Supply Chains, Services:

On this page

Summary

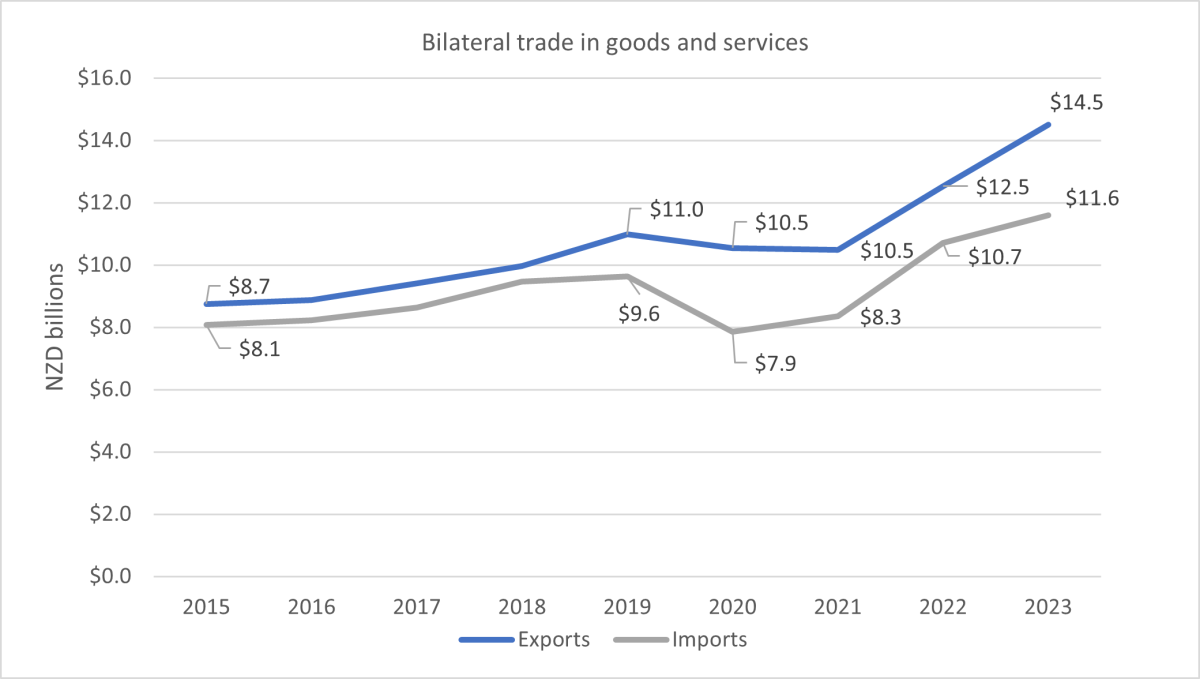

- In 2023 bilateral trade between New Zealand and the US continued a strong post-pandemic recovery and growth trajectory. With 16% growth in 2023, the US was New Zealand’s fastest growing major market. At NZ$14.6 billion, the US surpassed Australia to become New Zealand’s second largest export market in the year ending March 2024.

