Supply Chains:

On this page

Report

The Aotearoa New Zealand-United Arab Emirates (UAE) two way goods trade experienced a 43% decrease in 2022 (NZ$1.89 billion) from 2021’s NZ$3.33 billion. This has already resulted in the UAE dropping from New Zealand’s 10th largest two-way trading partner to the 16th largest.

The drop was largely due to a 65% (NZ$1.5 billion) decrease in oil imports from the UAE (being only NZ$350,000 in the second half of 2022), after the April 2022 closure of New Zealand’s only oil refinery, Marsden Point. This figure will likely go to almost zero going forward. The refinery was largely calibrated to refine Gulf crude oil (note the constitution of crude oil differs greatly between regions) and for most of the previous decade, Marsden sourced its supply of crude oil from the UAE. Given this context, the significant impact on UAE oil imports to New Zealand in the two-way trade statistics is therefore unsurprising.

Global oil supply

The closure of Marsden Point was intended to support Aotearoa New Zealand’s zero carbon transition and reflected a policy decision that there was certainty of supply of imported refined petroleum products (i.e. petrol, diesel etc).

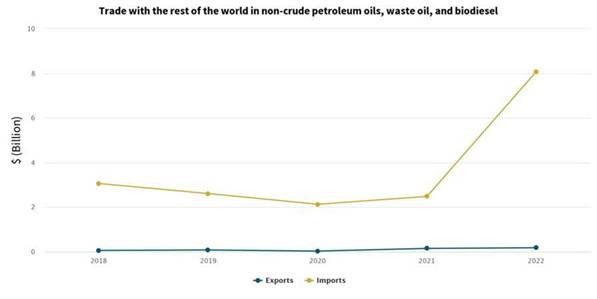

This has led to a predictable rise in non-crude products from other countries since Marsden Point’s closure. New Zealand petroleum suppliers have substituted UAE crude oil imports with refined (non-crude) oil imports, which more than tripled from 2021 (NZ$2.48 billion) to 2022 ($NZ8.08 billion):

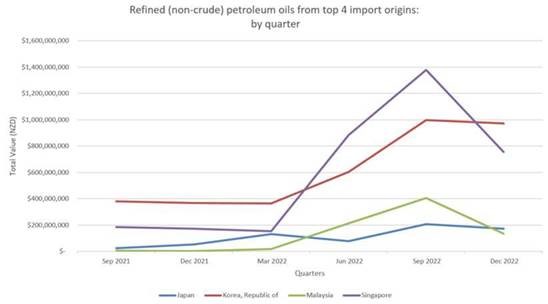

In our Indo-Pacific region, Japan, South Korea, Singapore and Malaysia are the most prominent exporters of refined petroleum products – all having invested significantly in surplus refining capacity. This jump in exports of these products for these four markets has seen a substantial increase, as expected, since April 2022:

What is the origin of Aotearoa New Zealand’s fuel imports?

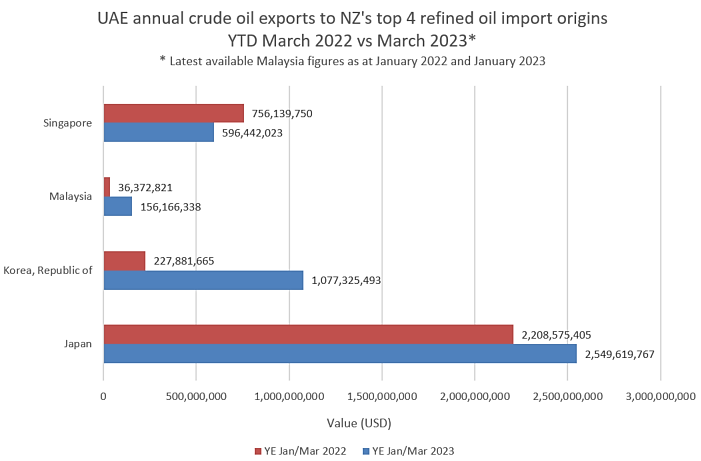

Japan, South Korea and Singapore have virtually no natural reserves of crude oil and Malaysia’s reserves are small on the global scale. This means that that the vast majority of Aotearoa New Zealand’s imported refined petroleum comes from large OPEC members, such as the UAE and Saudi Arabia.

At the level of New Zealand’s specific imports, it is very difficult to say with certainty the country-origin of the crude oil used by the large refineries in South East and East Asia. However, the UAE is a key import partner to New Zealand’s top four refined oil import partners (supplying between 9-38% of their total crude imports in 2022), and as depicted below, UAE crude oil exports to three of these partners increased in the 2022 calendar year:

Effect of real UAE – NZ imports?

Undoubtedly the closure of Marsden Point has greatly impacted Aotearoa New Zealand’s total goods trade with the UAE in nominal terms. However, in real trade terms the decline is much less, or even maintained, because a significant quantity of our imported refined petroleum from Asia would have been made from crude originating from the UAE. Unfortunately, it is hard to define a hard number on real trade values because these trade patterns may well have been affected in whole or part by other externalities.

NZ exports to UAE increasing

Aotearoa New Zealand’s exports to the UAE have remained sound, increasing to NZ$970 million in the year ended December 2022 from NZ$900 million in the year prior (ending December 2021). An area of increasing potential is Technology and Services, which has also seen heightened New Zealand exporter participation, including in events such as Arab Health.

The rapid transformation of healthcare services in GCC countries like the UAE is, in particular, creating a wealth of opportunities in the health tech, medical devices, and wellness fields. These are areas that New Zealand exporters are well placed to meet thanks to their fresh thinking, strong research capabilities and scientific excellence, their commitment to putting the patient first, and their ability to think globally from the moment they start innovating.

More reports

View full list of market reports.(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page.(external link)

Learn more about exporting

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.