a key player in global green energy supply chains. Lithium supply is set to more than double by 2027 and it plans to be a top 10 global producer of copper the end of the decade.

- The RIGI regime, providing tax breaks and currency security, has resulted in the announcement of eight large projects in gold, silver and lithium extraction and solar panels.

- This presents an opportunity for mining-adjacent businesses, or companies providing services to multinationals who can capitalise on the growth of the sector as exploration and strategic projects ramp up.

Healthcare and Tech Sectors

- Other sectors with opportunities for New Zealand exporters include health, software, and industrial machinery.

- The health sector in Argentina is made up of SMEs with different levels of technology usage, incorporating technologies developed by multinationals, and located where the main hospitals and health centres are (CABA, Buenos Aires, Cordoba and Santa Fe). The return on investment is high, especially when companies are innovating to stay in business and maintain stable demand due to the replacement rate of their products.

- The software industry is expanding as a result of the availability of skilled human capital, with a high levels of English proficiency and tertiary education. The manufacturing, agriculture and transport and construction sectors (comprising two thirds of Argentina’s gross economic value) are the sectors with the lowest levels of IT technology adoption, and so provide the greatest opportunity for New Zealand tech companies.

An improved business environment but with remaining challenges

While the business landscape has certainly improved and continues to do so, the still complex financial, regulatory and bureaucratic environment alongside language barriers can be challenging for exporters. For example, payment in advance of imported goods and services is still not available due to currency regulations. Businesses that tend to succeed are those working closely with local partners and agents who help to navigate the market and leverage connections to unlock opportunities.

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.

Copyright

Crown copyright ©. Website copyright statement is licensed under the Creative Commons Attribution 4.0 International licence(external link). In essence, you are free to copy, distribute and adapt the work, as long as you attribute the work to the Crown and abide by the other licence terms.