Food and Beverage, Primary Products, Manufacturing (excludes F&B), Government:

On this page

Summary

Following the lifting of the national State of Emergency on 25 May, the downward trend in the Japanese economy has started to reverse due to the resumption of socio-economic activities and the Japanese government’s economic stimulus initiatives.

The Japanese economy nonetheless remains in recession and is forecast to shrink by around 6 percent in 2020.

A recent spike in COVID-19 cases indicates the emergence of a second wave of infections, which would likely set back Japan’s economic recovery efforts.

While New Zealand’s goods exports to Japan have performed very well so far in the year to date there are signs that this will not continue, with goods exports decreasing 9 percent in June 2020 as compared with June 2019.

Tourism and education services exports continue to be severely hit by COVID-19, and look set to remain this way in the short- to medium-term due to border restrictions.

There remains limited air connectivity; exporters are contending with reduced services and higher than normal airfreight costs.

The recent announcement by Rio Tinto that it will wind up its operations at the Tiwai Point aluminium smelter in August 2021 will have a significant impact on export figures in the medium term, (aluminium currently makes up approximately 16 percent of New Zealand’s goods exports to Japan).

Covid-19 situation in Japan: Sharp growth in reported cases in July

Japan now appears to be entering a second wave of COVID-19 infections, following the end of the nationwide State of Emergency at the end of May and the re-opening of almost all economic activity on 19 June.

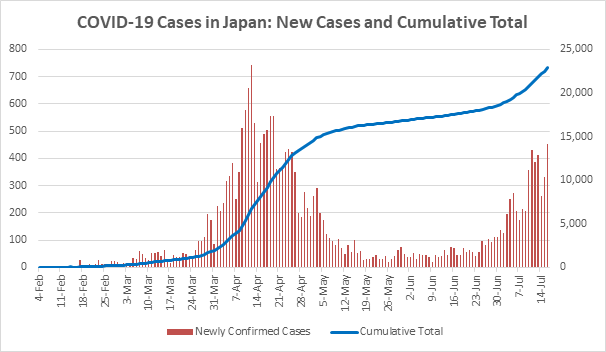

On 16 July, Tokyo recorded its highest ever one day total of new cases (286), and nationwide there were 453 cases. There was a sharp increase in reported cases in the first half of July (from a lower base) in the regions around Osaka and Nagoya. See Graph 1 below.

To date Japan has confirmed over 22,500 cases of COVID-19 and 984 people have died of the disease; this continues to be the lowest death rate among G7 countries.

For the time being a second State of Emergency does not appear imminent, but on 16 July the Japanese Government made travel to/from Tokyo ineligible for a domestic tourism subsidy programme (in response to concerns about spreading infections to rural areas).

Graph 1: Covid-19 cases in Japan: new cases and cumulative total

Economic situation

COVID-19 hits Japan’s economy hard

Japan’s economy has been hit hard by the impact of COVID-19. The OECD estimates that real GDP will contract 6 percent in 2020 or by over 7 percent if Japan re-imposes confinement measures in response to the likely second wave of infections.

This month the Bank of Japan downgraded its assessments of all nine regional economies in the country for the second straight quarter, for the first time since January 2009.

Due to the domestic State of Emergency (April – May) corporate profits and business sentiment have deteriorated and the employment and income situation has been weak. The unemployment rate rose to 2.9 percent in May from 2.6 percent in April, although on this measure Japan continues to fare better than other economies.

The contraction has been most pronounced in the automotive, machinery, retail, hospitality and tourism sectors.

The global impact of COVID-19 has seen a substantial decline in Japan’s exports. In the January to June period, exports fell 15.4 percent from a year earlier, with car exports falling by over 30 percent.

Japan’s exports to the US were down 27 percent and 18 percent to the EU as compared to June 2019, largely as a result of the decrease in demand for automobiles. By comparison exports to Asia (and particularly China) have been comparatively more stable, driven by demand for ICT-related goods (related to 5G, data centres and semiconductors). Exports to China fell by only 3 percent in June as compared to the same month in 2019.

The Japanese government had been aiming to attract 40 million tourists in 2020. However, Japan received only an estimated 2,600 foreign visitors in June, down 99.9 percent from a year earlier (and the third monthly consecutive decline).

Some signs of rebound, but uncertainty over possible “second wave”

In the short-term (second half of 2020) it is currently predicted that the Japanese economy will rebound, boosted by the resumption of socio-economic activities following the end of the State of Emergency and the Japanese government’s stimulus initiatives.

There are signs that this is already occurring. Private consumption (which makes up over half of Japan’s GDP and which took a big hit in April and May) is showing signs of picking up.

While the pattern of improvement is not uniform, there have been increases in the first half of June as compared to the latter half of April in the following industries (as compared to January 2020):

- Department store sales (-75.4 percent to -20 percent);

- Apparel and accessories sales (-33.8 percent to +11.7 percent); and

- Dining out (-71.9 percent to – 41.3 percent).

The automotive sector is also seeing a rebound. In June Toyota sold 100,000 new vehicles domestically. While this was still a 23 percent decrease from June 2019, it was more than in May 2020 when sales were down 33 percent.

The Bank of Japan assesses that the overall improvement in the Japanese economy will likely only be moderate while the impact of, and uncertainties around, COVID-19 remains worldwide.

