Food and Beverage, Primary Products, Sustainability:

On this page

Summary

- Cyclone Gabrielle has caused significant damage to homes, infrastructure, and livelihoods across northern and eastern regions of the North Island. The cyclone is New Zealand’s costliest non-earthquake natural disaster, with economic losses expected to exceed the $2bn-$4bn of losses of the 2016 Kaikōura earthquake.

- Primary sector exports will be largely unaffected, with the exception of apple exports, where orchards were hit hard as Gabrielle struck the Hawke's Bay during a key harvest period. Damage to orchards and farms is also likely to see some lost primary production beyond 2023 too. However, other key export industries such as dairy are expected to experience limited disruption.

- The disruption and losses will weigh on New Zealand’s March quarter GDP, which may have contracted. However, the New Zealand economy remains very much open for business, with cyclone damage and disruption isolated to specific regions. Looking ahead, the recovery and rebuild work is expected to add to growth in the coming quarters. Tentative estimates by the RBNZ sees the recovery adding 1% to New Zealand’s GDP over coming years.

- Like most of the developed world, New Zealand is experiencing uncomfortably high inflation. Prices for food, vehicles, accommodation, and construction could be propelled higher over the first half of 2023 due to Cyclone Gabrielle. CPI inflation may remain above 7% for a little longer than had been expected.

Report

Originating in the Coral Sea in early February, Cyclone Gabrielle tracked south and struck Aotearoa between February 12 and 16, 2023. The devastation caused, including the loss of life, homes, possessions, and livelihoods, has been heart breaking. Gabrielle was felt over a wide area, including Northland, Auckland, the Coromandel, Waikato, Bay of Plenty, Gisborne/Tairāwhiti and Hawke's Bay. However, damaging rainfall, winds and flooding hit the Hawke's Bay and Gisborne/Tairāwhiti regions the hardest. The cyclone came close on the heels of Ex-Cyclone Hale and the Auckland Anniversary Weekend flood. A national state of emergency was announced for only the third time in New Zealand’s history.

At the height of the cyclone’s impact, around 225,000 homes were without power, and thousands of people were displaced as flood waters rose. In the worst affected areas there has been significant damage to agricultural land, property, and livelihoods. There has been extensive damage to key infrastructure in the east coast of the North Island, including roading, electricity, telecommunication, and water infrastructure. The damage continues to cause disruption to commerce and peoples’ lives

The costliest non-earthquake natural disaster in New Zealand.

