Supply Chains, Food and Beverage, Primary Products:

On this page

Summary

- Singapore is expected to achieve around 1% GDP growth in 2023 off the back of softer global demand, down from 3.6% in 2022. Growth of 2.5% is predicted for 2024.

- Visitor numbers are continuing to recover gradually post-COVID-19, passing one million passenger arrivals per month this year for the first time since 2019.

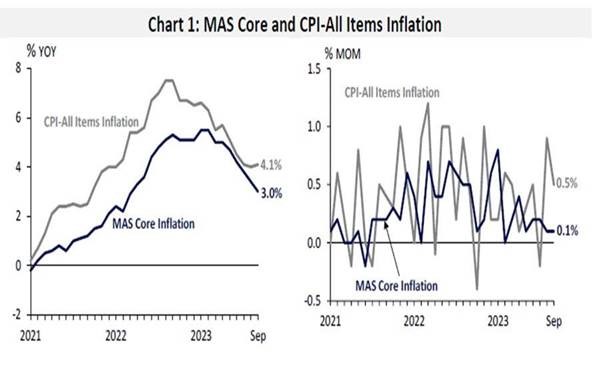

- Headline and core inflation has eased to 4.1% and 3.0% respectively in the most recent monthly data, down from 6.5% and 5.1% in December 2022. This reflects a price slowdown across a range of goods and services categories as well as an easing in the labour market.

- Fiscal policy this year has continued to target cost of living pressures for households and further support for business. A new Enterprise Innovation Scheme will deliver tax deductions to businesses of up to 400% on qualifying activities related to the innovation value chain.

- Monetary policy has held steady in 2023, off the back of 12 months of consecutive tightening. A loosening of monetary policy might be possible in 2024, provided inflation continues to ease.

- Property prices have continued to climb, but at a slower rate than 2022. Increases to stamp duties and further supply of housing units are expected to bring further relief.

- Singapore continues to bolster its ‘hub’ status, recently launching refreshed Industry Transformation Maps for both its professional services and financial sectors. It also continues to invest in its hub infrastructure, including long-term projects developing a new maritime port at Tuas and fifth terminal at Changi Airport.

- Notwithstanding a broader slowdown in global trade, many New Zealand exports have performed well in the Singapore market in 2023, with double-digit growth for a number of products in the F&B category.

- New Zealand has 14% market share in Singapore for the import market comprising those F&B product categories where New Zealand is a significant global exporter. There is scope for further growth as Singapore continues its resilience efforts toward a safe and secure supply of food.

Report

GDP growth: positive but slowing

Singapore’s economy has seen sluggish levels of GDP growth through Q1-Q3 of 2023. Real GDP grew by 0.4% and 0.5% respectively through Q1 and Q2 of 2023 with a provisional estimate of 0.7% growth for Q3 (in year-on-year (yoy) terms). It narrowly avoided a technical recession in the front half of 2023. In Q1 the economy actually contracted -0.4% in quarter-on-quarter seasonally-adjusted terms before recording 0.1% growth in Q2 and (provisionally) 1% growth in Q3.

Annual GDP growth in 2023 is expected to be on the lower half of the forecast range of 0.5-1.5%, according to the Monetary Authority of Singapore (MAS). This is backed up by the EIU which is predicting 1% growth for 2023, while the S&P estimate is more bullish, predicting 1.2% growth. In comparison, in 2021 and 2022, Singapore delivered real GDP growth of 8.9% and 3.6% respectively. Nominal GDP is expected to reach S$690b in 2023 (according to the EIU). This equates to a modest S$5b real increase on 2022 GDP in inflation-adjusted terms (on the basis of 2015 market prices).

Weakened growth in 2023 can largely be attributed to three consecutive quarterly contractions in manufacturing output ranging between -5% to -7.7%. Singapore’s merchandise exports dropped -6.5% and -16.9% respectively in the first two quarters of 2023 – a broader pullback from record-high goods exports in 2022. This reflects softer global demand particularly in the electronics sector and including in the US, EU, and China.

This decline in manufacturing output and exports has been partially offset by comparatively stronger performances in the construction sector and services sector. Both have produced positive (albeit) modest growth through 2023. However, after strong double-digit growth in 2022, services exports have pulled back significantly in 2023, contracting -2.5% yoy in Q2. The Ministry of Trade and Industry (MTI) attribute this to a drop-off particularly in transport services. Other services sectors have fared better through 2023.

