Food and Beverage, Manufacturing (excludes F&B):

On this page

Prepared by the New Zealand Embassy in Beijing

Summary

China’s economy continues its recovery from the COVID-19 pandemic, with the majority of key economic indicators continuing to track towards pre-COVID levels. As such, China is now on track to be one of the few global economies to grow in 2020, by approximately 2%. The World Bank and IMF expect China’s economy will continue rebounding, reaching around 8% growth in 2021.

While there have continued to be localised COVID-19 outbreaks in the last few months, these have not become substantial or widespread, or had a significant impact on the general trend of economic recovery.

Despite this, all is not back to normal yet, with China’s borders remaining tightly controlled and neither domestic travel nor tourism back to normal levels. Detections of the COVID-19 virus on the outer packaging of cold chain food products in China remains another issue for exporters to watch.

Regular China market updates and other useful resources are available on the New Zealand Trade & Enterprise (NZTE) website(external link). The Ministry for Primary Industries (MPI) provides requirements (Overseas Market Access Requirements or OMARs(external link) and Importing Countries Phytosanitary Requirements or ICPRs(external link)) and For Your Information (FYI)(external link) documents, including for China, with guidance on exporting issues relating to animal products (such as meat, seafood, honey, and dairy), food products, plant products, and wine.

Economic Situation in China

China’s Gross Domestic Product (GDP) grew by 4.9% in the third quarter (Q3). Despite falling 6.8% in Q1, China’s economy quickly rebounded to record growth in Q2 (3.2%) and an even larger magnitude of expansion in Q3, meaning growth over the first three quarters of the year reached 0.7%.

China’s economic recovery has so far been uneven across sectors with industrial output a key driver and consumption spending lagging the wider recovery. Restoring domestic demand continues tobe a priority in the current stage of China’s recovery. There were some positive signs in October, with official data showing total retail sales of consumer goods growing by 4.3% year-on-year (y-o-y), marking three straight months of growth.

The recovery of consumption spending itself has also been uneven. Sales of goods quickly began to recover after the initial lockdown, then stalled amid measures to contain new outbreaks, before finally returning to growth in recent months as most COVID-related restrictions were lifted.

However consumer spending in the services sector (which makes up the bulk of household consumption) has been much slower to rebound, and in the year to October the index of services production has decreased by 1.6%. While certain service industries are starting to experience monthly growth, the tourism sector, which experienced a 62% decline in revenues in the first half of 2020, continues to suffer. The accommodation and catering industry experienced year-on-year declines in October, and domestic air and rail travel are also both down more than 10% on October 2019.

Modes of consumption have shown signs of change; convenience stores were once the fastest-growing offline retail channel but are now losing ground to online grocery deliveries.

Recently released Chinese Customs data shows that China’s exports expanded 11.4% y-o-y in October, stronger than September’s 9.9% growth. Exports to China’s major trading partners have all grown this year –with medical goods and electronic goods continuing to lead this growth. The pace of export growth is expected to slow as other countries get back to more normal levels of production and exports in coming quarters.

China’s imports grew by 4.7% over the same period. This was a significant deceleration from the previous month’s 13.2% growth –which was largely attributable to Chinese companies stockpiling technological components ahead of any further US technology export restrictions.

A range of recent economic data suggests that China’s economy is recovering across the board, for example:

- China’s industrial output expanded, with the total value added by industrial enterprises growing by 6.9% y-o-y in October, for a year-to-date increase of 1.8%.

- The manufacturing purchasing managers’ index (PMI) was 52.1 for November, with a reading above 50.0 indicating growth in factory output. The non-manufacturing PMI (services and construction sectors) was 56.4. Both were the highest levels since COVID.

- The official urban unemployment dropped to 5.3% in October, continuing its decline from the COVID peak 6.2% in February and returning to its pre-COVID level.

China’s official consumer price index (CPI) rose 0.5% in October from a year earlier, down from 1.7% in September. The low inflation numbers are largely attributable to falling pork prices in September, which have long been elevated because of the African Swine Fever epidemic.