Furthermore, the Bank of Japan notes that its current economic modelling does not factor in a large-scale second wave of COVID-19 in Japan.

NZ goods and services exports

Overall goods picture still positive for the year to date

In the year to date (January to June 2020) total goods exports to Japan have increased by approximately 10 percent to $2,060 million, compared to the same period in 2019.

Total goods exports to Japan held up well in May, decreasing only slightly (by 0.1 percent) from $426.3 million (May 2019) to $425.9 million (May 2020). May 2019 was the highest May goods exports result since 2010, with the May 2020 result a close second.

The following exports at the sector-level increased in May:

- Metal and metal products (by 13.2% to $49.4 million); and

- Miscellaneous food and beverage products (by 84% to $26.8 million)

While the following sectors saw a decrease:

- Horticulture (fruit, vegetables, and wine) (-3.4% to 167.4 million);

- Dairy products (-2.7% to $84.7 million);

- Meat and meat products (-9.7% to $36.1 million);

- Forestry and wood products (-13.8% to $28.8 million);

- Fish and seafood products (-21.5% to $6.3 million);

Although several sectors saw an overall decline, there were some stand-outs at the product level:

- Gold kiwifruit increased by 5% to $110 million;

- Aluminium, not alloyed, increased by 11% to $36.6 million, and aluminium alloys increased by 21% to $9.1 million;

- Cheese including cheddar and colby increased by 24% to $34.2 million;

- Boneless frozen beef increased by 6.6% to $13.2 million;

- Food preparations increased by 74.7% to $12 million; and

- Honey increased by 319% to $9.3 million.

As we noted in our June market report there were several factors that contributed to these results, including that most of the goods exported were in the food and beverage sector (F&B) that was seeing growth via supermarket, delivery and online channels and in products that appealed to health conscious consumers, such as manuka honey.

The reduction in tariffs agreed under CPTPP also provided a boost to some sectors, including dairy, fruit and honey.

There is also likely to continue to be demand over the Japanese summer for imported fresh fruit products as poor weather has significantly reduced domestic fruit production.

But the negative economic situation is starting to be reflected in our goods exports

Provisional trade data shows that NZ’s goods exports to Japan were down 9 percen in June 2020 at $313 million, as compared to $344 million in June 2019.

As Table 1 below shows, this was a lower performance for June than has been experienced in the past five years.

Table 1: New Zealand Total Goods Exports to Japan June, 2016 - 2020

| Year | Month | New Zealand Dollars |

|---|---|---|

| 2016 | June | 335,194,152 |

| 2017 | June | 338,831,594 |

| 2018 | June | 335,951,828 |

| 2019 | June | 343,881,324 |

| 2020 | June | 313,000,000 |

A detailed breakdown of the June goods exports data is not yet available, but the decrease is likely due to a combination of the following factors:

- Overall decreased demand due to local COVID-19 related market disruptions and global economic uncertainty;

- Some exporters moving more product to market earlier in the year due to uncertainties around COVID-19;

- Customers having higher than normal inventories, which will reduce imports in the months ahead; and

- While there has been some rebound in the food service sector, not all restaurants have reopened and turnover is reportedly 50 percent down as compared to pre-COVID-19.

And services exports to Japan have been severely hit

Services exports are also taking a significant hit due to COVID-19 and border restrictions.

Pre-Covid-19, the average monthly returns from Japanese tourists visiting New Zealand amounted to approximately NZD$27 million. As shown in Table 2 below, this sector has experienced significant decreases since March, with a 94 percent decline recorded in April.

In the education sector, the number of Japanese nationals undertaking long-term study in New Zealand has dropped by approximately 30 percent (or 1,000 students) from June 2019 to June 2020.

Regarding short-term study, approximately 7,000 Japanese citizens are normally granted short-term study visas each year. This has not been possible since the introduction of border restrictions.

Table 2: Comparison of the number of Japanese arrivals to NZ from January to May 2019 to 2020

| 2019 | 2020 | % change | |

|---|---|---|---|

| January | 8,187 | 9,063 | 11% |

| February | 11,679 | 12,942 | 11% |

| March | 12,915 | 3,420 | -74% |

| April | 6,981 | 6 | -94% |

| May | 3,807 | 9 | -91% |

Outlook for short to medium term

There will likely continue to be demand for specific products in the F&B sector that meet Japanese consumers’ heightened interest in healthy products and those sold through channels other than the food service industry.

For most exports outside the F&B sector, we expect that the economic situation including the uncertainly around whether a significant second wave of infections will materialise will dampen demand for the remainder of 2020 at least.

Likewise, significant services exports to Japan in tourism, education and transportation will continue to be hit hard while borders remain restricted.

The recent announcement by Rio Tinto that it intends to wind up operations at the Tiwai Point aluminium smelter in August 2021 will also have a significant impact in the medium-term. At present, aluminium is New Zealand’s third largest export product to Japan, making up 16 percent of total goods exports.

The Japanese Government has recently announced focus areas for its Growth Strategy action plan for FY2020, which include improved ways of working, implementing an environment more conducive to cashless transactions, digitalisation of the marketplace and advancement of open innovation. These focus areas could offer some new opportunities for New Zealand exporters of goods and/or services.

To contact our Export Helpdesk

- Email exports@mfat.net

- Call 0800 824 605

- Visit Tradebarriers.govt.nz(external link)

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.