Services, Sustainability:

On this page

Summary

The northernmost Västerbotten and Norbotten regions of Sweden have become green innovation hubs, attracting more than 80% (NZ$135 billion) of Swedish “green transition” investments to 2040. Key sectors include wind power, batteries, steel, and rare earths.

But rapid industrial and population growth has increased demand for energy and infrastructure which is causing challenges for the regional governments. Businesses too are struggling to find staff, particularly given current immigration settings. Maintaining traditional Sàmi reindeer herding routes is a further challenge.

This experience could be relevant to New Zealand policy makers, and may present opportunities for New Zealand businesses.

Report

Sweden’s far north regions of Norbotten and Västerbotten are experiencing the highest levels of industrial growth in the country. The green transition has fuelled much of this growth. Sweden totals NZ$165 billion of planned investments up to 2040, with NZ$135 billion planned for the Västerbotten and Norbotten regions. This figure includes private and public sector investments. The government offers a range of incentives(external link) for international companies wishing to set up new establishments in the North of Sweden under the Regional Investment Grant, and Regional Transportation Grant. Examples of investments planned from 2016-2035 are listed below.

|

Västerbotten |

Northvolt green batteries |

SEK 30 billion (NZ$4.6 billion) |

|

SCA paper mill in Umeå |

SEK 7.5 billion (NZ$1.2 billion) |

|

|

Komatsu forestry machinery factory |

SEK 1 billion (NZ$0.15 billion) |

|

|

Rototilt, excavator machinery products |

SEK 150 million (NZ$23 million) |

|

|

Martinson’s Sawmill |

SEK 120 million (NZ$18.5 million) |

|

|

Norrbotnia Railway Line expansion |

SEK 15 Billion (NZ$2.3 billion) |

|

|

Boliden Rönnskär, electronics recycling |

SEK 1.1 billion (NZ$0.17 billion |

|

|

Skellefteå municipality investments for the port, airport, cultural centre, waterworks, travel centre, schools, preschools, real estate, infrastructure |

SEK 25 billion (NZ$3.85 billion) |

|

|

Umeä railway wagon workshop |

SEK 100 million (NZ$15.4 million) |

|

|

Dåva Railway Terminal |

SEK 80 million (NZ$12.3 million) |

|

|

Port of Umeå |

SEK 1.4 billion (NZ$0.44 billion) |

|

|

Housing construction in Skellefteå |

SEK 10 billion (NZ$1.54 billion) |

|

|

Liquid wind/Umeå energy |

SEK 4 billion (NZ$0.62 billion) |

|

|

Njordr Offshore Wind |

SEK 25 billion (NZ$3.85 billion) |

|

|

Vattenfall Wind Power Projects |

SEK 10 billion (NZ$1.54 billion) |

|

|

Nordic Wind Power |

SEK 1 billion (NZ$0.15 billion) |

|

|

Norrbotten |

Seskarö sawmill |

SEK 100 million (NZ$15.4 million) |

|

Rolfs sawmill |

SEK 20 million (NZ$3.1 million) |

|

|

Combi terminal Gammelstad |

SEK 40 million (NZ$6.2 million) |

|

|

Kåbdalis ski resort |

SEK 500 million (NZ$77.0 million) |

|

|

H2 Greensteel |

SEK 25 billion (NZ$3.85 billion) |

|

|

Luleå energy |

SEK 100 million (NZ$15.4 million) |

|

|

Markbygden Wind Farm |

SEK 60 billion (NZ$9.23 billion) |

|

|

Global watch satellites Monitoring |

SEK 20 billion (NZ$3.1 billion) |

|

|

SCA Piteå paper mill |

SEK 200 million (NZ$30.8 million) |

|

|

Port of Piteå |

SEK 650 Million (NZ$100 million) |

|

|

|

SEK 10 billion (NZ$1.54 billion) |

|

|

Taiga resources |

SEK 2 billion (NZ$0.31 billion) |

|

|

LKAB |

SEK 400 billion (NZ$61.6 billion) |

|

|

Hybrit demo plant |

SEK 10 billion (NZ$1.54 billion) |

Rapid industrial development challenges in the North of Sweden

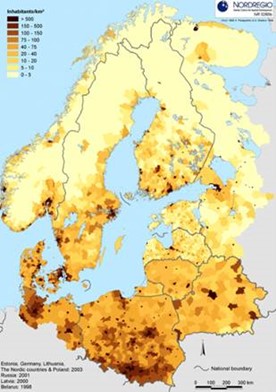

The top challenge this rapid growth presents is the need for skilled workers. Norbotten and Västerbotten each require a 20% increase in workers. Northern Sweden has a high standard of living as the top rated region in the EU European social progress index(external link). However, low population density(external link) requires that residents pay proportionally higher taxes to support public services and infrastructure than other Swedes. This can act to dissuade Swedes from moving to the Northern regions, while the government’s immigration policy settings affect the ability to attract new migrants. Both regions are investing significant resources in enticing people to the regions and making them attractive places to live.

Swedish Population Density Map

This new investment also requires rapid growth in infrastructure, particularly electricity which needs to double across Sweden by 2050. Plans to expand infrastructure, including winds farms and Arctic mines, need to consider the rights of the indigenous Sámi to herd reindeer in the region as well as other issues in order to obtain the necessary permits.

City of Umeå, Capital of Västerbotten, opportunities and challenges of rapid industrial growth

Umeå’s development has brought much-desired population growth to the region.

The city has created more than 1,100 jobs per year and is one of the top growth regions in Sweden. Umeå’s goal is to increase its population from 130,000 to 200,000 by 2050 to support industrial growth. This growth requires large infrastructure investments including the North Bothnia railway line, the expansion of the Umeå port, and development of Umeå airport. Umeå Council is working to ensure the growth is managed in an environmentally and socially sustainable way, engaging residents on issues and needs relating to social urban spatial design, density, public transport and services, and green and community spaces. This will also help to entice new residents. This model of public engagement may be of interest to New Zealand councils.

Skellefteå, Västerbotten, home of Northvolt, opportunities and challenges of rapid industrial growth

Skellefteå was an industrial town in slow decline since the 1970s – until it became the centre of Northvolt green batteries in 2015. Northvolt is expected to need an additional 3,000 workers by 2025. The company is also investing NZ$13.9 - 15.4 billion in the region, which is encouraging other companies to invest in the region.

Skellefteå is positioning itself as a leader in the green transition, including in sustainable buildings, mobility, and industry. Northvolt is actively collaborating with the public sector on sustainable growth, demonstrating a model of public-private partnerships.

Rapid investment also brings challenges. Although Skellefteå has had a goal of population increase since 2011, an increase of 24-30% in 7 years requires new infrastructure to support this growth. The region needs additional workers who are proving hard to attract. Skellefteå Council(external link) is actively promoting the region and assisting with relocations, but movement to the region is not keeping up with demand.

Large-scale investment is creating a hub for large, medium and small enterprises and start-ups.

Rapid investment in green technology and infrastructure have made Västerbotten and Norbotten hubs for businesses of all sizes.

Umeå University, one of the northernmost Universities and a leader in Arctic Research, now hosts 37,000 students. It has become home to a number of incubator hubs, including the now well-known companies Nordic Biomarker(external link), Lipum(external link), and medsens AB(external link).

The Norbotten and Västerbotten regions provide a useful case study of the opportunities and challenges that come with large-scale investment and rapid growth which New Zealand can learn from in its own green transition journey or which may offer commercial opportunities for New Zealand businesses.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.