Supply Chains, Food and Beverage:

On this page

Summary

- China’s GDP grew by 3.9% in Q3 marking a recovery from the 0.4% GDP growth in Q2. Analysts have cited policy support from central government as key in driving the rebound.

- However October’s macroeconomic data showed a weak start to Q4, with various results falling short of forecasts. Early indicators from November suggest this downward trend has continued.

- The broader picture is one where weakening export growth, depressed domestic consumption, real estate market challenges, and COVID-related uncertainties all hinder economic growth.

- Analysts’ growth forecasts for China are sub-3% for 2022, rebounding above 5% in 2023 if China’s COVID policies are relaxed.

- Recent indications that China’s COVID-19 policy are shifting have rallied markets, but a great deal of uncertainty still remains.

- Despite these challenges, New Zealand’s goods trade into China has remained resilient through 2022. Services trade have yet to return to pre-COVID levels.

Report

Stronger than anticipated Q3 results turn the page on a weak Q2…

In Q3 China registered 3.9% yoy GDP growth, signalling an economic recovery from the low point of 0.4% GDP growth in Q2. The bounce back from Q2’s weak results was faster than expected (forecasted at roughly 3.4%), which analysts have attributed to the improvement of supply chains and the implementation of pro-growth policies (made up largely of financial stimulus). China’s industrial production rebounded strongly in Q3, with annual growth increases registered in mining, manufacturing and the energy sectors. Electric vehicles continued their strong performance up 112.5% in September yoy.

However the Q3 results were tempered by a continued slowdown in export growth, from 7.1% yoy in August to 5.7% yoy in September (far below an 18% gain in July). Weakness also persisted in imports, contracting by -0.2% yoy in September, down from 2.3% yoy growth in August.

… But October data shows early weakness in the last quarter of 2022…

October’s economic data showed a weak start in Q4 with a range of results falling short of forecasts. Retail sales fell by 0.5% yoy, missing market expectations. Apparel, catering and home appliance recorded the largest falls in sales, however, the overall retail sales result was buffered by growth in car sales and a surge in the online sale of physical goods. Measures of industrial growth missed forecasts and also slowed in October, and measures of investment in manufacturing were slower than over the same January-October period last year – a slowdown analysts have attributed to the combination of slowing export growth and weak domestic demand. One bright spot was an increase in infrastructure investment (spurred on by the government’s pro-growth policies).

Exports contracted by 0.3% yoy, marking the first decline in 28 months. Analysts pointed to a number of unfavourable external factors dampening external demand for Chinese exports - namely the war in Ukraine, the energy crunch in Europe and high inflation outside of China.

The real estate sector continued its downturn, with property sales falling by 23% yoy and the number of new construction projects starting declined 35% yoy. Home loan growth also slowed in October. In response, on 13 November, China’s central bank and financial regulatory authorities announced a 16-point plan to support the housing market. Of the 16 policies announced, the majority were supply-side focused. New policies aim to address the liquidity crisis among property developers, as well as a loosening of down payment requirements for homebuyers. This is on top of a previously-announced bond financing scheme that supports private firms, including several large property developers. While market sentiment has lifted in response to the newly announced measures, it is unclear whether this will translate into new demand and new loans.

… Early November results suggests weakness in the economy continuing into Q4

A key index measuring manufacturing activity fell in the month of November, reaching its lowest level since April this year. Indices measuring activity in construction and services sectors also fell in November. Analysts suggest this data likely reflect the impact of the lockdowns in major cities in November. China’s exports and imports also shrank in November, falling 9% and 10.9% respectively from a year ago. This matched earlier forecasts of a drop in outbound shipments from this time last year. Analysts attribute the negative result to high interest rates in major markets cooling demand for Chinese products.

Commentators have raised concerns over the underperformance of several macroeconomic indicators in October and November; some contending China has yet to see any substantive improvement in its economic fundamentals or business profitability. In this context, analysts argue there are increasing expectations that policy makers shore up domestic demand.

