Manufacturing (excludes F&B), Creative and ICT:

On this page

Summary

- The Netherlands has long thrived as an open economy and international hub for start-ups and innovative technologies. It has benefitted greatly from free trade flows and is one of the most important European countries in the semiconductor sector, largely due to its flagship company ASML.

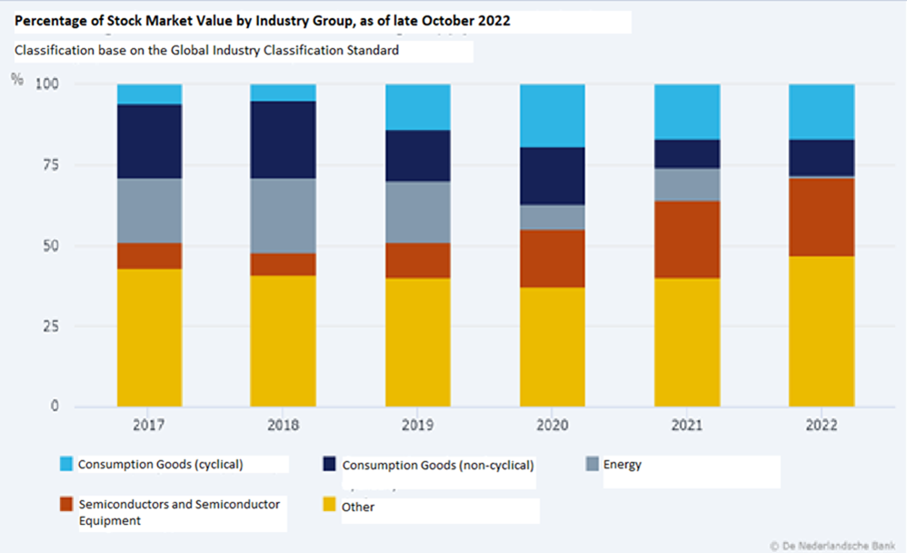

- Dutch semiconductor companies account for around 9% of the global market share for semiconductors, and 24% of the value (or around EUR 276 billion) of all registered stock market companies in the Netherlands. The Netherlands government is investing EUR 230 million in the sector as part of its ‘Technology and Innovation Strategy’. This is a part of its broader ‘National Technology Strategy’, which is due to be released in July 2023.

- At the same time, with geopolitical competition between China and the United States increasing, and semiconductors playing into the European Union’s “open strategic autonomy”, Dutch companies have been bracing themselves in relatively choppy waters. Managing its economic and security interests, the Netherlands government has recently come to a decision regarding the limit of the export of the most high tech semiconductors.

Report

Facts, Figures and Trends in the Dutch semiconductor industry

Semiconductors are small computer chips that are used in all kinds of machines and technological applications, from satellites to missiles, and from medical equipment to washing machines. While semiconductor manufacturing companies NXP and STM produce semiconductors themselves, the Netherlands flagship company, ASML, makes the machines which are able to produce semiconductors. ASML’s product is one of the few of its kind produced in the world, which is capable of producing the most high-tech semiconductors on the market. These semiconductors are used in satellites, medical equipment, but most significantly, in modern military applications. Given this, the machines are increasingly becoming a strategic export product.

The Netherlands’ semiconductor industry is growing quickly, with the Netherlands considered a world leader in this industry. In 2017, the sector accounted for 5% of the economic value of all stock market registered companies in the Netherlands. In 2022, this had increased to 24% at a value of EUR 276 billion. The machines produced by ASML are built in few places in the world and are necessary for the production of the highest-grade semiconductors. It has a global market share of 9%, coming in fourth behind the United States (52%), Taiwan (16%) and China (12%).

The largest semiconductor companies in the Netherlands are ASML, NXP Semiconductors and STMicroelectronics. The largest, ASML, had a revenue of EUR 21.2 billion in 2022, and looks to double that in the coming year with orders in the pipeline. In terms of production, ASML delivered only 50 of their highest specification model and 400 machines in total. With relatively small levels of supply, the machines are of high demand and value. The machine comes with its own technician who takes care of maintenance, as only ASML staff have the necessary knowledge and expertise.

From innovation to securitisation

The machines that ASML produce contain some of the world’s most advanced technology, only produced in a few locations around the world. Beyond the Netherlands, key suppliers include Japan and the United States. As a result, they are of geostrategic interest.

In March 2023, the Dutch government decided to limit the export of semiconductor machines. The decision restricts exports of the most advanced technology, such as DUV (Deep Ultraviolet) lithography and deposition. It also controls the ‘booster tech’ that upgrades older systems. In a press release, ASML stated that it is not concerned about these restrictions, as it only concerns the highest-grade machines, and not ‘common’ technology. ASML itself also faces concerns regarding knowledge theft, with its annual report in 2021 stating that there are increasing risks of illegal knowledge transfer taking place from its factories.

The Dutch position ties into more general points about EU export policies, and the need to build the EU’s chip industry, protect supply of critical raw materials, streamline EU processes around licensing and access to subsidies, as well as how these policies will compare to the US Inflation Reduction Act.

The EU and the concept of Open Strategic Autonomy

The strategic and economic importance of the Dutch semiconductor industry is not unnoticed in Brussels. The European Commission, in early 2022, identified areas of crucial strategic interest, with semiconductors being among them. By investing billions of euros, EU Member States are set to become less dependent on third countries in the field of semiconductor technology and to bring more production to the EU. The European Commission and its Member States have reserved a combined EUR 43 billion of investments for this, and the Commission will be more flexible towards state aid rules in this field as well. This means that an increase in government subsidies will be allowed in this sector to strengthen the position of European company’s vis-à-vis the rest of the world.

As part of European autonomy, Taiwanese semiconductor giant TSMC would be able to move a maximum of 6% of its global production capacity to the EU from 2025. However, this may only be a feasible economic strategy for the EU if the end products, which use the chips, would also be produced in the EU (i.e. there may be limited semiconductor production in the EU if there are no companies in the EU which use them further up the chain). It is possible to move more of this production to the EU or to more likeminded countries (so-called “friend-shoring”), however this may also lead to higher prices.

In April 2022, the Dutch government announced that it will invest EUR 230 million in strategically-important research projects in the field of semiconductors and photonics, as part of its Technology and Innovation Strategy. Minister Adriaansens of Economic Affairs and Climate stated that the goal of the investments is keeping Dutch businesses “competitive and leading in innovation”.

In July 2023, the Dutch government will present its National Technology Strategy, which aims to secure the leading Dutch position in the field of technology and semiconductors, while at the same time reduce strategic dependencies and diversify supply chains.

Conclusion – The gates of Europe are closing around semiconductors

The Dutch semiconductor industry remains of strategic importance and is likely to find itself increasingly woven into discussions on national security. ASML’s strategic global position means that it may be difficult to separate its commercial interests from geopolitical realities. At the same time, additional public investment in the sector is expected to keep it competitive and innovative.

More reports

View full list of market reports(external link)

If you would like to request a topic for reporting please email exports@mfat.net

Sign up for email alerts

To get email alerts when new reports are published, go to our subscription page(external link)

Learn more about exporting to this market

New Zealand Trade & Enterprise’s comprehensive market guides(external link) cover export regulations, business culture, market-entry strategies and more.

Disclaimer

This information released in this report aligns with the provisions of the Official Information Act 1982. The opinions and analysis expressed in this report are the author’s own and do not necessarily reflect the views or official policy position of the New Zealand Government. The Ministry of Foreign Affairs and Trade and the New Zealand Government take no responsibility for the accuracy of this report.