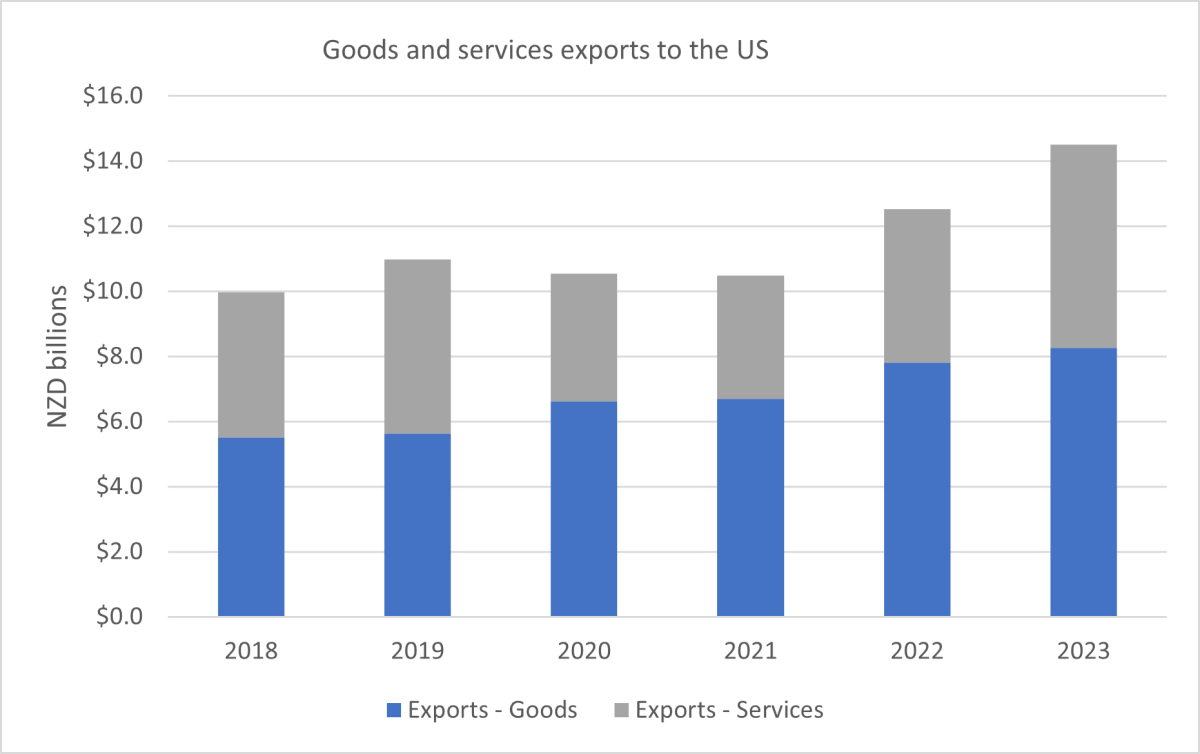

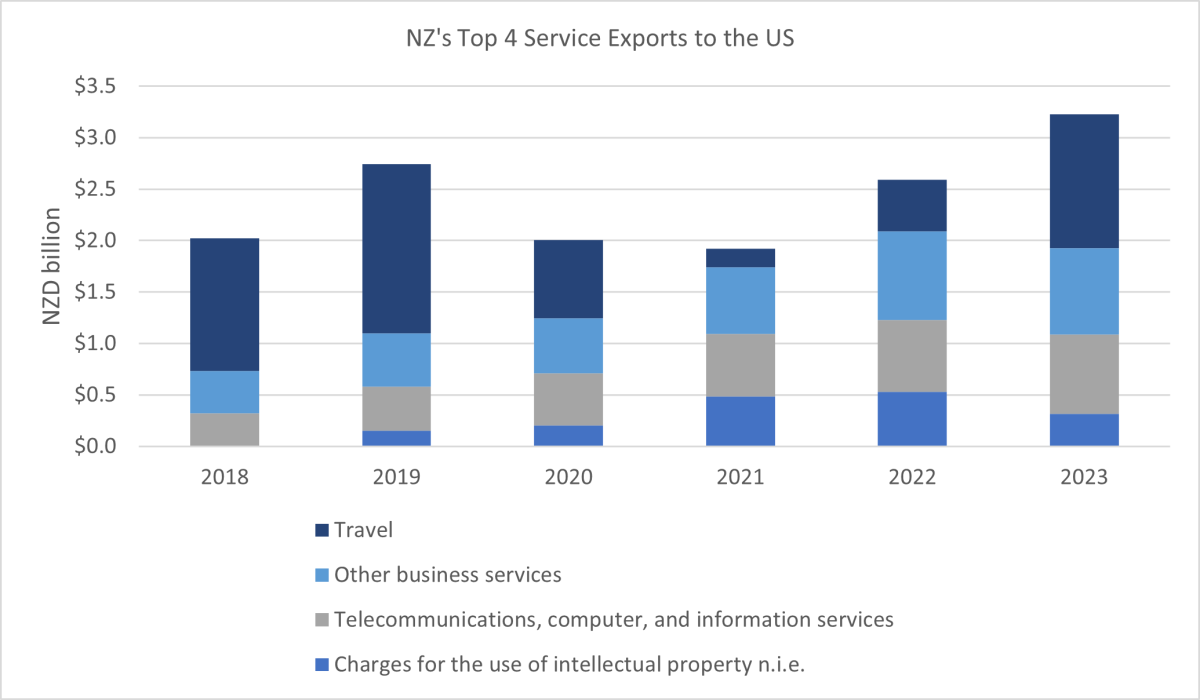

- The growth in exports to the US was led by a strong services sector - up 32.2% to NZ$6.2 billion. This was driven by tourism numbers almost returning to pre-pandemic levels. This trend seems to be continuing in 2024, with visitor numbers up by 33% compared to January to March 2023.