Visitors: returning but not yet at pre-2020 levels

A rebound in passenger arrivals has helped support travel-related services and tourism in 2023. Monthly visitor arrivals passed one million for the month of March 2023 for the first time post-COVID-19 and have held steady through to September, ranging between 1.02-1.42 million. However Singapore is yet to achieve the comparatively higher volumes of pre-COVID-19 years, which in 2019 saw monthly visitor arrivals fluctuate between 1.46-1.80 million.

Current account: in good shape

Notwithstanding headwinds to Singapore’s total export value in 2023, its current account is in good shape and remains on track to deliver another healthy surplus in 2023 (the last time Singapore held a current account deficit was 1987). This reflects goods and services trade surpluses that have eclipsed losses from primary and secondary income deficits according to MTI. However, a decline in domestic demand (down -5.6% yoy in Q2) and associated slowdown in imports (particularly goods imports which are down -12% for YE September 2023) may also be contributing factors.

Inflation: tracking down

Inflation has by and large eased throughout 2023, a trend which is expected to continue through 2024. In December 2022, CPI-All Items inflation (i.e. headline inflation reflecting price level shifts across the entire CPI basket) stood at 6.5% (yoy) with core inflation (i.e. inflation data with accommodation and private road transport excluded) not far behind at 5.1%. This has steadily tracked down in 2023 (albeit with some fluctuations) with September 2023 data placing headline and core inflation at 4.1% and 3% respectively (yoy). MAS predicts that for 2023 headline inflation for the year will average 5% and core inflation 4%.

Looking out to 2024, MAS projects that core inflation will sit between 2.5%-3.5% and headline inflation between 1.5%-2.5% on average (though noting this excludes the impacts of a 1% point increase to GST scheduled to take effect in 2024).

Downward pressure on inflation is largely attributed to softening commodity and services costs, an easing in the labour market, and increases in supply of housing units.

Labour market: holding its own

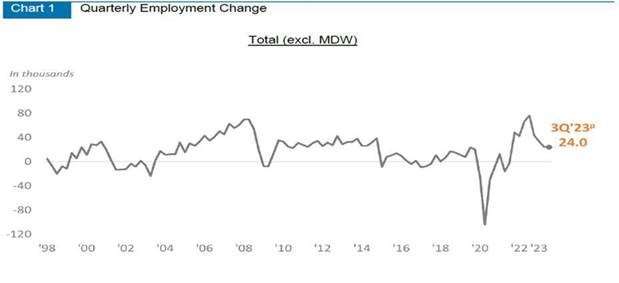

Provisional Q3 2023 figures indicate that total employment has continued to expand for the 8th consecutive quarter, albeit with an increasingly slowing growth rate compared to 2022 figures.

Unemployment rates remain low overall, sitting at 2% in September 2023 (seasonally adjusted). This represents a slight uptick in what has been a steadily declining unemployment rate from levels above 4% in 2020/2021. According to Singapore Ministry of Manpower, the proportion of firms intending to hire in the following quarter fell from 58% in June to 43% in September 2023, reflecting a deterioration in business expectations throughout 2023. In some cases, firms are actually undertaking restructures, resulting in an ongoing uptick in retrenchments from historical low points in 2022.

Fiscal policy: focused on cost of living and the business environment

Fiscal policy in 2023 has continued to target cost of living pressures for households as well as provide further support to the business environment. Budget 2023 added S$3b to the Singapore Assurance Package (a cash payment scheme launched in 2020 to ease expense pressures from GST increases) as well as further increases to the quantum of GST vouchers (available specifically to low-and-middle income Singaporeans). Further cost of living support was announced off-budget in September 2023, which included an additional S$800m to the Assurance Package.

For businesses, S$4b was added to the long-standing National Productivity Fund (designed to improve business productivity and support education for workers) and its scope was expanded to include investment promotion. Singapore also announced a new Enterprise Innovation Scheme, which will deliver tax deductions to businesses of up to 400% on qualifying activities related to the innovation value chain. This is in addition to the S$25b already committed to R&D investment over the period 2021-2025, approximately equal to 1% of Singapore’s GDP.

After running a S$2b deficit in FY2022, Singapore Ministry of Finance is estimating an even narrower S$350m deficit in 2023. A return to surplus is expected in the next 1-2 years (Singapore is constitutionally obliged to deliver a balanced budget across each term of Government).