Supply chains improve in Q3, but disruptions continue into Q4; air connectivity improving

The outlook on supply chains for Q3 has been more positive than the first-half of the year (i.e. when Shanghai was in hard lockdown). However, as COVID case numbers rise across China, inland logistics, trucking and warehousing in affected regions are expected to come under increased pressure as pandemic control measures are stepped up. An index measuring suppliers’ delivery times fell in November, suggesting the impact of disruptions are already being felt on supply chains.

In regards to airfreight, the lifting of China’s circuit breaker measures for inbound international flights (which previously allowed China to suspend inbound international flights if they carried more than a certain number of COVID cases) has provided greater certainty for airlines operating both passenger and cargo flights. This was part of a broader announcement of 20 “optimisation” measures by aviation regulators to facilitate greater flexibility in capacity for airlines. Separately, the lockdown of the Apple production facilities in Zhengzhou has resulted in a sharp decrease in the volume of technology products that are air freighted out of China during Q4, which has in turn freed up international air freight capacity.

In addition to the cancellation of circuit breaker measures, China further relaxed its COVID-related entry requirement for inbound passengers. The mandatory quarantine period has been reduced by two days (down to eight days total from the previous ten). China has also reduced its pre-departure testing requirements to one PCR test within 48 hours of boarding a flight to mainland China; this test result is valid through transits too. The number of international flights into China has also increased (but still well below 2019 levels).

NB: The latest information on specific entry requirements for travellers to China, including pre-departure requirements and visa application processes, can be found on the website of the Chinese Embassy in New Zealand(external link). Please also note the latest New Zealand Government travel advice on the Safe Travel(external link) website.

Recent changes indicate a potential shift in China’s COVID policy, but the growing number of active cases poses challenges

The shift in China’s COVID policy takes place against the backdrop of rising case numbers. Major Tier 1 cities (Beijing, Guangzhou and Chongqing) and other locations saw record high case numbers - Guangzhou and Chongqing averaging 8000 daily cases, and Beijing 4000. This surge in cases in mid-November came at the same time as the cancellation of circuit breaker measures and the relaxation of other restrictions on air services on 11 November. Since 30 November, various provincial and municipal governments in China have made announcements of the relaxation of COVID rules.

Looking ahead: remainder of Q4 and beyond

With China’s export growth levelling-off and the continued difficulties in the housing market, analysts highlight China’s need to increasingly rely on consumption-led growth in Q4. However, domestic demand remains weak. While demand-side stimulus implemented by the government has encouraged consumer spending to some extent, analysts continue to cite ongoing COVID-related restrictions as a significant impediment to meaningfully lifting domestic demand. At recent meeting on the economy by Chinese leadership on 6 December, it was noted that efforts would be made to ‘expand domestic demand’ and ‘give full play’ to the role of consumption and investment.

While the consumption-led recovery may not come in the near term, there remains optimism among analysts for stronger growth in 2023. Forecasts that the two major risks facing the economy - COVID-19 and the depressed property market - are likely to ease next year has fuelled optimism. ANZ raised its growth forecast for 2023 to above 5%, Goldman Sachs also predicted GDP growth to pick up in 2023 H2 and into 2024, while Morgan Stanley has forecasted a strong uptick in consumer spending. 2023 GDP growth forecasts from economists in China range from 4% to 6%. Importantly, these predictions are predicated on a relaxation of zero-COVID policies and a spur in domestic demand as a result. Analysts caution that such a rebound in domestic consumption may only come when COVID infections start to drop – and even then, some households could still prefer to keep more cash on hand. Given the uncertainty, attention should therefore be paid to how China navigates the current COVID outbreak.

New Zealand China trade: Recent trends in key export sectors

NB: the most recent goods trade data available for New Zealand is to September 2022; for services trade and total trade it is to June 2022.

China remains Aotearoa New Zealand’s top trading partner, with two-way goods and services trade totalling NZ$38.5 billion in the year ending June 2022. Over this period China remained New Zealand’s largest market for exports (NZ$20.9 billion) and imports (NZ$17.6 billion).

In the second quarter of 2022 China remained New Zealand’s largest market for goods exports (NZ$5.13 billion), down by 6% from Q2 last year.