- New Zealand’s goods exports to the US grew 5.8%, primarily driven by growth in the value of primary sector exports, with notable growth in dairy (23%) and red meat (15%). Goods trade for 2024 appears to be continuing this growth trajectory with trade up 14% in the first quarter from 2023.

- Imports from the US grew by 8.3% in 2023. The US remains a key supplier of high-tech goods and services, including critical aerospace products and computer services.

- The strong and growing trade and economic connections between New Zealand and the US is a substantive and welcome element in a key bilateral relationship. It reflects a strong US economy and a growing desire for the sorts of high-quality goods and services that New Zealand produces.

Report

New Zealand exports to the US trending upwards

- New Zealand-US bilateral trade has continued to trend upwards over the past year. The US surpassed Australia to become New Zealand’s second largest export market in the year ending March 2024, behind China and ahead of Australia and Japan. In the year ending March 2024 New Zealand exported NZ$14.6 billion in goods and services to the US and imported NZ$11.4 billion, representing a trade balance of NZ$3.5 billion and a total trade value of NZ$25.8 billion[1].

- New Zealand exports to the US have followed a steady growth trajectory. COVID-19 interrupted that trend, but the post-pandemic rebound has seen a strong bounce-back. Exports grew by 16% to a new high of NZ$14.5 billion in 2023.

- Unlike the overall export figures for New Zealand in 2023 which saw goods export growth fall and services increase, both goods and services exports to the US grew. Goods growth was a solid 5.8% though services enjoyed particularly strong growth of 32%.

What’s driving this?

Services

- The US is New Zealand’s top export market for services. At NZ$6.2 billion they accounted for around 23% of New Zealand’s total services exports in 2023 and grew by 32.2% that year.

- The value of US travel exports has helped drive the post-pandemic recovery. Boosted by New Zealand’s hosting of major events like the FIFA Women’s World Cup, passenger numbers were up 159% in 2023 and by the end of 2023, visitor arrivals from the US were back up to 92% of pre-pandemic levels. Figures for 2024 also appear to be tracking strongly so far; January visitor arrivals were up by around 28% compared to pre-pandemic January 2019.

- It is an exciting period for air connectivity between New Zealand and the US, with a number of new flight services commencing in 2023. During peak season there are almost 40 direct flights per week between California and New Zealand, and United Airlines’ flight from San Francisco to Christchurch is the first by an American airline to fly non-stop between the South Island and the United States.

- Other services exports picked up significantly during the pandemic, including telecommunications, computer and information services (growing by 80% since 2019) and other business services (i.e. consulting services and research and development) (growing by 62% since 2019). Growth in these services tapered off last year but still reached a new combined high of NZ$1.6 billion.

