Government:

On this page

Summary

- Singapore’s economy is forecast to grow between 3% and 4% in 2022, with a recovery in the service sector being offset by dampened trade-related growth due to global economic headwinds.

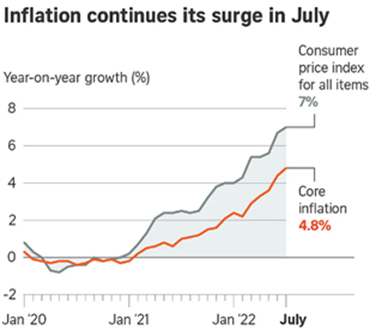

- Headline inflation in July 22 (year-on-year) reached 7% - the highest in 13 years - with core inflation sitting at 4.8%.

- To buffer against the rising cost of living, the Monetary Authority of Singapore has allowed the Singapore dollar to strengthen during 2022. The Government is also providing financial support for middle and lower income Singaporean families.

- The Government is also pushing forward with plans to evolve and upgrade the economy – including through significant infrastructure investments such as the Tuas Megaport and Changi Airport Terminal 5.

Report

Singapore economy: crunching the numbers

Singapore’s economic growth for 2022 is projected to come in at around 3-4%, after 7.6% growth was achieved in 2021 (following a 4.1% contraction in 2020). Although service-orientated sectors have staged a recovery during 2022 (reflecting the removal of most COVID-19 control measures and increase in cross-border people flows), growth in export orientated sectors has softened due to global headwinds. For instance, as China is a key market for petroleum and chemicals products from Singapore, the weakness in its economic outlook has adversely affected the growth prospects for Singapore’s chemicals cluster and the fuels & chemicals segment of the wholesale trade sector.

Like much of the region, inflation in Singapore has been increasing. In July 2022, year-on-year growth headline inflation was 7.8% and core inflation 4.8%. Key figures for July include:

- Accommodation (rents): 4.6%

- Food inflation: 6.1%

- Private transport inflation: 22%

- Electricity and gas inflation: 24%

Singapore central bank economists forecast that underlying price pressures could ease towards the end of the year, assuming that global commodity prices stabilise and global supply constraints loosen somewhat. The price for natural gas (the primary fuel source for Singapore’s electricity network) however is forecast to remain elevated for the foreseeable future – with Singapore-based energy analysts noting that there is considerable competition on the spot market from European and Asian buyers.

Unemployment rates have been trending downwards since peaking in October 2020, and held steady after reaching pre-COVID levels in February 2022, amidst a tight labour market and record high number of job vacancies. In June 2022, unemployment rates were 2.1% overall, 2.9% for residents, and 3.1% for citizens.

Singapore: cost of living pressures

A recent poll of Singaporeans about their current ‘top concerns’ saw 90% of respondents identify cost of living pressures as their number one concern. To try to ease inflationary pressures, MAS has used its main regulatory tool – gradually tightened monetary policy since late 2021 through increasing the rate of appreciation of the Singapore dollar nominal effective exchange rate (S$NEER). The appreciation of the Singapore dollar contributed to a S$7.4

billion loss by MAS in FY21/22 (the first loss posted since 2013).

The Singapore government has also rolled out a S$1.5 billion package of financial support for medium and low income households. The support has included staggered cash pay-outs and rebate / voucher schemes. According to government figures, a middle-income family with two young children can expect an additional S$2,200 in support this year, while a lower-income two children family can expect to receive around S$3,700.

The government also continues to closely monitor the labour market and assesses that the risk of a wage/price spiral remains contained. The relaxation of border restrictions, and the continued inflow of foreign workers, are felt likely to ease labour market tightness, and moderate labour cost pressures. At the same time, the government continues to roll out the progressive wage model on a sector-by-sector basis, for workers whose earnings are in the bottom 20 percent (Note: the PWM is in lieu of setting a minimum wage). Retail assistants, for instance, will see their wages go up around 8.5% annually over the next three years.

Despite inflationary pressures, the government will go ahead with its plans to increase the GST rate from 7% to 9%, to support meeting long-term public sector cost pressures (e.g. rising health care costs due to an ageing population), although the increase will now be staggered over two years (with a 1% increase scheduled for January 2023 and a further 1% increase scheduled for January 2024). The government will also implement a $6.6 billion Assurance Package (announced in the 2022 budget) to cushion medium to low income households from the impact of the increase for the next 5 to 10 years.

Singapore’s economic prospects

PM Lee, in his 21 August 2022 national day rally speech noted that – while the government will do all it can to support Singaporeans through a period of higher inflation – the era of golden weather for international trade is now over:

“The basic reality is that international economic conditions have fundamentally changed. It is not just the pandemic or the war in Ukraine. The recent decades were an exceptional period. Globalisation was in full swing; international trade grew rapidly; China’s economy was growing exponentially, and exporting more and more goods at highly competitive prices all over the world – this brought down the cost of many products, and kept prices world-wide very stable. This era is now over. China’s growth and exports are slowing. Their costs are going up. Some countries have raised tariffs against each other, particularly between the US and China.”

Against the backdrop of challenging global economic conditions, the government continues to stress that Singapore must press on with economic upgrading and restructuring. In the words of PM Lee: we must “redouble our transformation efforts, and encourage workers to upgrade their skills at every opportunity.” These restructuring efforts include pushing forward with significant infrastructure investments – including the fully automated Tuas megaport (which, when completed in 2040, will be able to handle 65 million TEUs per annum, almost doubling the city-state’s current capacity) and Changi Airport Terminal 5 (which when completed in the 2030s will be able to handle approximately 50 million passengers per year, again almost double the capacity across the current four terminals).

The government is also doubling down on the broader evolution of the economy – in line with the strategy Singapore Economy to 2030 (available here). The strategy covers:

- Accelerating development of new engines of growth in services.

- Manufacturing 2030: Building up a strong manufacturing sector.

- Enterprise 2030: Growing Singapore Global Enterprises and strengthening the core capabilities of local enterprises.

- Trade 2030: Enhancing trade and strengthening our connectivity to the world.

- Green Economy Strategy and the Singapore Energy Transition: Transitioning Singapore to a low-carbon

economy

More reports

View full list of market reports

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.