Monetary policy: steady in 2023

Singapore has held its monetary policy steady through 2023, off the back of consistent tightening over 2021 and 2022. The Monetary Authority’s primary monetary policy mechanism is through ‘band adjustments’ to the Singapore Dollar’s nominal effective exchange rate (S$NEER). The S$NEER is a trade-weighted index that pitches the Singapore Dollar against a basket of currencies from Singapore’s major trading partners. MAS sets the parameters or “band” of the S$NEER and can adjust the slope, level, and width of the band in response to economic conditions. If the dollar deviates beyond the parameters of the band, MAS can then intervene in currency markets to return the dollar within the band. Both monetary policy statements from MAS this year (April and October) found that current policy band settings of the Singapore dollar nominal effective exchange rate were sufficient for medium-term price stability in light of cooling inflation data.

Housing market: still very, very warm

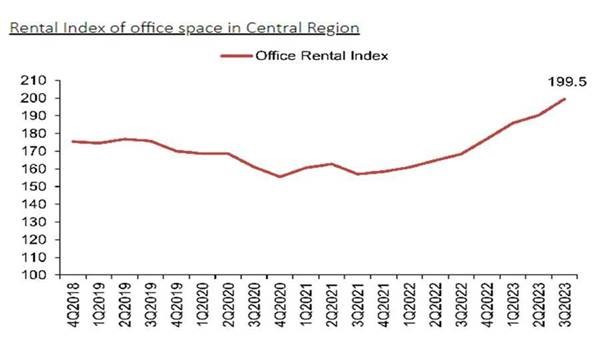

House prices have continued to increase in 2023, notwithstanding a slight drop in Q2 (the first in three years) but at a slower rate than 2022. Rate hikes to buyer stamp duties (BSD) and additional buyer stamp duties (ABSD) were announced in 2023 as a demand side intervention. This included a doubling from 30% to 60% ABSD for residential property purchases by non-residents. The Urban Redevelopment Authority is projecting that a total of 20,000+ residential units will be built in 2023 (the highest since 2017), with hopes it will deliver some supply side relief. However price levels in the housing market remain a significant challenge, with Urban Land Institute finding in May that Singapore private homes and rentals had become the most expensive in the region, eclipsing Hong Kong. Real estate pressures remain a significant factor for businesses operating out of Singapore, with the office rental index continuing to steadily track upward from local lows in 2020.

Singapore as a regional and international hub: bolstering its status

Singapore has continued to strengthen its hub status, including as a global financial centre. Since March 2022, Singapore has risen from 6th place to 3rd on the Global Financial Centres Index, which aggregates a range of data points to compare financial centres around the world. Singapore has recently overtaken both Hong Kong and Shanghai on the index and now sits behind only London and New York.

In February 2023, Singapore launched a refreshed Industry Transformation Map (ITM) for the Professional Services Industry to “strengthen Singapore’s role as a leading business hub.” This ITM focuses on 1) further attracting and supporting company headquarter investments into Singapore; and 2) increasing the capabilities of professional services firms including through digitalisation, talent development, and reskilling. The objective of this ITM is to grow the value-added growth of the sector to S$27b by 2025, creating an additional 3,800 jobs per year. This accompanies the 2022 refresh of the Financial Services ITM which has a strong focus on global market connectivity. Out to 2025 it seeks annually to achieve both 4%-5% value added growth for the sector as well as the creation of 3000-4000 jobs per year.

Singapore is also continuing to invest in long-term hub infrastructure projects. This includes the new Tuas Port which commenced operations in 2021. The four phases of its development are set to be completed in the 2040s and will include 66 berths. Construction of a fifth terminal at Changi Airport is expected to commence in 2025, and on completion will add significant additional passenger and air freight handling capacity.

2024: a more promising outlook

Growth in Singapore is expected to accelerate in 2024 with the MAS Survey of Professional Forecasters for September estimating 2.5% growth. This reflects an anticipated partial recovery in global demand, particularly in the tech and electronics sector. Downward trending inflation in the near-term is expected to create space for a loosening in monetary policy, possibly in 2024, bringing some relief for the financial sector. The key downside risks to Singapore’s economy comprise 1) external growth slowdown; 2) inflationary pressures (particularly from further shocks to global prices for energy and food) and 3) spillover effects from the cool down in China’s economic growth.