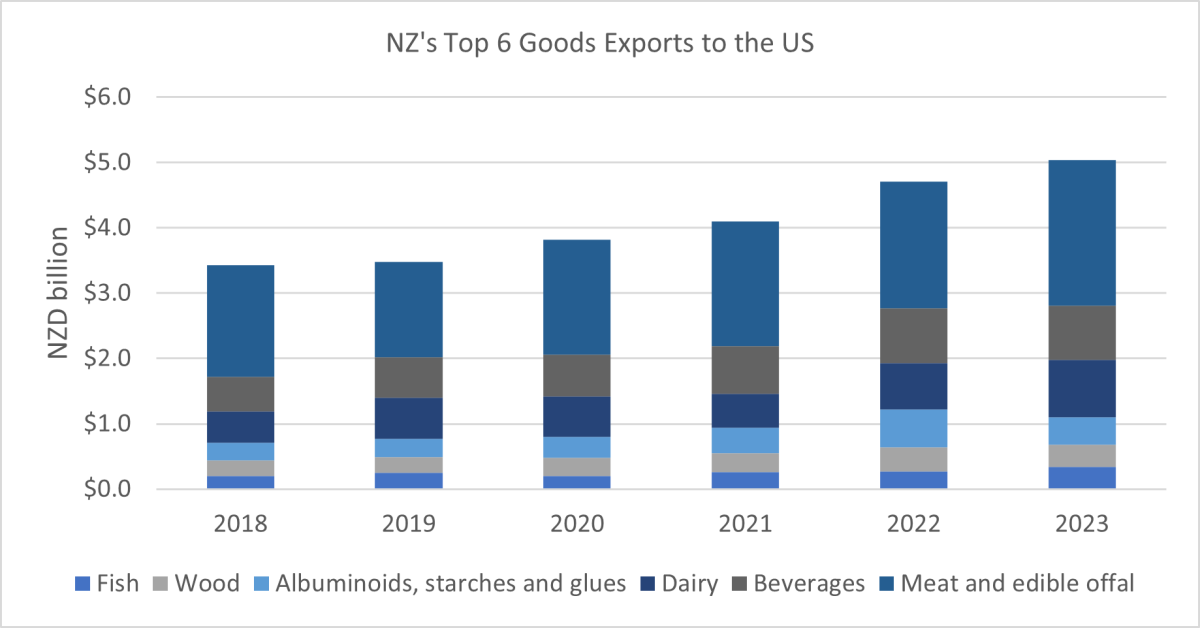

Goods

- The US is New Zealand’s third largest market for goods exports. Goods exports were valued at NZ$8.3 billion in 2023, growing by 5.8% that year. Trade in goods for the first quarter of 2024 seems to be following this growth trend, increasing by 14% compared to the same period in 2023. This growth is mainly due to higher exports of dairy and meat in February 2024.

- Primary sector products dominate the goods export portfolio. The US is the second largest market for the primary sector; behind China and increasingly ahead of Australia.

- Meat exports to the US grew by 15% last year to a high of NZ$2.2 billion, the majority of this is beef exports which benefitted from record US market prices and grew by 27% to NZ$1.5 billion last year. Exports to the US helped to offset much lower demand from China. Strong US demand for beef is projected to continue because of further slowing of cattle slaughter, fifty-year lows in US beef cattle inventory and large demand for lean beef which will be heavily reliant on imports.

- The US remains New Zealand’s number one export destination for wine, worth NZ$797 million in 2023. After Italy and France, New Zealand is the largest supplier of wine to the US. However, growth stagnated in 2023 after strong year on year growth averaging around 9% over the past 5 years. New Zealand Wine Growers President Philip Gregan has said that destocking of supply chains was a major dynamic affecting wine exporters across the globe in the second half of 2023 and it appears New Zealand Sauvignon Blanc exports to the US weren’t insulated from this.

- The value of dairy exports to the US hit a high of NZ$1.2 billion in 2023. This is in comparison to total New Zealand dairy exports which fell in 2023. US consumer and producer demand for specialised milk protein products has continued to increase, this provides opportunities for New Zealand dairy exporters in both traditional and emerging protein categories.

- Manufactured goods exports also performed well in 2023, for example, NZ$644 million in mechanical machinery products. These exports typically build off New Zealand’s primary sector expertise, for example harvesting machinery.

- Increasingly non-primary sector goods exports also include a range of high-tech goods, for example electro-magnets (NZ$107 million), electrical transformers (NZ$99 million) and machines for making semi-conductors (NZ$32 million).

- Notably, over the past year, the value of the New Zealand dollar been relatively low against US dollar, at average of 61 cents. The lowest average since 2008. A high US dollar coupled with solid economic growth over the last three years has benefited New Zealand exporters.

