Primary Products:

On this page

Summary

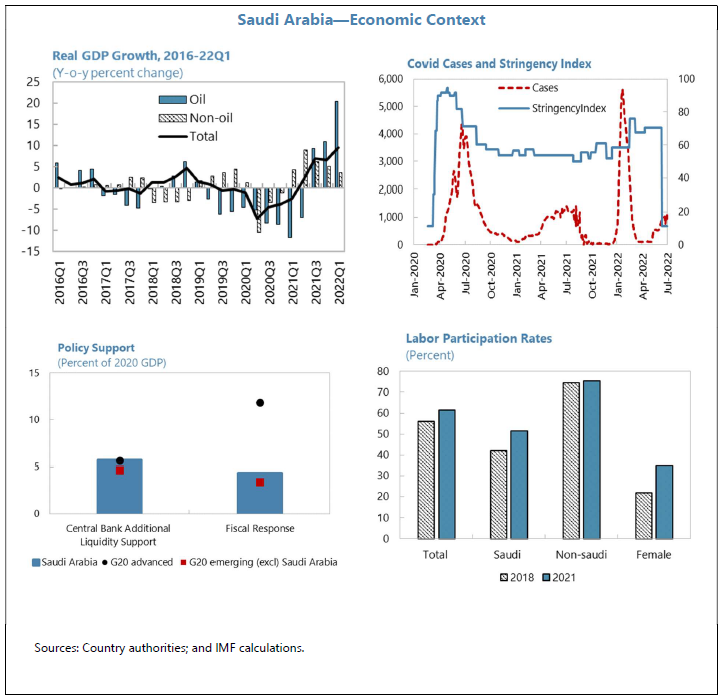

- In a world of economic bad news stories, Saudi Arabia (and the Gulf more broadly), is bucking the trend and reporting strong numbers – thanks to high oil prices as well as the continued growth of non-oil sectors.

- The Saudi economy has recovered well from the Covid-19 pandemic. It will likely be the world’s fastest-growing major economy in 2022, with an estimated growth rate of 7.6%, seeing it outperform not only the major developed economies of the G7, but also other major emerging economies such as China, India and Indonesia.

- Inflation is at 3.1% and unemployment has fallen. The percentage of women in the workforce has more than doubled in the last five years.

- Saudi Arabia’s fiscal position remains strong, with a budget surplus for the first time since 2013 – further increasing the pool of available funding for Saudi Arabia’s ambitious Vision 2030 economic diversification projects. The World Bank and IMF note, however, that there is a need to strengthen fiscal sustainability to prevent budget shocks when oil prices drop.

- Two key messages that New Zealand exporters can take from these developments are:

- Saudi Arabia (and the Gulf) will play an increasingly important role in New Zealand’s market diversification objectives for our traditional goods exports. Saudi Arabia’s population is young and increasingly affluent, and willing to pay a premium for safe, high quality food products.

- There is an explosion of opportunities for services and non-traditional exports to Saudi Arabia, particularly around the Vision 2030 economic development projects, which are now awash with funding and seeking global expertise in many areas of strength for New Zealand.

Report

While the world faces the twin economic shocks of Covid-19 and the Ukraine conflict, Saudi Arabia is bucking the trend and bringing in the cash. The economy has recovered strongly from the pandemic-induced recession, growing at a rate of 3.2% in 2021, before being supercharged in 2022 thanks to globally high oil prices. In 2022, Saudi’s golden goose Aramco overtook Apple as the largest company in the world. The International Monetary Fund (IMF) expects real GDP growth to increase to 7.6% in 2022, making Saudi Arabia the fastest growing economy in the G20.

The Kingdom may have benefited from oil prices, but it is not immune to inflation. The General Authority for Statistics has reported 128 food products were affected by rising prices in September 2022, with local potatoes (an increase of 65.95%) and local frozen chicken (an increase of 36.22%) heading the list and pushing a rise in inflation to 3.1%. There is little cause for alarm however. Consumer price inflation remains one of the lowest average rates amongst the G20, and the use of price caps on essential commodities such as fuel – as well as increased employment and entertainment opportunities introduced over the past six years – have suppressed any discontent about minor rises to the cost of living.

Although 73% of the economy is still derived from oil and oil products, diversification efforts are in full swing, and Aramco’s immense income continues to fund the ambitious Vision 2030 reforms at every level of society. The National Development Fund is focused on stimulating the private sector, with a goal of trebling the share of non-oil based GPD to reach $605 billion SAR ($283 billion NZD). The Crown Prince has now launched a National Industrial Strategy, which aims to promote industry and attract investment, in order to boost the value of industrial exports to $557 billion SAR ($261 billion NZD) by 2030.