Transport links

Regular cargo flights continue on commercial routes between Auckland and Shanghai, and Auckland and Guangzhou. Further information on airfreight options is available on the NZTE ‘MyFreight’ website(external link).

Domestic logistics within China are functioning normally. International sea freight appears to be operating stably between New Zealand and China, though a shortage of shipping containers, mostly due to COVID-19-related actions in other jurisdictions, is beginning to have an impact on shipments to and from China. There have also recently been some peak season and port congestion surcharges applied to certain shipping lanes to and from Chinese ports.

After semi-regular reports that the COVID-19 virus has been detected on imported food packaging at various points of the supply chain, China has announced it will increase COVID-19 testing and start disinfecting all cold-chain shipments. There have been ongoing reports of slowdowns in border clearance times and post-border distribution in certain areas.

Passenger flights from Auckland are operating to and from Shanghai by both Air New Zealand (twice weekly) and China Eastern Airlines (once weekly), and to and from Guangzhou by China Southern Airlines (twice weekly).

China has a process in place for those needing to visit China for “urgent or necessary economic activity” to seek an exemption to China’s border restrictions and apply for a visa. The process can be activated by the employing company or business partner in China writing to their local Chinese Government Foreign Affairs Office to seek an exemption. A number of New Zealand businesspeople have successfully applied for visas under this process. All New Zealand travellers to China must complete a 14-day quarantine on arrival.

China recently tightened its pre-departure requirements for flights travelling to China to require two nucleic acid (PCR) test results two days before boarding for those travelling from New Zealand. From December 10 this requirement will change to one COVID-19 PCR test and one COVID-19 Antibody (IgM) test two days prior to boarding China-bound flights. Travellers will need to provide these results to the Chinese Embassy or Consulates in New Zealand. The recent changes have also had implications for the ability to transit in other locations. The latest information on specific pre-departure requirements and visa application processes can be found on the Chinese Embassy in New Zealand’s website(external link).

New Zealand’s trade with China: Overview and post-COVID trends

China continues to be New Zealand’s top trading partner, with two-way trade totalling $32.4 billion for the 12 months to June 2020. China is New Zealand’s largest market for exports ($19.4 billion) and our second-largest source of imports ($13.0 billion).

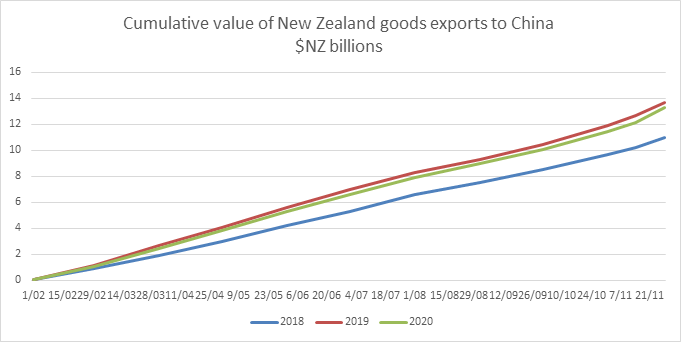

Provisional data[1] from Statistics New Zealand shows(external link) that for the period 1 February to 25 November 2020 (i.e. post COVID-19 outbreak data) New Zealand’s exports to China were around 2.8% less ($388 million) than pre-COVID (NZ$13.26 billion in 2020 vs NZ$13.65 billion in 2019).

The data is provisional and should be regarded as an early, indicative estimate of intentions to trade only, subject to revision.