Imports

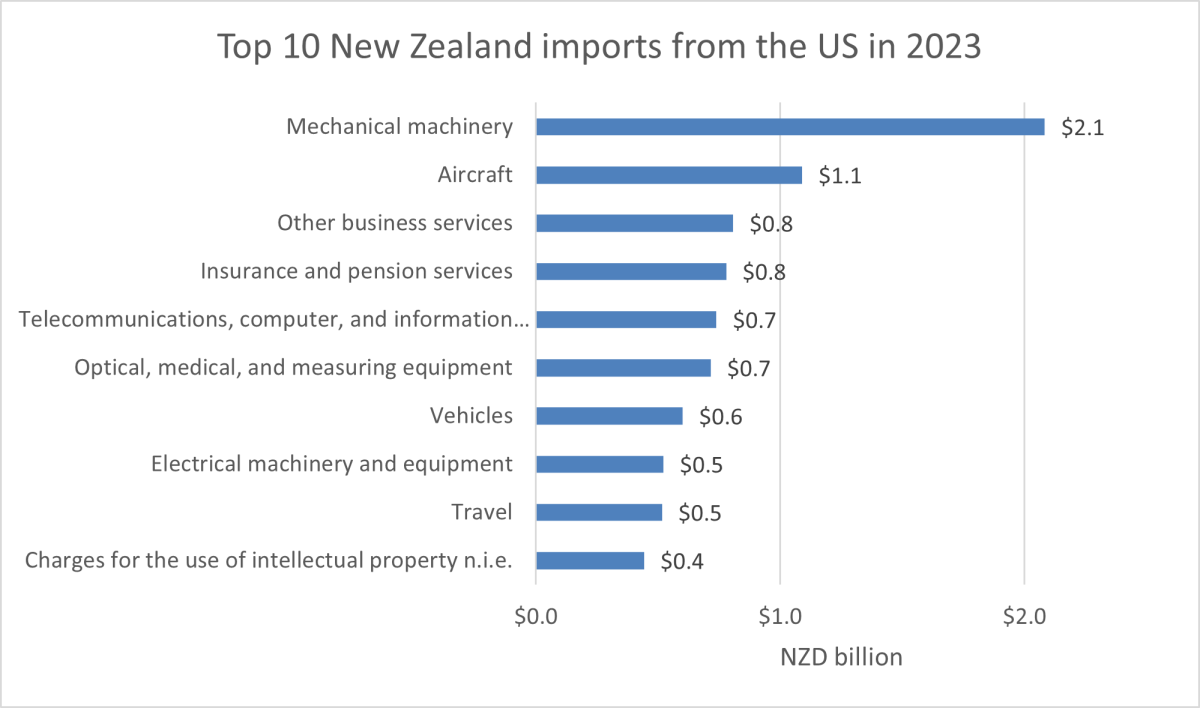

- New Zealand imported NZ$11.6 billion in goods and services from the US in 2023, growing by 8.3% and accounting for around 13% of total imports.

- In 2023 New Zealand’s goods imports from the US were NZ$7.6 billion. These imports are concentrated in the aerospace sector, for example mechanical machinery (turbo-jets and turbo-propellers) and aircraft and aircraft parts valued at NZ$2 billion.

- Notably, imported goods from the US for the first quarter of 2024 have decreased by 25% compared to the same period in 2023. This decline is mainly because there have been fewer imports of aircraft and aircraft parts.

- Similar to services exports, New Zealand imports of services from the US are concentrated in travel, and telecommunications and computer services.