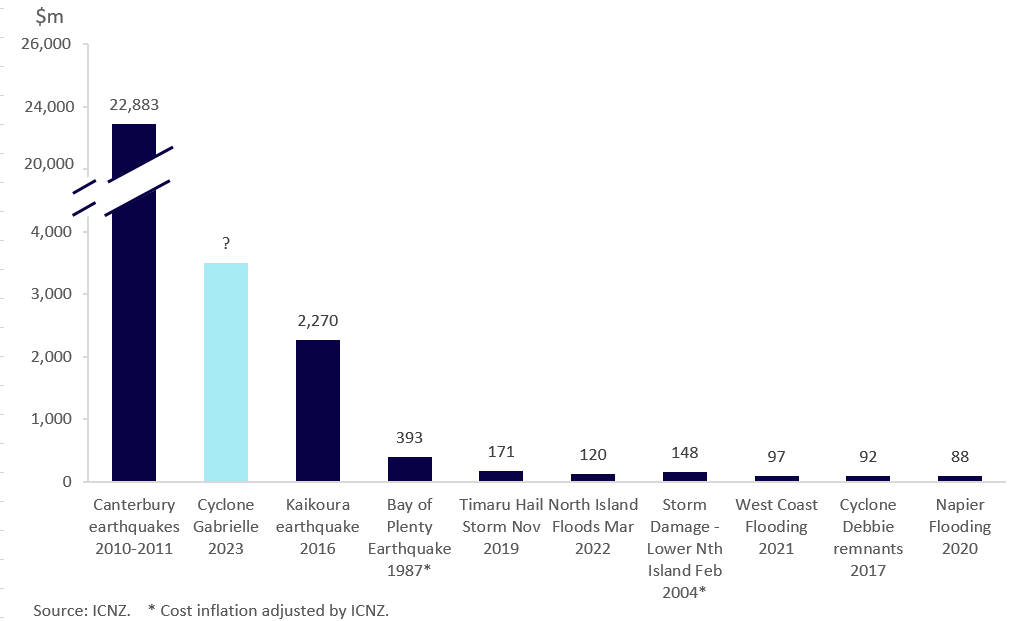

As the immediate response to Gabrielle eases, and the clean-up is now well underway, the extent of the damage across Aotearoa is slowly becoming clearer. Cyclone Gabrielle is New Zealand’s costliest non-earthquake natural disaster. As an indicator, data from the Insurance Council of New Zealand (ICNZ) records total insurance claims of major natural disasters going back to 1968. Cyclone Gabrielle is likely to dwarf the current highest non-earthquake natural disaster, the Timaru hail storm of November 2019 (Figure 1). Official estimates of the total cost are still being refined. However, the NZ Treasury indicates that it expects the economic losses to exceed the 2016 Kaikōura earthquake ($2-4bn); but still be dwarfed by the circa $40bn of losses from the 2010/11 Canterbury earthquakes. That would make cyclone Gabrielle the second costliest natural disaster in New Zealand history. Damage to roading will contribute significantly to the cost of the natural disaster, with the cost largely falling on Government.

Primary produce and exports will take a hit in 2023…

Cyclone Gabrielle differs from recent major earthquakes in Aotearoa due to its direct impact on New Zealand’s primary and exporting sectors. Most notable was the damage of crops such as apples, wine grapes, kiwifruit, and forestry in the worst affected areas. Adding to the distress for many producers was the timing of cyclone Gabrielle, hitting just as harvest was getting into full swing for some sectors. Initial estimates of on-farm revenue loss caused by the cyclone are between $500m and $1bn. Crop losses (as opposed to damage to property) are not something that can usually be insured against. Estimated losses do not include the impact on forestry, a major employer in Tairāwhiti, due to ongoing difficulty surveying plantation losses.

The apple industry is likely to be one of the hardest hit export crops in 2023. Hawke's Bay apple growers account for around 70% of New Zealand’s $900m annual apple export trade. Encouragingly, reports are emerging that damage to crops was concentrated in pockets and the majority of the Hawke's Bay’s apple crop has survived. Around 25% of the region’s orchards were severely damaged, or were at risk of tree loss due to extensive silt coverage, according to New Zealand Apples and Pears. In terms of the 2023 pipfruit crop, around 20%-30% of NZ’s total production may be at risk. While losses are likely to be material for other growers such as wine grapes and kiwifruit, these producers make up a much smaller share of national production, so aggregate export impacts will be much lower.

Dairy production faced limited disruption from cyclone Gabrielle. This is in part due to the small share of national dairy farming that occurs in the cyclone affected areas, but also because peak dairy production happens in spring and early summer. Nevertheless, damaged roading, and the inability to access farms in regions such as Northland, led to some dairy production losses and the early drying-off of herds. Fonterra has signalled it expects a 1% fall in expected production in the current 2022/23 season due to cyclone related losses as well as drought conditions at the bottom of the South Island. At the current projected milk price forecast mid-point of $8.50/kgms that would equate to a fall in revenue for Fonterra’s farmers of almost $130m.

In their latest set of quarterly forecasts, Westpac revised down its forecast of exports in 2023 by $1.2bn to account for cyclone Gabrielle. Westpac’s revision equates to 1.7% of the $72bn of New Zealand’s goods exports that occurred over 2022 – a non-trivial loss of export income for New Zealand, but not catastrophic. Actual lost export income will become clearer as the 2023 export season develops.

…and potentially beyond.

Physical damage to farm, orchard, forestry, and vineyard operations suggests there could be a lingering impact on related exports beyond 2023. Current estimates of on farm capital losses from the cyclone suggest losses of up to $1b, including damage to fencing, machinery, buildings, orchards, and vines. While replacement of some items may take only weeks or months, re-establishing orchards and vineyards, and remediation of damaged land can take years.