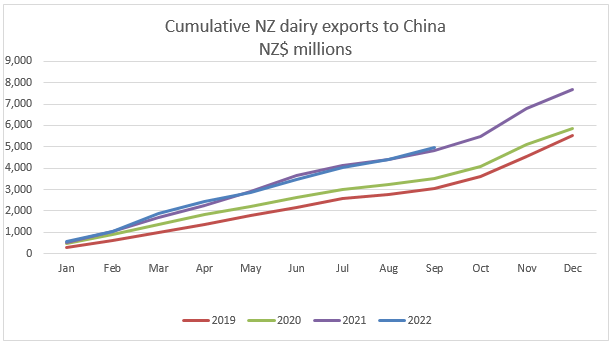

Dairy (not including infant formula)

The value of New Zealand’s dairy exports to China in Q3 totalled NZ$4.9 billion, 3% above the equivalent period in 2021. Overall demand for dairy products has held up despite intermitted lockdowns impacting Chinese consumers. However, in the past six months growth in milk solid equivalent trade in China did fall 28% compared to the same period last year.

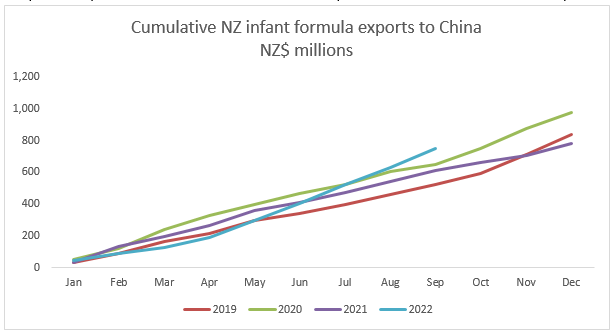

Infant Formula

The value of export earnings for infant formula in Q3 increased by 22% relative to the equivalent period in 2021, with a cumulative export value of NZ$749 million this year.

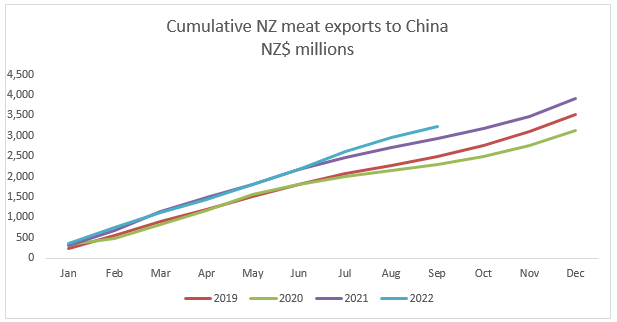

Meat and meat products

Meat exports to China in Q3 were up 10% on the equivalent period last year, with $3.2 billion sold so far this year. This increase driven in part by the high demand for beef products in China. The value of beef exports rise by 19% yoy while export volumes stayed at similar levels.

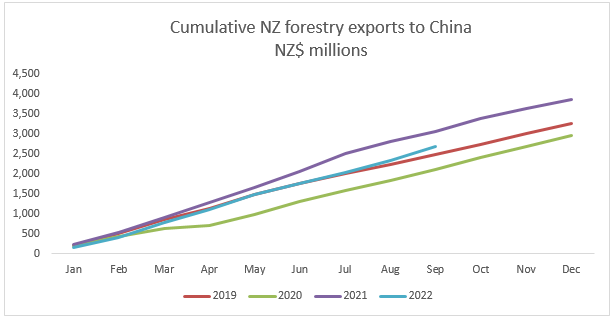

Forestry

In Q3 New Zealand’s forestry product exports to China decreased by around 12% relative to equivalent 2021 figures, with a total of NZ$2.6 billion worth of exports so far this year. The weakened demand for forestry products is likely connected with the slowdown of China’s construction sector, but this has been partially offset by a weak exchange rate, which has supported high export prices.