New Zealand export performance: strong, particularly travel and F&B

New Zealand services exports to Singapore increased 50% for year ending June 2023 (provisional Q3 data not yet available), reaching NZ$611m. This came off a modest base of NZ$411m in 2022, with the growth in quantum largely reflecting a post-COVID-19 resurgence in the travel category (which totalled NZ$204m YE June2023, up from NZ$41m in YE June 2022).

Total goods imports into Singapore from New Zealand are down 4.58% (yoy) to NZ$1.246b for year ending September 2023 (reflecting provisional Q3 data). However this is primarily due to a sharp decline in a small number of discrete product categories (particularly whole milk powder and bovine animal fat which combined declined NZ$150m yoy). Most F&B products, which dominate New Zealand’s trade into Singapore (with the exception of crude oil and some hydraulic machinery), have conversely grown in both value and (in most cases) volume. Of New Zealand’s top 20 goods imports into Singapore,[1] standout performers in year ending September 2023 have included:

| Product | Value increase (yoy) | Volume increase (yoy) |

| Skim milk powder | 22% | 34% |

| Butter | 35% | 28% |

| Food preparations | 18% | 9% |

| Casein and caseinates | 28% | -1% |

| Kiwifruit | 15% | -7% |

| Chilled beef | 10% | 8% |

| Liquid milk | 265% | 220% |

| Wine | 29% | 20% |

| Processed cheese | 46% | 42% |

| Anhydrous butterfat and other milk fats and oils | 20% | 20% |

| Buttermilk | 324% | 395% |

The growth in key New Zealand food exports to Singapore illustrated above reflects increasing broader demand in Singapore for a safe and secure food supply. Singapore continues to implement a three-pronged food strategy in response. The most well-known aspect of this strategy is the ‘Grow Local’ initiative to meet 30% of its nutritional needs by 2030 (Singapore currently imports approximately 90% of its food). Import source diversification and supporting Singaporean companies to grow food overseas comprise the other two prongs. But in addition to food security, Singapore is equally interested in ensuring food safety within its supply chain. In this respect, New Zealand’s track record as a reliable supplier of high quality food (including at the height of supply chain disruption during COVID-19) makes us an attractive choice.

Assuming Singapore’s ‘30 by 30 goals’ are achievable, it will still need to secure approximately 70% of its supply offshore. It is therefore no surprise that it remains keenly interested in continuing to foster the bilateral trade relationship and strengthen supply chain connectivity. The import market in Singapore for goods that comprise New Zealand’s top 15 F&B exports by product category[2] is worth almost NZ$5.3billion (and growing). New Zealand’s market share therein sits at 14% indicating substantial upside potential, provided Singapore can deliver the right price signals. Equally, New Zealand exporters must also ensure their approach to market takes into account the nuances of doing business in Singapore, which often benefits from:

- Due diligence – undertaking in-market research to ensure strategic market fit;

- A localised story – refining export brand story to tailor to the local context; and

- Cross-platform approach – applying an omni-channel approach to sales and marketing to connect consistently across key channels.

[1] Based on Enterprise Singapore import data at HS6 level

[2] Products: 0201 (Meat Of Bovine Animals, Fresh Or Chilled), 0202 (Meat Of Bovine Animals, Frozen), 0204 (Meat Of Sheep Or Goats, Fresh, Chilled Or Frozen), 0402 (Milk And Cream, Concentrated Or Containing Added Sweetening), 0405 (Butter And Other Fats And Oils Derived From Milk), 0406 (Cheese And Curd), 0404 (Whey And Other Products Consisting Of Natural Milk Constituents, Whether Or Not Concentrated Or Sweetened, Nesoi), 0401 (Milk And Cream, Not Concentrated Nor Containing Added Sweetening), 081050 (Kiwi Fruit (Chinese Gooseberries (Actinidia Chinensis Planch)), Fresh), 080810 (Apples, Fresh), 1901 Malt Extract; Food Preparations of Flour, Meal, Etc. Containing Under 40% of Cocoa Not Elsewhere Specified or Indicated; Food Preparations of Milk Etc. Containing Under 50% of Cocoa not elsewhere specified or indicated, 2106 Food Preparations not elsewhere specified or indicated, 2204 Wine of Fresh Grapes, Including Fortified Wines; Grape Must (Having an Alcoholic Strength by Volume Exceeding 0.5% Vol.) not elsewhere specified or indicated, 3501 Casein, Caseinates and Other Casein Derivatives; Casein Glues, 030631 Rock Lobster and Other Sea Crawfish, Live, Fresh, Chilled.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.