Trends in key export sectors in 2020 (January to October)

Dairy

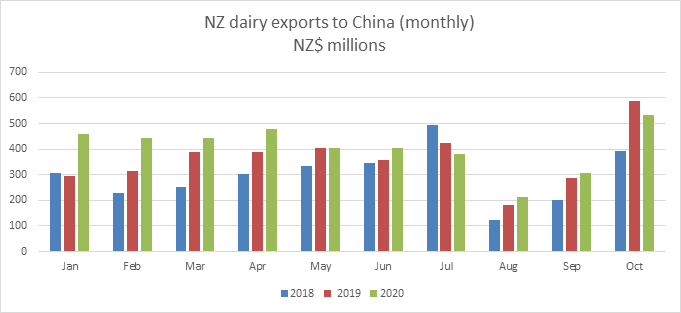

Dairy exports to China by value have grown steadily throughout 2020, consistently higher than the equivalent period in the previous two years, and up 12% overall compared to the same period in 2019. In general, sales into the food service sector including ingredient sales have continued to be relatively weaker (as they have for other product groups), but New Zealand’s dairy trade has been boosted by commodity and consumer sales.

Infant Formula

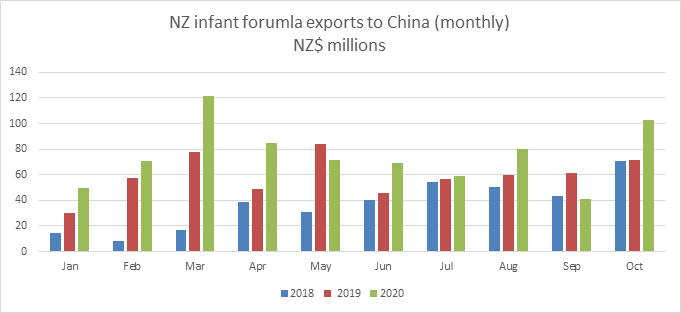

Alongside dairy, infant formula has also recorded strong growth so far this year, with the value of exports up 27% compared with the same period in 2019.

Meat and meat products

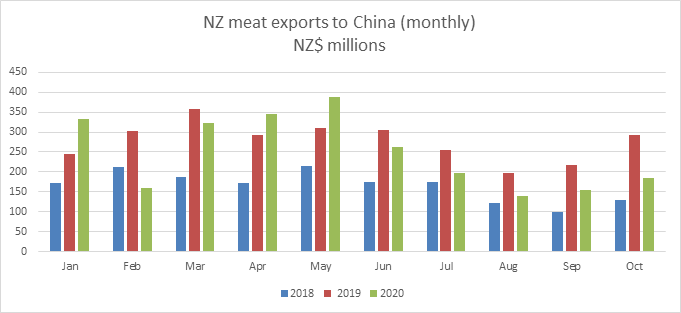

New Zealand’s meat exports to China started the year strongly, but were impacted by depressed food service sector and consumer demand during February and March. After a good performance in April and May, the second half of the year has shown reduced value of sales compared to the equivalent period in 2019.

Overall the value of meat sales to China this year is more than 10% down on last year’s figures. The recent decrease in exports was largely driven by decreased sales of frozen beef (down 26% in the first 10 months of 2020, compared to the equivalent period in 2019). China’s beef imports from Brazil have boomed over this period, up over 150%, reaching NZ$5.4 billion. In addition, an increase in premiums in the EU and US has led to increased New Zealand exports to markets other than China.

The October decline is largely due to the fact that in October 2019, NZ was sending record volumes of meat to China due to African Swine Fever significantly affecting China’s pig industry. While the value of exports this October was down compared to last year, it was still higher than October monthly exports in recent years.