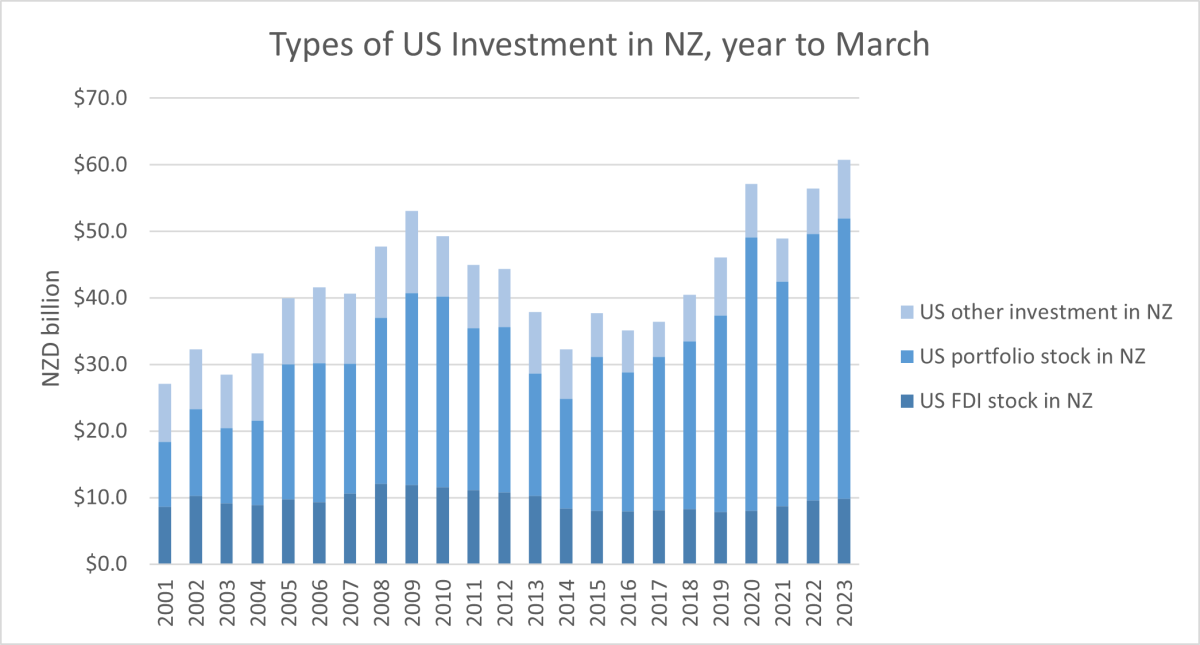

Bilateral investment continues to grow

The US is New Zealand’s third largest source and destination of foreign direct investment. In the year to March 2023, the US held a total stock of investment of NZ$64.6 billion in New Zealand, or 18.8% of the total investment stock. The bulk of this is portfolio stock (NZ$42.2 billion).

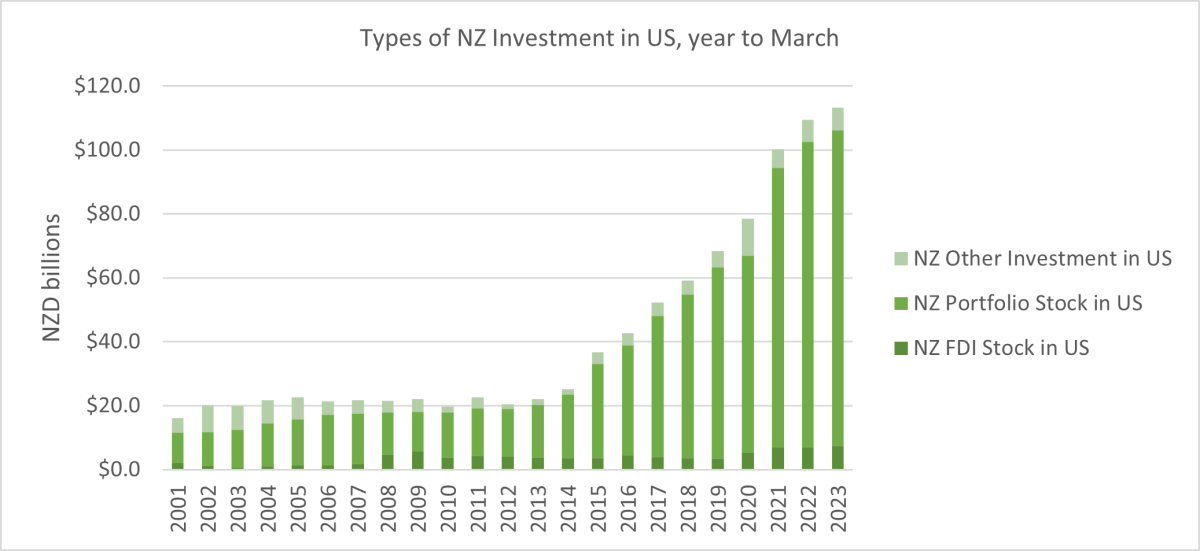

The value of New Zealand’s investment stock in the US also continues to grow. While the bulk of this investment is in portfolio stock, there are frequent examples of New Zealand companies investing in niche services, agriculture and manufacturing activities in the US.

The value of New Zealand investment also differs from State to State, for example New Zealand is the 6th largest foreign investor in Colorado – a number of New Zealand tech and aerospace companies have chosen to establish US operations from Colorado.

[1] Figures used in this analysis have not been adjusted for inflation. However, previous analyses of the post pandemic recovery have concluded that the nominal recovery is more than just inflation. For example, Sense Partners NZ-US Trade & Investment Relationship Report(external link) that used June 2023 trade data adjusted for inflation concluded that both nominal export and import values have recovered and are largely above pre-pandemic levels.

[2] Dairy (whey and milk constituents, butter and dairy spreads, milk powder, cheese, and albuminoids (casein, and peptones))

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.