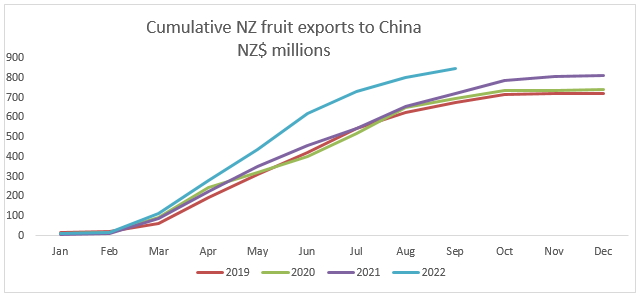

Fruit

China remains the highest-value single-country export market for New Zealand fruit exports, with NZ $846 million in exports in 2022 thus far, an increase of 17% on the previous year.

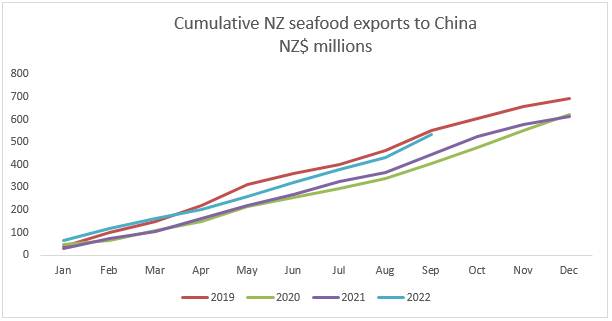

Seafood

In Q3 New Zealand seafood exports grew by 19% compared to the same period last year, with a with a cumulative export value of NZ$532 million this year.

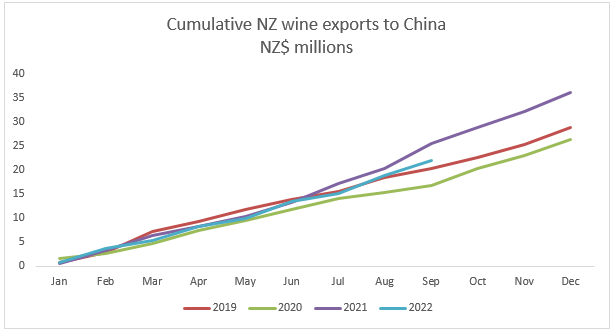

Wine

The value of New Zealand’s wine exports to China in Q3 totalled NZ$21 million, down 16% relative to the equivalent period in 2021.

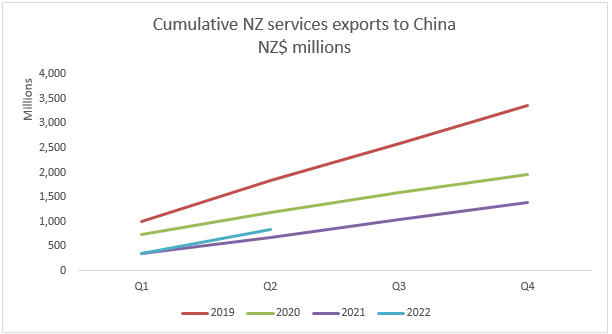

Services

Services trade is still recovering from the impact of COVID-19, but saw a 21% increase in export value in Q2 relative to same period in 2021 (down 52% from the pre-COVID level in 2019).

For addition information on New Zealand’s agriculture exports, the December publication of the Ministry for Primary Industries’ (MPI) Situation and Outlook for Primary Industries (SOPI) was released on December 1: SOPI reports | NZ Government (mpi.govt.nz)(external link). The SOPI provides a look back on the past year for New Zealand’s food and fibre sectors, as well as forecasting ahead with an eye on the upcoming challenges for 2023.

Regular China market updates and other useful resources are available on the NZTE website. Exporters can also sign up for myNZTE for China market information on a number of topics. The Ministry for Primary Industries regularly provides requirements (Overseas Market Access Requirements or OMARs (login required) and Importing Countries Phytosanitary Requirements or ICPRs) and For Your Information (FYI) documents, including for China, with guidance on exporting issues relating to animal products (such as meat, seafood, honey, and dairy), food products, plant products, and wine.

More reports

View full list of market reports(external link)(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.