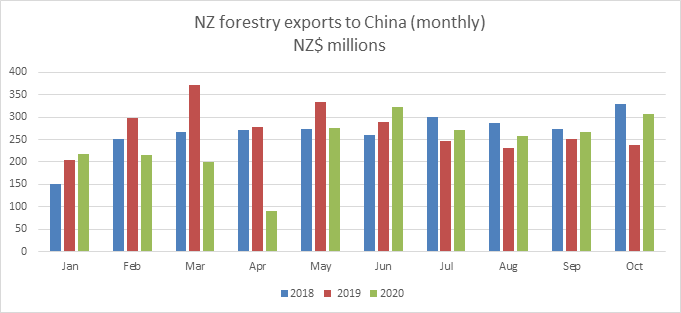

Forestry and forestry products

New Zealand forestry sector exports to China have fallen in all major product categories, and the overall value of exports in this sector is 12% down compared with the equivalent period last year, and down 9% compared to 2018 figures. Exports fell during February-April due first to supply chain issues followed by an inability to fell and process trees during New Zealand’s COVID-19 lockdown period. The decline has turned around somewhat in the second half of the year, with recent monthly exports higher than 2019 levels.

Chinese imports of forestry products were down across all source countries, except for Europe; this is likely a reflection of the cheap price of these logs relative to other softwoods. The volume of imported logs from Europe remains small and despite the declines, so far this year New Zealand remains China’s largest source of imported logs.

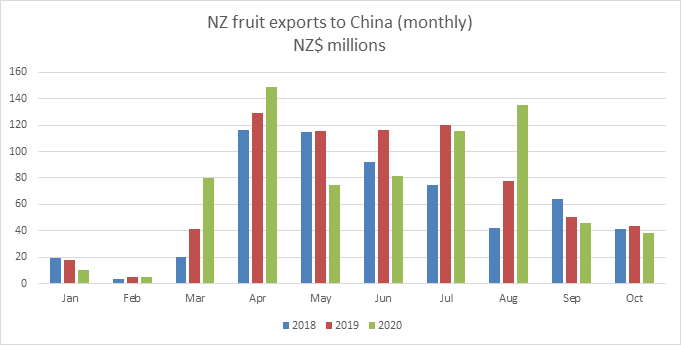

Fruit

After an inconsistent year, the value of New Zealand’s fruit exports to China are 2.6% ahead of the same point in 2019. Domestic growing conditions affected cherry exports earlier in the year and competition from Chinese apples at the start of the season have been among the challenges.

Seafood

The value of New Zealand seafood exports to China so far this year is down almost 21% compared with 2019, and down 5% on 2018 figures. Sales of premium fresh seafood are likely to continue to be sluggish due to the slower recovery in the restaurant and hospitality (hotels) sectors as well the banquet sector, which heavily impacts lobster sales in particular. However there are signs for optimism with spending in these sectors starting to trend upwards. Consumer perceptions of the risks around imported frozen products may also have had an impact on demand.

Wine

China remains a small market for New Zealand wine exports. Overall, New Zealand’s wine exports to China are down 11% on 2019 sales value, and down 27% compared with 2018. The tough food service environment, especially earlier in the year, is one reason for the decline. While China remains a small market for New Zealand wine, there is room to grow in the future and e-commerce platforms, such as TMall and JD.com, have become a more popular way to sell wine directly to consumers for personal consumption rather than for gifting (spurred by the dearth of functions during the height of COVID). The recent imposition of anti-dumping duties of up to 212% on Australian wines (China’s largest wine supplier by value, worth NZ$1.2 billion) will likely lead to market disruptions over the coming year.

Services

Regular data for New Zealand’s services exports for 2020 is currently not available, but preliminary data(external link) from Statistics New Zealand for the first three quarters of 2020 shows a $1 billion dollar decline in New Zealand services exports to China compared with the same period in 2019. This is as expected, given China is an important market for New Zealand’s tourism and export education sectors, and both have been severely impacted by the pandemic.

|

|

Services Exports to China: |

Percentage change |

|

|

Period |

2019 |

2020 |

|

|

Jan-Mar |

996,938,303 |

740,173,302 |

-25.8% |

|

Apr-Jun |

851,728,684 |

455,657,344 |

-46.6% |

|

Jul-Sep |

736,249,962 |

390,523,339 |

-47.0% |

|

Jan-Sep |

2,584,916,949 |

1,585,436,286 |

-38.6% |

To contact our Export Helpdesk

- Email: exports@mfat.net

- Phone: 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.