Maintaining momentum on social and fiscal reforms will provide important protection from budgetary shocks when oil prices inevitably fall again, and when global oil demand eventually dwindles. Non-oil GDP growth reached 4.9% in 2021, in part due to the ever-expanding retail and e-commerce sector, as well as trade and manufacturing. A $1.5 billion fund has been introduced for start-ups, with a particular focus on high tech areas. Electric car manufacturing is expected to begin in 2024. Meanwhile, the religious tourism sector has benefitted from the return of Hajj and Umrah pilgrims post pandemic restrictions, and both international and domestic tourism is likely to increase as new developments and festivals are introduced and implemented.

There has been a near constant drive over the last six years to increase the participation of Saudi nationals in the workforce. Overall, unemployment levels dropped from 7.4% in 2020 to 6.9% in 2021, and are expected to fall to 6% in 2022. Ongoing legal reforms targeting women’s economic empowerment, alongside incentives such as transport subsidies and support for childcare, have helped to lift female participation in the workforce to 33% (reaching the original 2030 Government target of 30% ahead of schedule). Monsha’at, Saudi Arabia’s small and medium enterprises agency, has launched several programmes to assist local business since 2016, including start up initiatives, funding opportunities, university entrepreneurial camps, and business accelerators. A dedicated team holds responsibility for encouraging and providing support to women-led SMEs. In 2022, the World Bank signed a Technical Cooperation Program Agreement with Saudi Arabia, in order to provide technical expertise and support the Government’s development agenda.

Opportunities for New Zealand business

As the largest economy in the Middle East for the foreseeable future, Saudi Arabia is undeniably a key trading partner for Aotearoa New Zealand. New Zealand Trade and Enterprise (NZTE) notes sustainable opportunities for New Zealand business within the local production sector (including dairy, packed food, and food supplements), food and beverage products for tourism developments in the Red Sea, the Saudi resort industry, and the ‘Mega’ cities, as well as healthy food and beverage products sold in retailers and pharmacies. While the Kingdom plans to respond to food insecurity by increasing domestic production in key sectors, demand is unlikely to drop for New Zealand’s more expensive, yet high quality, niche food and beverage exports, and our trade portfolios remain complementary in nature. Meanwhile, non-traditional sectors are growing. NZTE has identified several opportunities in the tech sector, specialised manufacturing, and localisation of services and production, as well as increased interest from New Zealand companies in media and entertainment prospects – thanks to the vast expansion in tourism that Saudi Arabia is currently pushing.

The Kingdom holds further opportunities for the provision of technical services, in areas such as sustainable tourism, education, urban planning, and the digital economy. The latter has undergone rapid change during the Covid-19 pandemic – Saudi Arabia has introduced online health services, courtroom hearings, and distance learning. The Ministry of Communications and Information Technology has advised Post and the New Zealand Government-to-Government Partnerships Office of the creation of a Digital Economy Strategy, with priority sectors in gaming, digital media, emerging trade and Fintech, tourism, agriculture, and the environment. Saudi officials are also interested in lifting the numbers of students studying in New Zealand, given our strong education profile and emphasis on skills development.

The Ministry of Investment (MISA) has worked to improve the ease of doing business in Saudi Arabia – 600 reform initiatives and regulations have been enacted over the last six years, including cutting customs clearance times down from two weeks to 24 hours, and removing the local invitation requirement for business visas. MISA is also responsible for the Invest Saudi website, which is the ‘one stop shop’ for prospective investors, and a dedicated team considers new regulatory changes in response to investor feedback. The IMF reported in 2022 that Saudi Arabia’s efforts have been “impressive steps to improve the business environment, attract foreign investment and create private-sector employment.”

Several sessions during the recent ‘Davos in the Desert’ event (the annual Future Investment Initiative Conference) focused on opportunities to expand investment, as well as Saudi Arabia’s announcement of a Supply Chain Resilience Initiative, which aims to attract $40 billion SAR ($18 billion NZD), and to address challenges in global supply chains. MISA has advised Post that the Kingdom is on its way to meeting the ambitious Vision 2030 foreign direct investment targets; FDI reached 2.3% of GDP in 2021, despite the disruption of the Covid-19 pandemic. Apple has now agreed to set up its Middle East distribution hub in Saudi Arabia’s first integrated economic zone, which will reportedly be exempt from certain taxes and labour regulations for up to 50 years. New Zealand businesses have expressed interest in the benefits of such freezones and logistics hubs, given their wide-ranging incentives.

Comment

The changes to the Saudi economy go beyond the numbers and high oil prices – a fundamental shift is undeniably in progress. The Kingdom is all too aware that oil profits will not last forever, and that now is the time to invest heavily in diversification efforts, or risk losing their status as an economic heavyweight. World Bank reporting notes their efforts will require a repositioning of the role of the State – moving from a “driver of the economy to enabler of private sector-led growth.”

MISA officials have commented to Post on the ambition behind this shift, and that they plan to get there via initial “shock therapy” projects – quick and targeted changes – as well as the introduction of more long-term initiatives to support continued growth. New Zealand businesses interested in opportunities will be able to access support directly from MISA. While we are currently covered by the Asia office, a new outpost is reportedly being planned in Australia.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.