Another major pain point for those affected by cyclone Gabrielle is the damage to key infrastructure, in particular water, electricity and transport infrastructure. The loss of multiple bridges in the Hawke's Bay and Tairāwhiti regions has disrupted, and in some cases cut, the movement of people and goods in these regions. The disruption also extends to some exports. Added to the damage of major roads, the impact on many smaller roads is making the movement of stock and cut timber off farms and plantations challenging for some. It appears that damage to key infrastructure, while significant, is concentrated to specific areas. A significant share of the damage caused by Cyclone Gabrielle, was to roading and stop banks. As a result, an outsized share of the cost to rebuild infrastructure will fall on central and local government to cover rather than private insurers.

Economic activity will be disrupted in the near-term, but the recovery will add to growth.

The disruption caused by recent severe weather events will detract from New Zealand GDP in the first quarter of 2023. Much of the disrupted production at the start of 2023 will be lost rather than deferred. Destroyed agricultural crops can’t be recovered. It is possible that New Zealand’s GDP will record a contraction in the March quarter, although slow growth was already widely expected for the March quarter even before cyclone Gabrielle hit.

Beyond the first quarter of 2023, recovery and rebuild activity from recent storms will add to New Zealand’s economic growth over the medium term. Despite adding to demand over the medium term, damage caused by a natural disaster makes an economy poorer due to a loss in wealth and productive capacity. In their February Monetary Policy Statement (MPS), published not long after Cyclone Gabrielle, the RBNZ estimated, albeit tentatively, that the recovery activity from recent storms would add around 1% to annual GDP – spread over multiple years. Moreover, cyclone recovery work may help to soften the previously expected slowdown, or potential recession, later in 2023. However, recovery work will occur at a time that the economy still faces capacity constraints adding to medium-term inflation pressure.

Cyclone Gabrielle will weigh on already stretched household budgets in the near term.

Cyclone Gabrielle is also likely to contribute to the rising cost of living, a pain point for many Kiwi households at present. Consumers Price Index (CPI) inflation is still running at over 7%, near a 32-year high, and well above the top of the RBNZ 1%-3% inflation target band. There is expected to be a lift in prices for some goods and services in the near-term, which will add to general inflation, including for new and used vehicles, household furnishings, accommodation for those displaced, and construction.

The RBNZ provided initial forecasts on the impact of recent storms on inflation at the latest MPS. The RBNZ estimates that recent storms may add 0.3%pts to headline CPI inflation in both the March and June 2023 quarters. This means that inflation may remain above 7% for a little longer than had been expected. However, inflation looks to have peaked in the current cycle and is projected to ease back toward the RBNZ’s 1%-3% inflation target band over this year and into next.

Medium-term inflation pressure caused by the recovery is likely to be contained.

More of a concern for the RBNZ are the medium term inflation pressures caused by cyclone recovery demand. This is a situation that might require the need for higher interest rates than otherwise. For now, it’s believed that cyclone recovery work won’t significantly add to medium-term inflation. The experience of the Canterbury earthquake rebuild was that pockets of price increases occurred, such as in construction. Yet there was little evidence of widespread inflation being generated across New Zealand. The key difference in 2023 however, is we are starting from a high inflation and capacity constrained environment. Some recovery work may be delayed as a result.

The construction sector is perhaps one exception.

The building industry is a well-documented pinch point for the New Zealand economy, facing labour constraints, and rising costs. As a result construction has been a major source of domestic inflation in the current cycle. However, signs are emerging that indicate that the heat is coming out of the building industry. Falling house prices, slowing demand for housing, and a sharp rise in mortgage rates are sapping demand. A slowdown in construction activity should free up resource for cyclone recovery work.

Moreover, recent housing damage reports indicate damage has been uneven and concentrated rather than widespread. For instance, a fraction (0.5%) of Auckland’s housing stock has been marked as red (severe) or yellow (moderate) stickered by authorities. Given the extent of storm damage relative to the size of Auckland’s housing stock, Auckland’s building sector should be able to absorb storm recovery work with limited upward pressure on construction costs. In the Hawke's Bay and Tairāwhiti larger shares of the housing stock – closer to 1% – have been stickered. In these regions recovery work may see more sustained construction related inflation. However, a rise in the relative prices of construction in the worst hit areas should help building resources flow to where they are needed most.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.